Monitoring Turkey: No Room For Complacency

Image Source: Pexels

October CPI came in below expectations, while annual inflation has returned to its downward trajectory with a small decline. Still, the data suggests that the disinflation process will remain challenging in the near term with continuing upside risks, leaving no room for complacency.

Turkey's economy at a glance

- Inflation at 32.9% in October has remained elevated this year vs the Central Bank of Turkey's (CBT's) interim target of 24%. Provided that no unforeseen shocks arise for the rest of the year, we anticipate that the annual inflation rate could be around 32% by the end of 2025. For next year, we expect inflation to decelerate to around 22% (vs the CBT’s interim target of 16%) with the balance of risks tilted to the upside.

- The CBT has responded to deterioration in the inflation outlook by slowing down rate cuts and further downsizing the pace to 100bp in October. With another 100bp cut in December, we expect the policy rate to be at 38.5% at the end of this year.

- The bank pledges to maintain a tight monetary stance to support disinflation and signals not to change the macroprudential framework in the near term. We expect the policy rate to be at 27% next year, while the size of the cuts ahead will depend not only on the inflation outlook, but also on considerations regarding dollarisation and reserves, as well as growth expectations and labour market conditions.

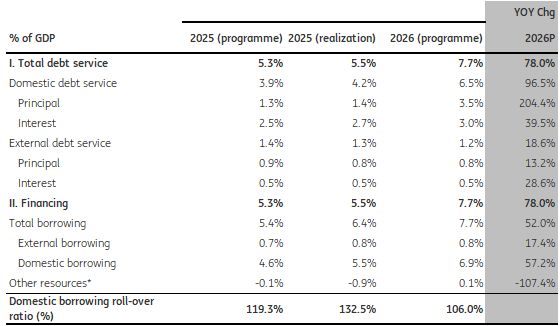

- In the 2026 borrowing plan, while expecting domestic debt rollover at 132.5%, well above what was envisaged in the programme for this year, the Treasury plans to cut the ratio to 106% in 2026. However, the programme forecasts a significant rise in debt redemptions next year – by c.2.3ppt of GDP – which stems solely from domestic debt.

- The central government budget registered a deficit of around 3.9% of GDP on a 12M rolling basis as of September, narrower than the 4.8% deficit recorded in the same month of 2024. The primary balance, which recovered from a deficit of 2.0% of GDP in the same period last year to a 0.4% deficit, also points to an improvement on the fiscal front.

Quarterly forecasts

Source: Various sources, ING

FX and rates outlook

Although the CBT cutting cycle is coming under pressure from slower disinflation and the rates market is seeing some repricing, the FX spot market remains rock solid. A more cautious and longer cutting cycle suggests a postponement of any changes to the current FX regime. It seems that the inflationary issues are making the central bank more cautious about additional inflationary pressures from a potential TRY depreciation.

At the same time, the FX market has become accustomed to political noise and the market seems to be more resilient than before, increasing our confidence that we will not see any changes here in the short-term and probably not even the medium-term. Forwards remain on the dovish side despite some hawkish movement in the rates space in September. Overall, the market will still see TRY longs in the spot market as the most attractive FX carry trade in the EM space, and recent developments suggest little chance of any change here. We expect 43.50 USD/TRY for the end of this year and 48.40 for the end of 2Q26.

Turkish government bonds (TurkGBs) are seeing continued pressure on the belly and long-end due to declining market confidence in the disinflationary process over the longer horizon. On the other hand, the front-end yields are grinding lower following CBT rate cuts, resulting in further steepening of the curve, and this trend can be expected to continue, although we believe that the disinflationary trend will resume. According to our calculations, MinFin has covered approximately 94% of the planned TurkGBs issuance, and it seems that this year's funding is fully under control. MinFin recently published its issuance plan for next year, which we discuss in the next sections.

Local bond yields vs CBT funding rate

Source: CBT, Refinitiv, ING

The Treasury’s borrowing plan for 2026

The Treasury and Finance Ministry announced the borrowing strategy for 2026. While expecting domestic debt rollover at 132.5%, well above what was envisaged in the programme for this year, the Treasury plans to cut the ratio to 106% in 2026. However, the programme forecasts a significant rise in debt redemptions next year – by c.2.3ppt of GDP – which stems solely from domestic debt.

Out of TRY5042bn domestic debt redemptions in 2026, TRY4,718bn will be made via the market (with the remaining TRY324bn to public institutions via non-competitive sales). Assuming that domestic borrowing from public institutions will be completely rolled over (the usual Treasury assumption, while the Treasury must meet total demand from these institutions), TRY5.020bn of TRY5,344bn domestic borrowing might be via the market (corresponding to a market rollover ratio of c.106.4%).

The Treasury last year announced that it would borrow US$11bn in 2025 and it has secured US$13bn, so far. According to the Treasury's own projections, it will repay US$6.2bn in the last quarter of 2025 and US$19.9bn (US$12.9bn of this amount is principal) in 2026. Despite the heavy schedule, it plans to raise issuance to US$13bn next year, while the CBT's strengthened reserve position should be a relief factor.

Despite plans for increased external funding, domestic borrowing requirements seem to be high given elevated budget deficits in recent years and the high-interest-rate environment. The rate outlook – given the CBT’s commitment to maintain a tight stance even after the rate-cutting cycle starts – and the continuation of foreign investors’ appetite will be key.

Details of the programme

Source: Ministry of Treasury and Finance, ING

No change in interim targets and forecasts

Turkish Central Bank Governor Fatih Karahan held a meeting to introduce the last inflation report of the year and shared the latest inflation forecasts. As expected, the CBT has kept inflation targets unchanged at 24%, 16%, and 9%, respectively for the 2025-27 period, given the interim targets strategy and adjusting them only under exceptional circumstances.

On the other hand, the bank raised the 2025 forecast range to 31-33% (mid-point 32%) from 25-29% vs the market consensus of 31.8%. While the forecasts for this year are more realistic, the bank has left the range for 2026 unchanged at 13-19% (mid-point 16%) to show its commitment to its target that is markedly below the market forecast of 22.1% in the latest market participants’ survey.

In the report, the CBT turned more cautious, acknowledging that the disinflation process has lost momentum in the last two months and has risen above the forecast range on the back of unfavourable food prices and slower-than-expected improvement in services inflation. While the CBT has responded to a deterioration in the inflation outlook by slowing down the rate cuts, Governor Karahan also pointed out that future policy steps will be guided by economic data and evaluated on a meeting-by-meeting basis, emphasising a cautious and flexible approach. The policy rate path will hinge on actual inflation outcomes, the underlying trend, and inflation expectations.

Details of the inflation report

Source: CBT, ING

Annual inflation resumed downtrend in October

October CPI inflation was 2.55% month-on-month, coming in lower than the consensus estimate. This was mainly due to unprocessed food and some non-food groups. As a result, after a temporary setback in September, annual inflation has returned to its downtrend with a decline from 33.3% to 32.9%. Core inflation (CPI-C) rose by 2.4% MoM, bringing the annual rate down to 32.5% on the back of a large base in 2024. The data shows that the seasonally adjusted monthly change declined across all main groups except for the services group. The change in the services group, however, was very limited.

The PPI increased by 1.6% MoM, while a significant portion of the monthly change is attributable to food products alone. Annual producer inflation inched up to 27% YoY, remaining on a gradual uptrend since April. However, the current level of PPI inflation indicates that cost pressures remain moderate as the FX basket showed only a very limited average increase of 0.9% MoM in October and its cumulative increase over the last 12 months remained at 27.0%.

Inflation outlook (YoY%)

Source: TurkStat, ING

Signals of a slowdown in the third quarter

While the second quarter GDP data reveals a clear acceleration in both annual and quarterly growth, defying previous expectations of a slowdown in quarterly momentum, early indicators for the third quarter suggest some moderation in industry and services production stemming from private consumption and external demand. Accordingly, comparing the Jul-Aug average with 2Q25, industrial production remained flat as growth in energy and capital goods production was offset by the decline in production in durable and undurable goods. This indicates a slowdown in 3Q25 amid weaker demand. Services production, on the other hand, was nearly flat, maintaining 0.2% sequential growth in 3Q over the previous quarter.

Early indicators for the last quarter suggest that firms anticipate a recovery in demand and production with the easing in financial conditions. In fact, the manufacturing capacity utilisation rate moved slightly up by 0.2pp MoM, while real sector confidence also improved by 1.2ppt MoM driven by current orders.

Real GDP (%YoY) and contributions (ppt)

Source: TurkStat, ING

Continued weak PMI

The manufacturing sector PMI, which has been below the 50 threshold since the first quarter of 2024, dropped further into contractionary territory to 46.5 in October from 46.7 in September (on a seasonally adjusted basis). The average in 3Q fell to 46.6 from 47.1 in 2Q, while the weak start to the last quarter of 2025 confirms ongoing weakness on the supply side.

Firms have witnessed continued slowdowns in new orders and output, and have maintained reluctance to commit to hiring or the fresh purchasing of inputs. Despite some signals of strength in prices with the currency weakness, inflationary pressures remained relatively subdued.

Findings in the sectoral PMIs, on the other hand, released by the Istanbul Chamber of Industry, are in line with what the manufacturing PMI data suggests in October, as all 10 sectors, except food, have remained below the 50 threshold, while six of them recorded a deterioration in PMIs in comparison to September.

PMI and business confidence

Source: ICI, CBT, ING

Unemployment rate flat in September

According to the seasonally adjusted labour market data, the headline unemployment rate remained unchanged in September due to the decline in labour force participation being slightly below the employment decline. Broadly defined unemployment indicators also showed a more positive outlook compared to the previous month.

The number of unemployed increased by 12K between August and September, reaching 3.08m, while the unemployment rate stood at 8.6%. The number of employed people decreased by 200K people compared to the previous month, while both the employment and labour force participation rates fell, standing at 48.9% and 53.5%, respectively. One of the broader unemployment indicators, the underutilisation rate – which combines time-related underemployment, potential labour force, and the unemployed – dropped by 1.2 ppt MoM in September, to 27.6%. Labour market dynamics suggest that domestic demand is likely to remain sluggish in the near term.

Labour market outlook

Source: TurkStat, ING

CBT cut again, despite September inflation surprise

At its October rate-setting meeting, the Central Bank of Turkey kept the asymmetrical interest rate corridor unchanged but slowed the pace of easing, cutting rates by 100bp to 39.5%, down from 250bp in September and 300bp in July. Estimates were ranging from 38% to 40.5%, while the prevailing expectation was a slowdown in rate cuts to either 100bp or 150bp rather than a pause.

With the CBT’s hawkish forward guidance – pledging to tighten policy if the inflation outlook strays from interim targets – the key question was whether the bank would pause or simply slow the pace of rate cuts in response to recent data. Based on the MPC statement, the CBT has turned more cautious. It acknowledged an increased underlying trend in September, referring to demand conditions that point to a slowdown in the disinflation process, and citing more pronounced risks posed by recent price developments in the disinflation process. This implies that the CBT has responded to the deterioration in the inflation outlook by slowing down rate cuts.

The policy rate vs. interbank O/N rate

Source: CBT, Refinitiv, ING

Record high surplus in August current account

In August, Turkey recorded its strongest current account ever at US$5.5bn vs US$4.9bn surplus in the same month of 2024. A comparison with last year reveals that the improvement was driven by higher services income attributable to a further increase in transportation and tourism revenues, a lower net energy trade deficit and a better primary income balance. We expect the persistent weakness in domestic demand to help contain the current account deficit this year, keeping it around 1.3% of GDP.

On the capital account side, we saw inflows in August of US$1.8bn. This was mainly driven by higher FDI, and continuation of net borrowing by both banks and corporates. On the flip side, residents’ increasing assets abroad and the central bank’s debt repayment have limited the net inflows. With a modest net outflow from errors and omissions of US$1.5bn, and considering the current account deficit, official reserves increased by US$5.7bn.

Current account (12M rolling, US$bn)

Source: CBT, TurkStat, ING

Budget deficit expanded in September

In September, the total central administration budget deficit amounted to TRY309.6 bn, exceeding the TRY100.5 bn deficit recorded in the same month last year. When breaking down the budget, tax collection slowed to an annual increase of 20.4%, largely because temporary corporate tax collections had already occurred in September of the previous year. Excluding interest payments, expenditures rose by 39.7% YoY, maintaining a similar pace to the previous month, with the key driver being the deceleration in the annual increase of current transfers to 37.4%.

In summary, with the September realisation, the ratio of the 12-month cumulative budget deficit to GDP reached 3.9%, while the primary balance posted a deficit of 0.4%. The underlying budget trend, excluding one-off revenues, can be tracked through the program-defined (IMF-defined) primary balance. Accordingly, excluding one-off revenues, the 12-month cumulative budget deficit reached 4.5% of GDP.

Budget performance

Source: Ministry of Treasury and Finance, ING

More By This Author:

Strong Currency Keeps Hungarian Inflation At BayHungarian Government’s Budget Bombshell Sends Shockwaves

FX Daily: Bittersweet Government Reopening For The Dollar

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more