Monthly Dividend Stock In Focus: Canadian Apartment Properties Real Estate Investment Trust

Investing in real estate investment trusts, or REITs, can be a fruitful option for investors seeking high-income yields. This is due to their obligation to distribute the majority of their profits to shareholders in the form of dividends. Many income-focused investors, particularly retirees, find REITs appealing but usually focus on the U.S.-based ones.

It may be wise to explore opportunities beyond the U.S. market, as there are reliable dividend-paying REITs in other countries. Canada, in particular, features several REITs that boast decades of consistent shareholder value creation. One such is Canadian Apartment Properties Real Estate Investment Trust (CDPYF).

Canadian Apartment Properties REIT stands out among other REITs, as it offers monthly dividend payments, whereas most REITs provide dividends on a quarterly basis.

While there are a few other REITs that also offer monthly dividends, this is a distinguishing feature that sets Canadian Apartment Properties REIT apart from the pack. This is especially true in this case, as the company has paid a monthly dividend consistently since 1998 and has never cut it despite the hardships that have arisen since.

Canadian Apartment Properties REIT offers a dividend yield of more than 3% at current prices, which is notably higher than the broad market’s dividend yield, as that stands at about 1.6% right now.

The above-average dividend yield and the fact that Canadian Apartment Properties makes monthly dividend payments make the REIT worthy of research for income investors. This article will discuss the investment prospects of Canadian Apartment Properties (in short, CAPREIT) in detail.

Business Overview

CAPREIT is Canada’s largest real estate investment trust. The company owns approximately 59,689 suites, including townhomes and manufactured housing sites, in Canada. Further, the company, directly and indirectly, owns a 66% equity stake in European Residential Real Estate Investment Trust, another publicly-traded Canadian REIT. Through this investment, the company also owns approximately 6,900 suites in the Netherlands.

In total, CAPREIT manages approximately 66,586 of its owned suites in Canada and the Netherlands and, additionally, approximately 3,800 suites in Ireland.

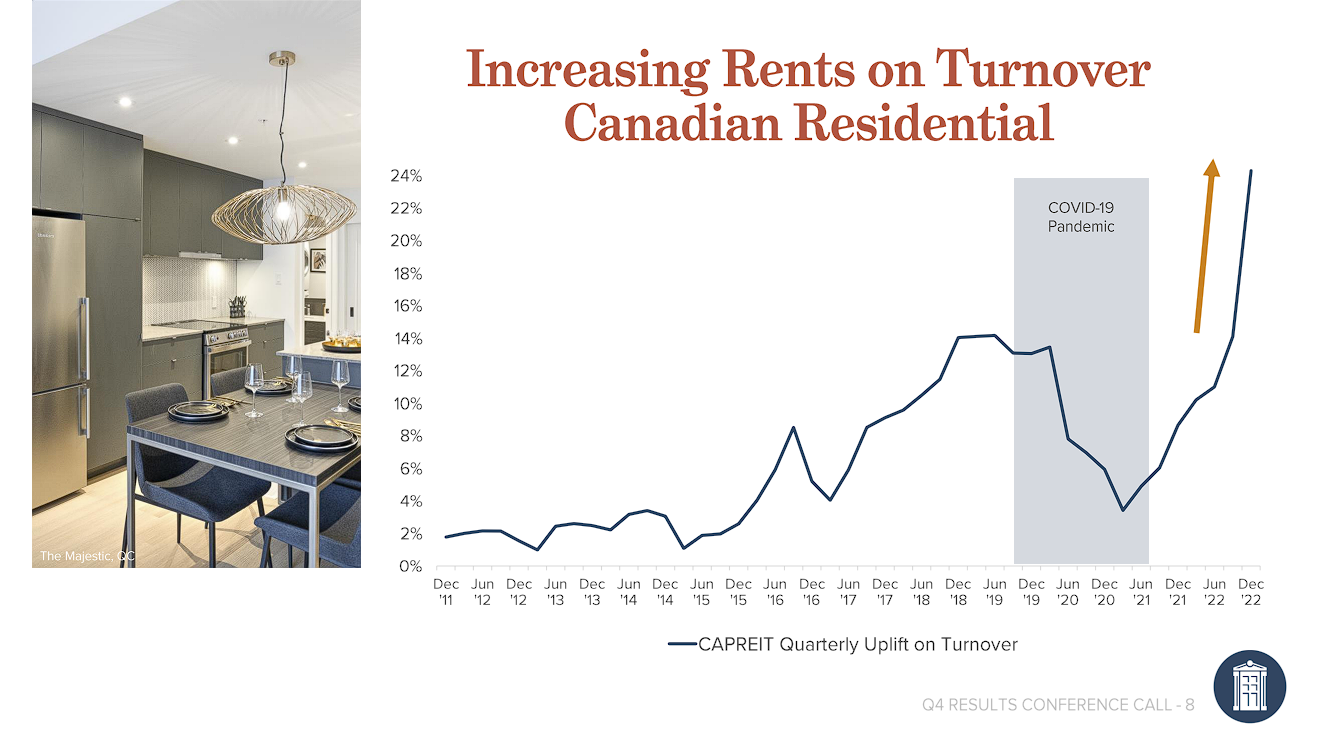

In 2022, CAPREIT celebrated its 25th anniversary, adding another year of record-breaking results to its books. In particular, capitalizing on the rapidly-growing demand for residential properties in Canada, CAPREIT managed to achieve a record-breaking fourth-quarter and annual rent uplift on turnover of 25% and 15%, respectively.

Source: Investor Presentation

The company was also able to further expand its already impressive occupancy levels from 98.1% to 98.3% during the year, which along with higher average rents, drove revenues 7.1% higher to C$1.0 billion. While higher expenses offset much of this increase, Normalized Funds from Operations (NFFO) per share still grew by about 1% to C$2.328.

The company currently prioritizes its core objectives as follows:

- To provide shareholders with long-term, stable, and predictable monthly dividends,

- To grow NFFO, sustainable dividends, and NAV (net asset value) through active property management, accretive acquisitions, and dispositions, and,

- To deploy internal CAPEX in order to maximize earnings in its existing properties.

Growth Prospects

Moving forward, we expect CAPREIT to drive growth through accretive acquisitions and organic rent growth, as it has done in the past. In 2022, for instance, the company acquired a total of 1,181 suites and manufactured home community sites in Canada for $517 million.

Management believes that acquiring newly built properties should be a favorable strategy these days, as such properties should reduce its future capital investment needs and, therefore, the company’s exposure to inflationary pressures.

Like all REITs, CAPREIT taps into both debt and equity markets to finance its future growth. As interest rates continue to rise, one valid concern investors could have is the potential challenges to the company’s expansion efforts due to financing becoming notably more expensive lately. Despite this, CAPREIT has established an impressive credit profile over the years, which allows it to access financing at highly competitive rates.

While the company’s average interest rate has slightly increased from 2.47% to 2.61%, it remains remarkably low. Additionally, with a weighted average term of maturity of 5.4 years, the company won’t need to refinance its debt to higher rates anytime soon.

Even a significant mortgage refinancing of C$879.3 million in 2022 had a weighted average term of maturity of 8.0 years and a weighted average interest rate of just 3.36%, showcasing CAPREIT’s capability to negotiate highly favorable terms even during turbulent market conditions.

Simultaneously, CAPREIT’s total debt to gross book value stands at a comfortable 39.4%, meaning that the company can comfortably undertake further borrowing without over-burdening its balance sheet. Therefore, we maintain our confidence in the company’s ability to grow and generate value for its shareholders.

Dividend Analysis

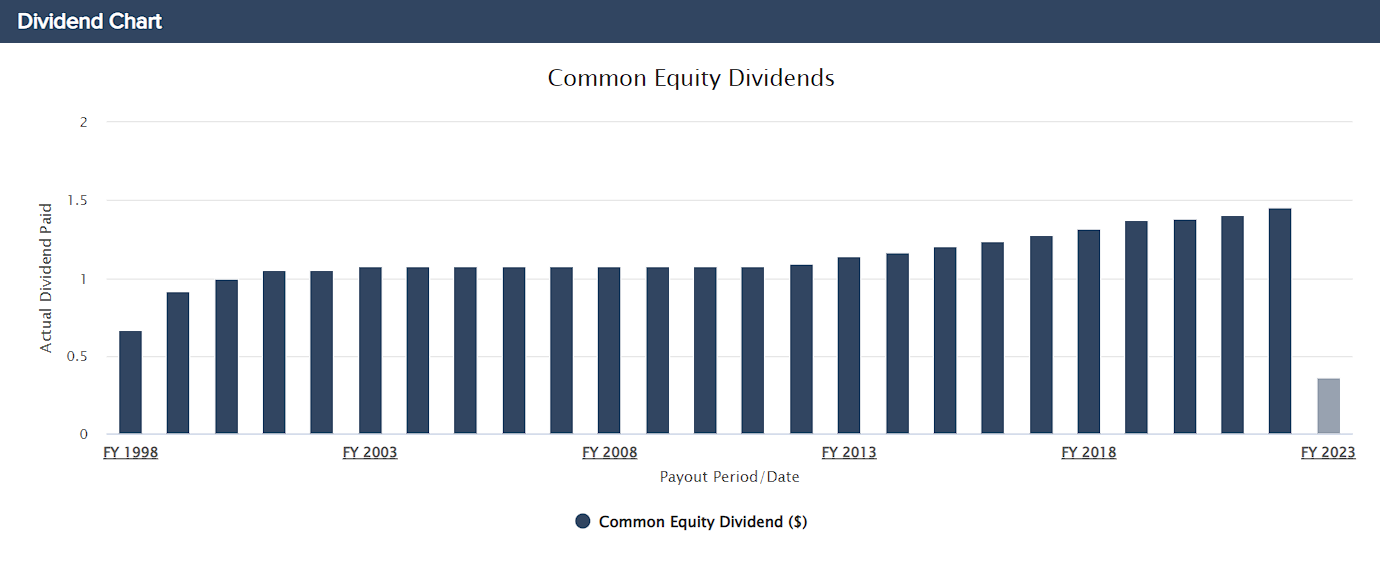

CAPREIT boasts an impressive track record of paying monthly dividends for 25 consecutive years. Most importantly, the company never had to cut its dividend, even during challenging times like the Great Financial Crisis and the COVID-19 pandemic, when most REITs struggled significantly.

Except for the years between 2004 and 2011, when the dividend remained stable at C$1.08 annually, CAPREIT has consistently increased its dividend every other year during its 25-year history.

Source: Investor Relations

Although the current annual rate of C$1.45 yields just over 3%, which is below average for the sector and somewhat underwhelming given today’s interest rates, we remain highly confident in CAPREIT’s dividend safety. Not only has the company proven its resilience in harsh economic conditions, but with a comfortable NFFO payout ratio of 62.1%, there is ample room for future hikes and no concerns about potential cuts.

Final Thoughts

CAPREIT is one of Canada’s most reputable REITs, with a proven track record of growing its financials and dividends. In 2022, the company achieved record-breaking figures, and although the current macroeconomic climate may not align with its growth strategy, we predict that CAPREIT will fare better than its peers in the face of rising interest rates.

Overall, while CAPREIT’s yield is not sizeable, the stock is likely to keep serving income-oriented investors who seek a predictable payout quite satisfactorily. After all, long-term, stable, and predictable monthly cash dividends is the company’s number one objective.

More By This Author:

Monthly Dividend Stock In Focus: Sienna Senior Living

3 Regional Banks To Buy Now

Monthly Dividend Stock In Focus: Savaria Corporation

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more