Monthly Dividend Stock In Focus: Atrium Mortgage Investment Corp.

Atrium Mortgage Investment Corporation (AMIVF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 7.7% dividend yield.

#2: It pays dividends monthly instead of quarterly.

The combination of a high dividend yield and a monthly dividend could render Atrium Mortgage Investment Corporation appealing to income-oriented investors. In addition, the company is the leading non-bank lender in Canada and thus it has a reliable business model in place. In this article, we will discuss the prospects of Atrium Mortgage Investment Corporation.

Business Overview

Atrium Mortgage Investment Corporation is a non-bank lender that provides residential and commercial mortgages services in Canada. The company offers various types of mortgage loans, such as land and development financing, construction and mezzanine financing, and commercial term and bridge financing services for residential, multi-residential, and commercial real properties. Atrium Mortgage Investment Corporation was founded in 2001 and is headquartered in Toronto, Canada.

Atrium Mortgage Investment Corporation invests in commercial and residential mortgages from customers who cannot borrow funds from the traditional banking channels. In order to reduce its risk, the company has a diversified mortgage portfolio and does its best to maintain a disciplined underwriting policy.

A typical loan in the portfolio of the company has an interest rate of 6.99%-12.99%, a duration of 1-2 years, and includes monthly mortgage payments. The mortgage portfolio of Atrium Mortgage Investment Corporation currently has a weighted average interest rate of 10.77% and consists of 88% residential mortgages and 12% commercial mortgages.

Source: Investor Presentation

The company does its best to reduce operating expenses and provide stable dividends to its shareholders, with minimum volatility. To this end, it maintains a high-quality mortgage portfolio, which is characterized by a conservative underwriting policy.

Thanks to its prudent management, Atrium Mortgage Investment Corporation has offered consistent returns to its shareholders over the last decade. During this period, the company has offered a return on equity that has steadily remained 600-800 basis points above the yield of the 5-year bond of the Canadian government.

Thanks to its solid business model, Atrium Mortgage Investment Corporation has proved extremely resilient throughout the coronavirus crisis. This is impressive, as the pandemic would normally be expected to affect the borrowers of the company, who cannot borrow funds from large financial institutions. The resilience of Atrium Mortgage Investment Corporation to the pandemic is a testament to the strength of the business model of the company.

Growth Prospects

Atrium Mortgage Investment Corporation has exhibited a remarkably consistent performance record over the last nine years. The focus of its management on minimizing operating expenses and providing stable returns to the shareholders has certainly born fruit.

On the other hand, the company has posted essentially flat earnings per share over the last nine years. Therefore, investors should not expect meaningful earnings growth going forward. In other words, the reliable performance of Atrium Mortgage Investment Corporation comes at a price, namely lackluster growth prospects.

Given the rock-solid business model of Atrium Mortgage Investment Corporation, but also its lackluster performance record, we expect approximately flat earnings per share five years from now.

Dividend & Valuation Analysis

Atrium Mortgage Investment Corporation is currently offering an exceptionally high dividend yield of 7.7%, which is nearly quintuple the 1.6% yield of the S&P 500. The stock is thus an interesting candidate for income-oriented investors, but U.S. investors should be aware that the dividend they receive is affected by the prevailing exchange rate between the Canadian dollar and the USD.

Atrium Mortgage Investment Corporation has a payout ratio of 85%, which is elevated. However, it is in a strong financial position, with its interest expense currently consuming slightly less than 25% of its total interest and dividend income. As a result, the company is not likely to cut its dividend significantly anytime soon.

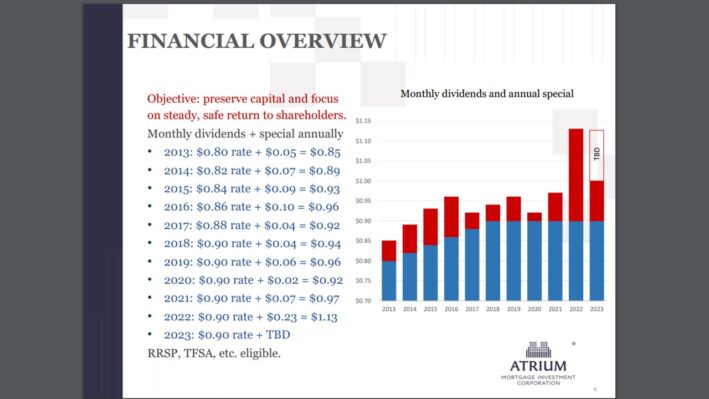

It is also remarkable that Atrium Mortgage Investment Corporation has maintained a solid dividend record over the last decade.

Source: Investor Presentation

As shown in the above chart, the company has grown its base dividend at a slow pace while it has also offered material special dividends every year. Overall, the shareholders should rest assured that the base dividend of Atrium Mortgage Investment Corporation is safe while the company is likely to keep paying a special dividend year after year.

On the other hand, the company has hardly grown its dividend in USD over the last nine years due to the depreciation of the Canadian dollar versus the USD. Given also the low-single digit growth rate of the dividend in Canadian dollars, it is prudent for U.S. investors to expect minimum dividend growth going forward.

In reference to the valuation, Atrium Mortgage Investment Corporation is currently trading for 11.3 times its earnings per share for the last 12 months. Given the resilient business model of the company, but also its lackluster growth prospects, we assume a fair price-to-earnings ratio of 12.0 for the stock. Therefore, the current earnings multiple is slightly lower than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will enjoy a 1.2% annualized gain in its returns.

Taking into account the flat earnings per share, the 7.7% dividend yield and a 1.2% annualized expansion of valuation level, Atrium Mortgage Investment Corporation could offer a 7.9% average annual total return over the next five years. This is a decent expected total return, but we recommend waiting for a significantly lower entry point in order to enhance the margin of safety and increase the expected return from the stock.

Final Thoughts

Atrium Mortgage Investment Corporation is characterized by prudent management and a defensive business model. In addition, the stock is offering an exceptionally high dividend yield of 7.7%. The company has an elevated payout ratio of 85% but it has a strong balance sheet and a consistent dividend record. As a result, its dividend should be considered safe, though investors should not expect meaningful dividend growth anytime soon. Overall, the stock seems fairly valued right now and hence investors should probably wait for a more attractive entry point in order to enhance their future returns.

Moreover, Atrium Mortgage Investment Corporation is characterized by extremely low trading volume. This means that it may be hard to establish or sell a large position in this stock.

More By This Author:

Monthly Dividend Stock In Focus: ExtendicareMonthly Dividend Stock In Focus: Pizza Pizza Royalty Corp.

Monthly Dividend Stock In Focus: Bridgemarq Real Estate Services