Monthly Dividend Stock In Focus - Canadian Apartment Properties Real Estate Investment Trust

Image Source: Unsplash

The Canadian Apartment Properties Real Estate Investment Trust (CDPYF) has three appealing investment characteristics:

- It is a REIT, so it has a favorable tax structure and pays out the majority of its earnings as dividends.

- It offers a 3.2% dividend yield, which is double the 1.6% yield of the S&P 500.

- It pays dividends on a monthly basis instead of quarterly.

The Canadian Apartment Properties Real Estate Investment Trust’s trifecta of its favorable tax status as an REIT, its above-average dividend yield, and its monthly dividend make it appealing to investors. But there’s more to the company than just these factors.

Business Overview

The Canadian Apartment Properties Real Estate Investment Trust is a growth-oriented investment trust that owns freehold interests in multi-unit residential properties, including apartment buildings, townhouses, and land lease communities located in or near major urban centers across Canada.

The objectives of this REIT are to provide shareholders with long-term, stable, and predictable monthly cash distributions while growing distributable income and shareholder value through active management of its properties, accretive acquisitions, and strong financial management.

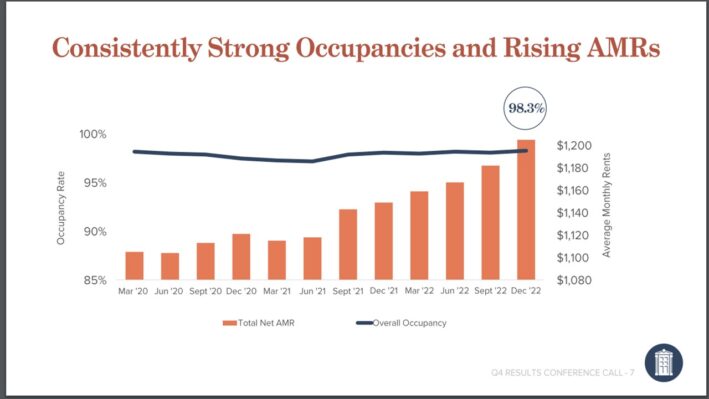

The REIT has exhibited consistently high occupancy rates and rising average monthly rents over the last three years.

Source: Investor Presentation

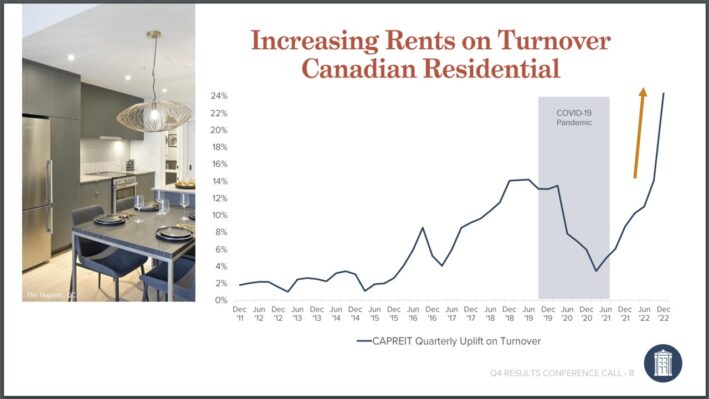

Rent growth decelerated sharply during the core of the coronavirus crisis, but it has been recovering strongly now.

Source: Investor Presentation

The Canadian Apartment Properties REIT has recently been enjoying decent business momentum. Thanks to its recovery from the pandemic in the fourth quarter, the REIT grew its same-property net operating income by 5.0% over the prior year’s quarter and its funds from operations (FFO) per unit by 1.4%. In the full year, adjusted FFO per unit dipped 6%, from $1.79 to $1.69, but this is mostly due to a non-recurring goodwill impairment.

Growth Prospects

The Canadian Apartment Properties REIT aims to grow by acquiring attractive new-built properties. The REIT invested $1.05 billion in 3,744 suites/sites in 2021 and another $646 million in 1,537 suites/sites in 2022.

Moreover, the REIT is running a capital recycling program. It sells old properties that no longer fit to the core business of the REIT and uses the proceeds to invest in high-return properties and pay off debt.

The REIT has grown its average FFO per unit by 2.0% per year over the last decade. It has promising growth prospects ahead, but we note that there is limited growth potential from the side of occupancy, which currently exceeds 98%.

In addition, the trust will be hurt by fast-rising interest rates, which are likely to increase expenses significantly in the upcoming quarters. Overall, we expect the Canadian Apartment Properties REIT to grow its FFO per unit by about 2.0% per year on average over the next five years, in line with its historical growth rate.

Dividend & Valuation Analysis

The Canadian Apartment Properties REIT is currently offering a 3.2% dividend yield, which is double the 1.6% yield of the S&P 500. The REIT is thus an interesting candidate for income-oriented investors, but the latter should be aware that the dividend may fluctuate significantly over time due to the gyrations of the exchange rate between the Canadian dollar and the US dollar.

Thanks to its solid business model, a decent payout ratio of 65%, and a healthy interest coverage ratio of 3.7, the trust is not likely to cut its dividend in the absence of a severe recession.

Notably, the Canadian Apartment Properties REIT has maintained a stronger balance sheet than most REITs in order to have the sufficient financial strength to endure a potential recession. We praise management for maintaining a decent balance sheet, with net debt of $5.7 billion, which is marginally less than the current market capitalization of the stock.

On the other hand, due to the aggressive interest rate hikes implemented by central banks in response to high inflation, interest expense is likely to rise significantly in the upcoming years. This is a headwind for the vast majority of REITs. If high inflation persists for much longer than currently anticipated, high-interest rates will probably take their toll on the bottom line of this REIT.

In reference to the valuation, the Canadian Apartment Properties REIT has recently been seen trading for 20.1 times its FFO per unit in the last 12 months. This is a markedly high FFO multiple, especially in the current investing environment, in which the valuation of most stocks has been compressed due to high inflation. High inflation reduces the present value of future cash flows and thus compresses REITs’ price-to-FFO ratios.

We assume a fair price-to-FFO ratio of 15.0 for the stock. Therefore, the current FFO multiple is higher than our assumed fair price-to-FFO ratio. If the stock trades at its fair valuation level in five years, it will incur a -5.7% annualized drag in its returns.

Taking into account the 2% annual FFO-per-unit growth, the 3.2% dividend, and a -5.7% annualized contraction of valuation level, the Canadian Apartment Properties REIT could offer just a -0.2% average annual total return over the next five years. Thus, the REIT is richly valued right now, and investors should wait for a meaningful correction of the stock.

Final Thoughts

The Canadian Apartment Properties REIT has been enjoying a strong recovery from the impact of pandemic. As the stock is offering a 3.2% dividend yield and has decent growth prospects ahead, it remains an attractive candidate for the portfolios of income-oriented investors.

However, the market seems to have already appreciated the virtues of this REIT. As a result, the stock seems fully valued right now. Moreover, the REIT is characterized by exceptionally low trading volume. This means that it is hard to establish or sell a large position in this stock.

More By This Author:

Monthly Dividend Stock In Focus: SmartCentres Real Estate Investment Trust

Monthly Dividend Stock In Focus: H&R Real Estate Investment Trust

3 Small-Cap Stocks With High Yields

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The more