Monthly Dividend Stock In Focus: Itau Unibanco

Banks in the US are generally well thought of when it comes to income investing. They tend to pay decent yields, and the best run banks offer relative dividend security, as well as the potential for dividend growth. Internationally, banks have proven riskier due to a variety of factors, including geopolitical risk, localized economic weakness, currency risk, and others.

Itau Unibanco (ITUB) is a Brazilian bank that pays a very small dividend to shareholders, but one that is quite secure. In addition, it pays its dividend monthly, instead of quarterly, allowing for faster wealth compounding and current income.

Itau Unibanco is one of only 56 stocks that makes monthly dividend payments. You can download our full list of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Click here to download your free spreadsheet of all 56 monthly dividend stocks now.

Despite the payout ratio being extremely low, and therefore implying high levels of dividend safety, we see many growth challenges ahead for Itau Unibanco. With the earnings outlook quite murky, and Brazil’s economic growth in serious doubt, we have concerns about the bank’s near-term future.

Given this, we are cautious on Itau Unibanco’s prospects as an investment at this time, despite its attractive monthly payout schedule.

Business Overview

Itau Unibanco is a very large bank that is headquartered in Brazil. It generates in excess of $21 billion of revenue annually and trades with a market capitalization of $47 billion. For this article, we’ll use the company’s NYSE listing under the ticker ITUB, as well as US dollars throughout the report, unless otherwise noted.

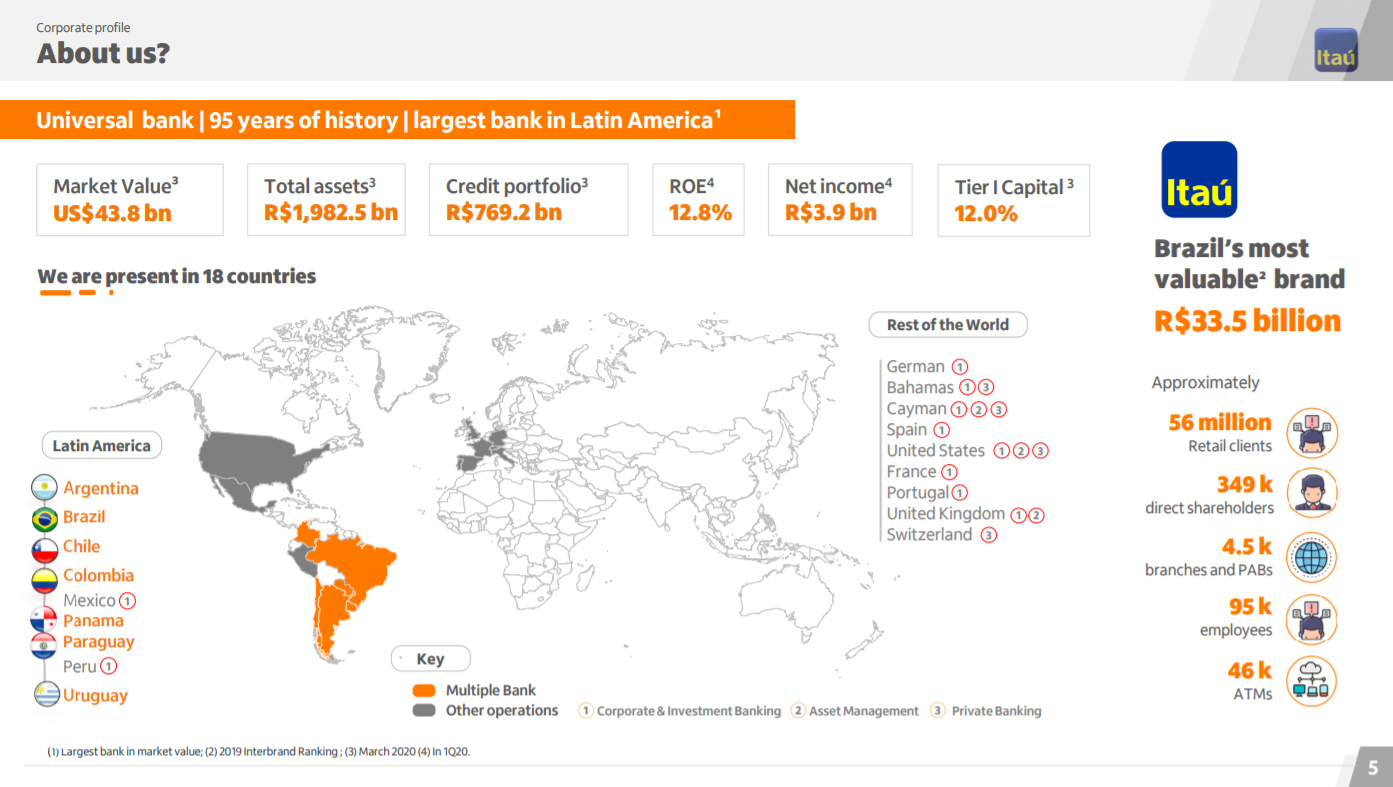

Source: Investor presentation, page 5

Itau Unibanco conducts business in 18 countries around the world, but the core of its business is in Brazil. It has significant operations in other Latin American countries, as well as select businesses in Europe and the US.

Its scale is huge in relation to other Latin American banks, with 56 million retail customers and nearly 100,000 employees. The bank’s credit portfolio is $142 billion, so it is relatively small against large American banks. But in the markets where Itau Unibanco competes, it is quite large.

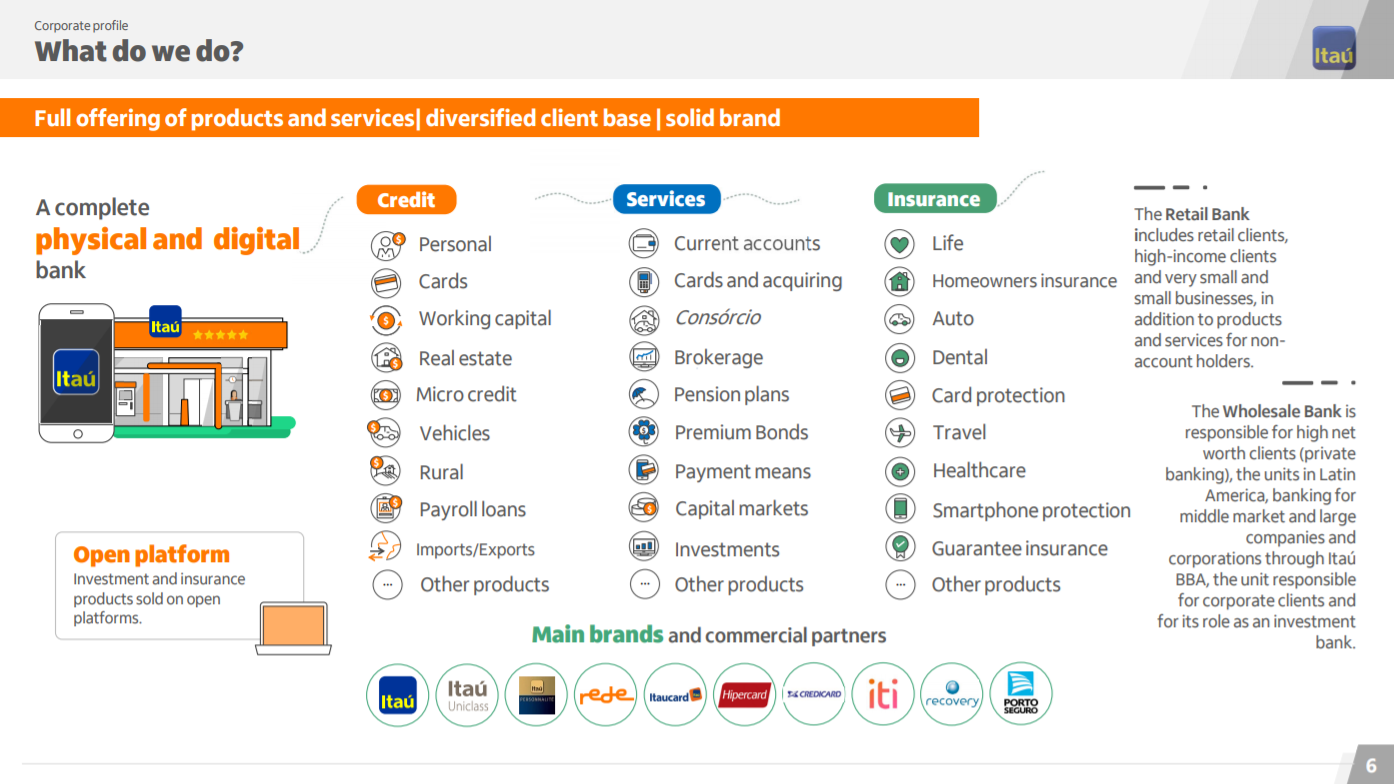

Source: Investor presentation, page 6

The bank offers an impressive list of services to its customers, running the entire spectrum of financial products. This huge list of offerings has helped Itau Unibanco grow to the size it is today, while also diversifying its revenue streams.

Its business has two main segments – Retail Banking and Wholesale Banking. Retail Banking serves smaller, mostly consumer accounts, while Wholesale Banking serves larger, mostly business accounts. The retail business produces about two-thirds of the company’s total net income, with the wholesale business making up the balance. Both are critically important to the bank’s profit outlook, but like many other large banks, Itau Unibanco’s business is heavily dependent upon consumers.

Given Itau Unibanco’s reliance upon Brazil and other South American countries for its earnings, we have significant concerns about its ability to grow.

Growth Prospects

Itau Unibanco’s strategy of trying to be everything to every consumer and business isn’t unusual in the world of banking. The major US banks have adopted a similar strategy over time, providing core banking services like deposits and loans, but also insurance products, equity investing, and a host of other products to help attract customers.

However, what sets Itau Unibanco apart is its exposure to emerging economies, rather than established ones in Europe or the US.

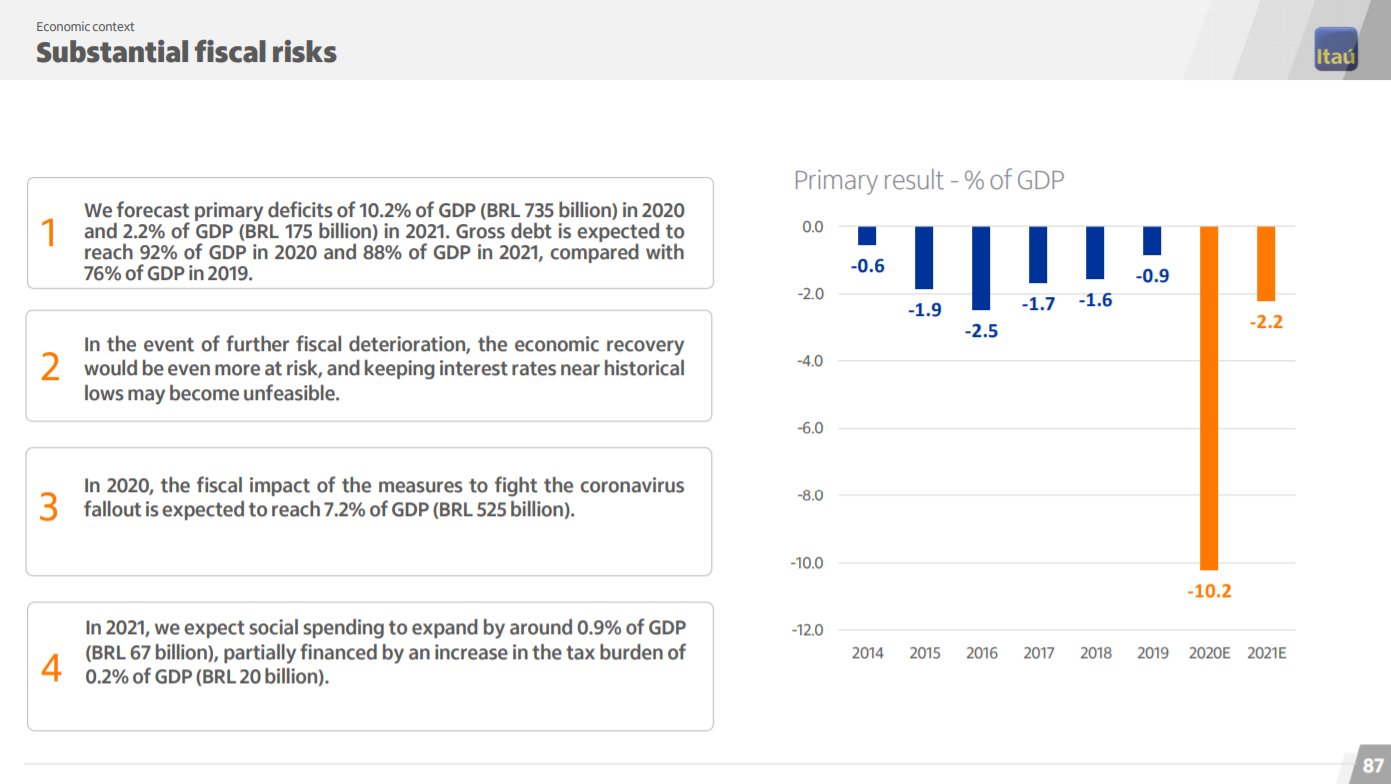

Source: Investor presentation, page 87

Indeed, the above chart shows Brazil’s GDP deficits for the past several years, and the trend is clear. It has been a very long time since Brazil has shown positive economic growth, and many of the other countries Itau Unibanco operates in are in similar, if not worse, situations.

This is a primary concern for us regarding the company’s ability to grow, because the business model of a bank requires broad economic growth for its own expansion. Without this growth, Itau Unibanco will have a difficult time producing profit expansion.

Source: Investor presentation, page 89

We can see the impact of this weakness, among other factors, in the company’s Q1 results. Itau Unibanco has spent years trying to reduce its non-interest expense because its earnings are exposed to a weakening Brazilian economy. This is certainly a factor in its international expansion, and while diversification is a good thing, the worldwide economic shutdowns as a result of COVID-19 are also discouraging.

The credit portfolio grew nicely from Q4, adding nearly 9% in just one quarter. Non-interest expense pulled back as well, falling 7% quarter-over-quarter thanks to intentional hiring limits and other cost saving measures.

However, expected losses have soared since the beginning of 2020, so we are quite cautious after Q1 results.

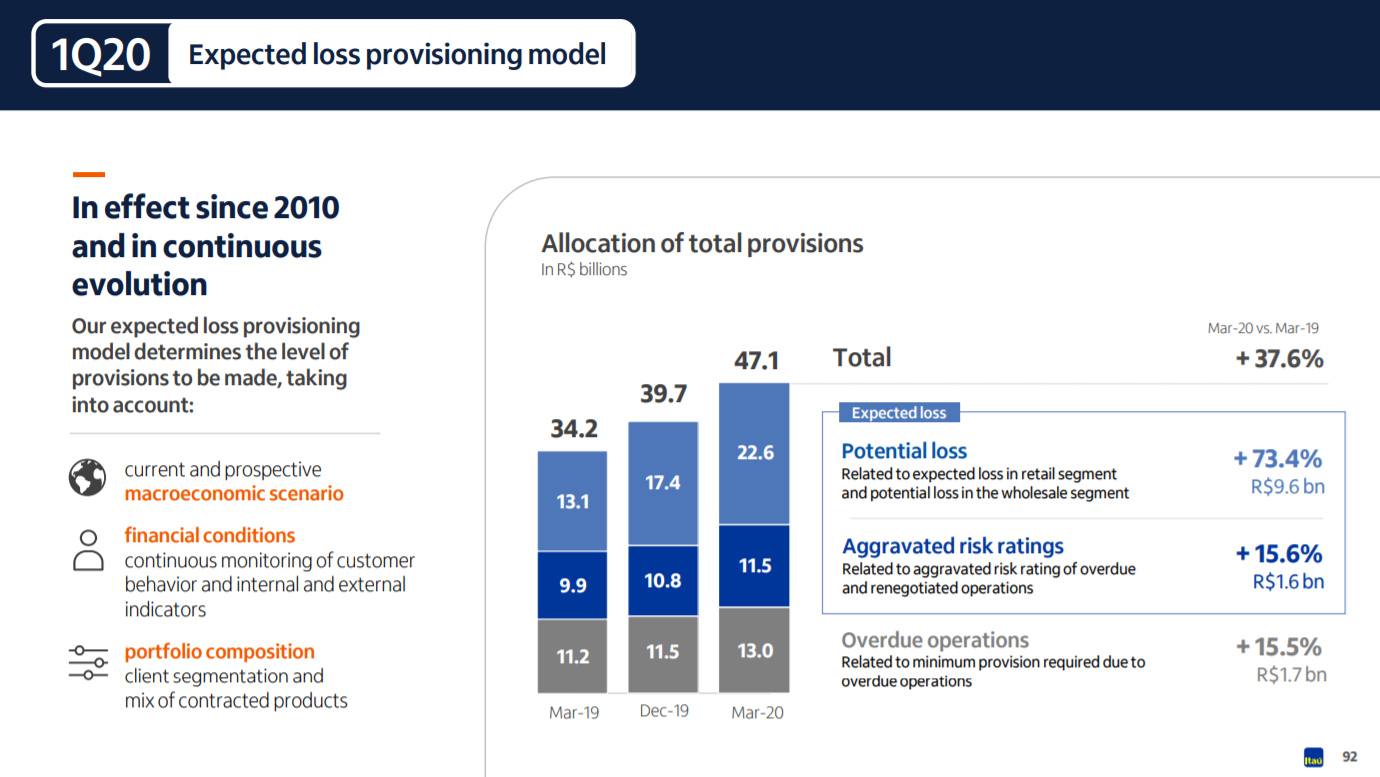

Source: Investor presentation, page 92

Itau Unibanco has taken huge loan loss provisions in the past year, with that total rising 38% since last year’s Q1. The retail segment has seen its expected losses soar 73% higher in the past year thanks to rapidly deteriorating credit quality among consumers.

In short, losses like this will take some time to recover, and if there is another worldwide economic shutdown due to COVID-19, they will almost certainly become a lot worse.

Source: Investor presentation, page 95

Higher losses aren’t the only problem Itau Unibanco faces. The cost of credit has risen substantially in recent months, driving the poor performance shown above. Higher credit cost has caused the bank’s margins to plummet, particularly on a risk-adjusted basis. While Q1 was impacted by COVID-19, shutdowns didn’t occur until very late in the quarter. We expect Q2 results to be worse than this, with the outlook for returning to normal for Itau Unibanco quite murky.

We see the path to any growth ahead for Itau Unibanco as difficult, and expect a flat long-term EPS for the next few years, following the decline this year and rebound into next year. Under normal conditions, we still expect the bank to struggle to grow.

Dividend Analysis

Itau Unibanco has a conservative approach to paying its dividend. The bank pays out dividends to shareholders based upon its projected earnings and losses, with the goal being the ability to continue to pay the dividend under various economic conditions.

The bank’s current payout equates to just 4 cents per share annually on its US listing, which is good for a current yield of 0.8%. Thus, Itau Unibanco isn’t a pure income stock by any means, as its yield is simply too small to be attractive to income investors.

On the plus side, this very small yield affords the bank strong dividend coverage. Current estimates for this year are for 40 cents per share in earnings, good for a payout ratio of just 10%. We therefore do not see any risk of a dividend cut today, but we are also cautious on future growth given the uncertain outlook for Brazil’s economy. Thus, we do not believe income investors should be interested in Itau Unibanco stock, due to its fairly low yield and the number of elevated risk factors.

Final Thoughts

We see a difficult road ahead for Itau Unibanco. With little to no projected earnings growth under normalized conditions, as well as a diminutive yield, we don’t view this stock as attractive.

At the same time, buying international stocks carries multiple unique risk factors, including geopolitical risks and currency risk, among others. Itau stock does provide geographic diversification for investors who are particularly interested in investing outside the United States.

However, the risks seems to outweigh the potential rewards for this stock. Given all of the above factors, we recommend investors avoid Itau Unibanco, despite its monthly dividends.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more