Monitoring Hungary: Hopes For Growth Face A Reality Check

In our latest update, we reassess our Hungarian economic and market forecasts at a time when economic activity has severely disappointed in the second quarter, leading us to lower our full-year GDP forecast to 1.5%. Our updated outlook prompts us to revise our terminal policy rate call for 2024 to 6.25%.

Hungary: At a glance

- Second-quarter GDP data showed a quarterly contraction, while the outlook for the second half remains less than rosy. As a result, we have lowered our 2024 full-year GDP forecast to 1.5% from 2.2%.

- Both retail sales and industrial production figures have recently surprised to the downside, at a time when economic sentiment has corrected to January levels.

- The resilience of the labour market is very impressive, but in a rather uncertain business cycle the impact on the real economy remains limited.

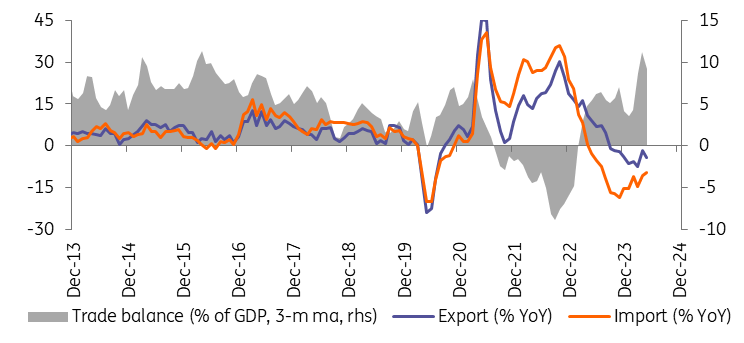

- As import dynamics fall below those of exports, the trade surplus will remain intact, which may result in a significant current account surplus by December 2024.

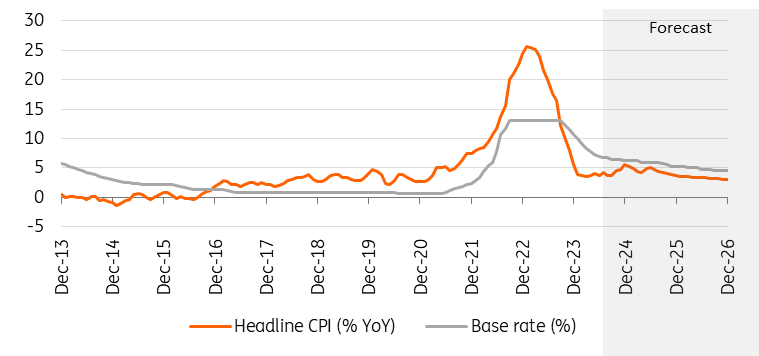

- Although headline inflation surprised to the downside in June, core inflation has accelerated after 18 months of decline. We still expect inflation to move markedly above 5% by year-end.

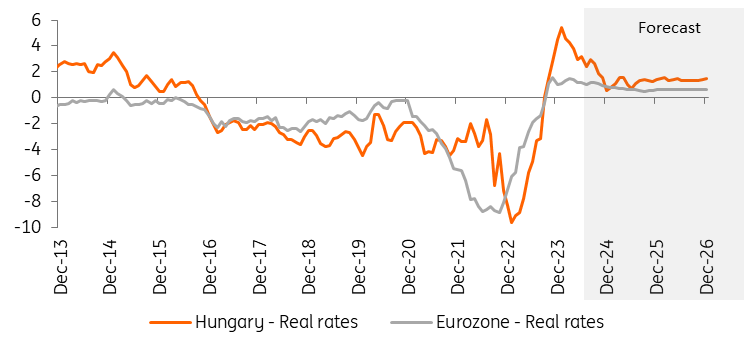

- The central bank appears to be more open to rate cuts than we had previously expected, and given the changing Fed landscape, we expect two more rate cuts from the National Bank of Hungary, bringing the base rate to 6.25% by year-end.

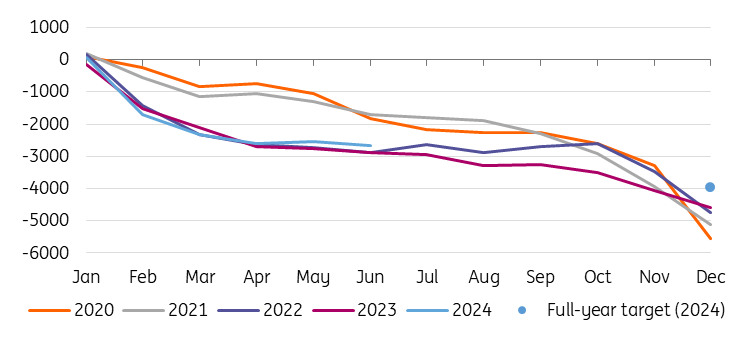

- The latest budgetary measures improve the achievability of the 4.5% deficit target, but with economic activity proving to be lacklustre, we still see risks that the final figure will be somewhere between 4.5–5.0% of GDP.

- Aggressive dovish repricing after the last NBH rate cut pushed EUR/HUF near this year's highs. This in turn opens the door in front of an early reversal unless we get more dovish signs.

- The short-end of the IRS curve is pricing more rate cuts than we expect, but it's hard to go against in the current climate. The long-end of the IRS and HGB curves still offers good value with a weaker-than-expected economy and improvement on the fiscal side.

Quarterly forecasts

Source: National sources, ING estimates

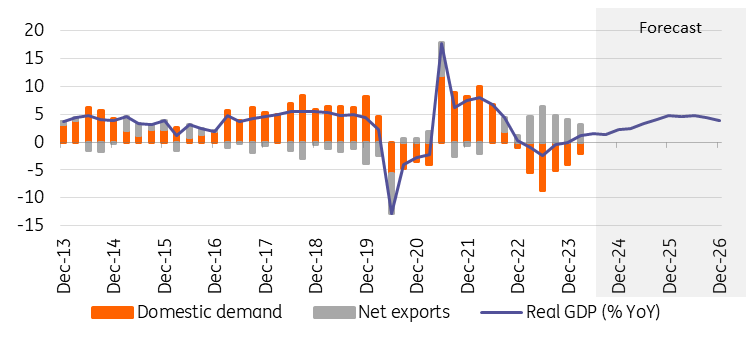

The economic recovery has once again come to a halt

The Hungarian economy crawled out of stagnation in the first quarter of 2024, but the recovery was short-lived, as evidenced by the quarterly contraction in the second quarter. Seasonally and calendar adjusted, economic activity fell by 0.2% quarter-on-quarter (QoQ), while the year-on-year (YoY) figure was up to 1.5% due to last year's low base. The preliminary release provides only a brief commentary, and on the basis of this we believe that domestic demand may have disappointed once again.

In fact, we may only have seen an improvement in services, which supports the view that the 'recovery' from 2023 remains very fragile and limited to a few segments of the economy. In light of this gloomy report, we have lowered our full-year GDP forecast from 2.2% to 1.5%. We remain more pessimistic than the government, with the Finance Minister recently mentioning a range of 1.8-2.2% for 2024 as a whole.

Real GDP (% YoY) and contributions (ppt)

Source: HCSO, ING

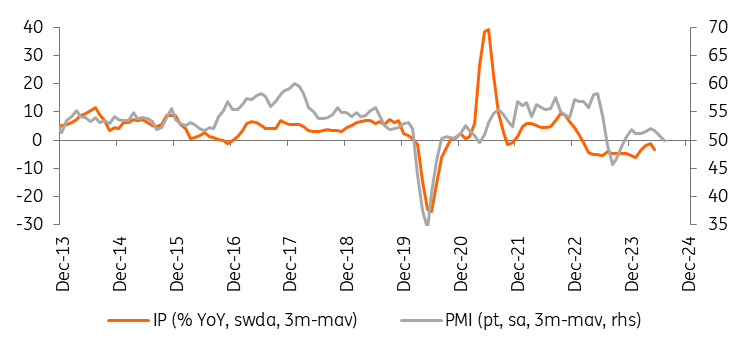

Industrial production is in freefall as export activity deteriorates

Industrial production surprised to the downside in May, as production volumes fell by 1.1% month-on-month (MoM), contributing to a 4.9% YoY decline in output on a working-day basis. Although capacity utilisation has recovered slightly to 76.1% in 3Q24, the outlook remains bleak. Manufacturers have started to explore options for a cautious optimisation of workloads in light of weak external demand.

In this regard, the total order book continued to deteriorate, falling 23.9% YoY, with export orders a major headwind. As we don't expect a significant improvement in external demand conditions in the second half of 2024, we maintain our view that industry will make a negative contribution to GDP growth this year.

Industrial production (IP) and Purchasing Manager Index (PMI)

Source: HALPIM, HCSO, ING

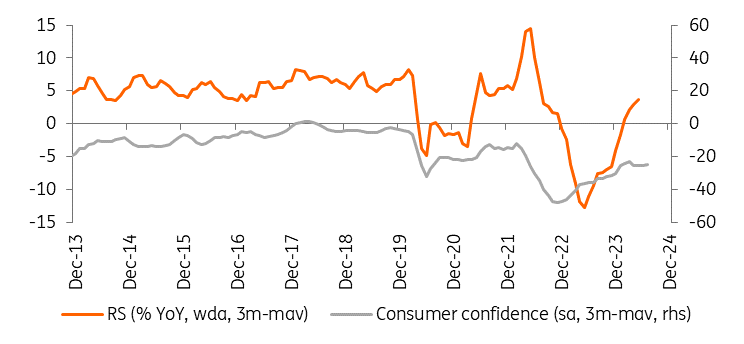

Retail sales performance is still limited by low confidence

Retail sales volumes rose by just 0.1% MoM in May, bringing the YoY figure to 3.6%, adjusted for seasonal and working-day effects. The monthly stagnation paints a gloomy picture, especially as it comes after a negative reading in April. At the component level, food retailing posted a 1.5% rise in sales on a monthly basis, helped by falling food prices. In contrast, non-food and fuel sales fell by 1% and 2.6% respectively, underlining the fact that ongoing household caution remains a headwind.

The remarkably strong wage growth so far hasn't translated into a sustained boost to retail sales, as the recovery in consumer confidence is proving to be very gradual. With the latest second-quarter GDP data showing a quarterly contraction, we suspect that June retail sales won’t provide too much of a positive headline.

Retail sales (RS) and consumer confidence

Source: Eurostat, HCSO, ING

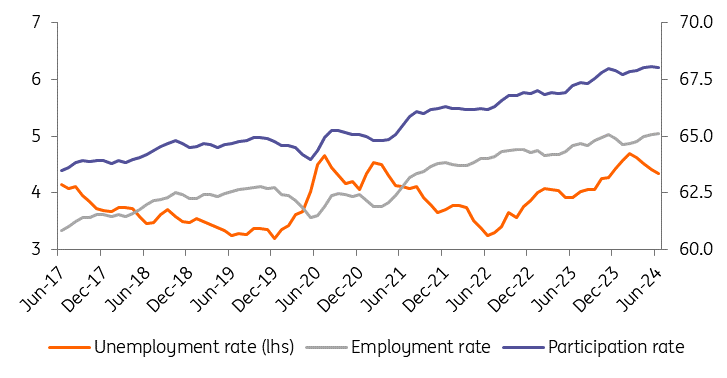

Labor market resilience is one of the few silver linings at the moment

The recent stabilisation in labour market statistics continued in June, as the three-month (April-June) unemployment rate improved to 4.3%, marking the fourth month of continuous improvement. The latest employment expectations survey points to an improving outlook across all sectors, supported by seasonal hiring, and therefore we expect further marginal improvement in the coming months.

The resilience of the labour market is also reflected in the latest wage growth figure, which accelerated to 14.8% YoY in May. At the same time, the pace of wage growth in the private sector is 13.5%, which in our view poses a substantial risk to services inflation. Nevertheless, with economic activity proving so lacklustre, the surrounding business environment seems to be dampening both the positive and negative effects of labour market resilience.

Historical trends in the Hungarian labor market (%)

Source: HCSO, ING

Another silver lining is the current account surplus

May brought another large trade surplus of EUR1bn, despite continued weakness in industrial export sales. However, exports are only one side of the equation, and with imports falling more sharply, the result remains a trade surplus. In this respect, while the volume of exports at current prices fell by 4.8% between January and May, the volume of imports fell by a significant 11.4%, hence the persistent trade surplus. As far as the latest May figure is concerned, we have seen a change in direction, with export momentum falling more sharply than imports.

However, we believe that the general trend we've seen so far will continue throughout 2024, so the trade surplus will remain intact. Against this backdrop, we turn up our optimism on the current account, and we now expect a larger upside risk than before regarding the 2024 surplus.

Trade balance (3-month moving average)

Source: HCSO, ING

We still expect inflation to move markedly above 5% by year-end

Headline inflation fell slightly, with the year-on-year rate moving to 3.7% in June, while the monthly repricing was flat, suggesting that favourable base effects were not the main reason for the slowdown in the main price indicator. Despite the lowering headline rate, core inflation rose for the first time in 18 months as a result of a 0.5% MoM increase, while many underlying inflation indicators also moved higher.

Going forward, we expect inflation to remain on an upward trend, with monthly repricing remaining above historical norms. As a result, we expect both headline and core rates to creep back firmly above 5.0% by December 2024. Nevertheless, subdued economic activity poses a downside risk to our forecast for 2024, while the expected impact of fiscal measures and strong real wage growth in 2025 will keep pressuring underlying inflation. As a result, we see average inflation being higher next year compared to this year.

Inflation and policy rate

Source: NBH, ING

We lower our terminal rate call for 2024 to 6.25%

At its July meeting, the National Bank of Hungary (NBH) maintained the previous pace of rate cuts at 25bp, bringing the key rate to 6.75%, while maintaining the +/- 100bp symmetric interest rate corridor around the key rate. It seems that the new era has brought with it the same decision, another rate cut, which leads us to believe that the NBH is not as hawkish as we previously thought. Nevertheless, the changing Fed landscape is taking some of the pressure off emerging market currencies.

This, combined with a lower short-term inflation outlook compared to a few months ago, opens the door to further rate cuts. As a result, we revise our terminal rate call for 2024 to 6.25%, as we now expect two additional 25bp rate cuts. However, the timing of these cuts is rather uncertain, with the NBH remaining in a truly data dependent mode.

Real rates (%)

Source: ECB, NBH, ING

We still expect the deficit to be somewhere between 4.5–5.0%

The monthly budget deficit was HUF108bn in June, bringing the year-to-date general government cash flow deficit to HUF2.66tn. This means that the shortfall has reached 67% of the planned financing needs in 2024. However, we expect the pressure on the expenditure side to ease in the coming months, as interest payments have been frontloaded. At the same time, recently announced measures contribute to a general improvement in the budget of around 0.6% of GDP, which increases the chances of achieving the deficit target.

However, sluggish economic activity poses a downside risk to indirect tax revenues, and we therefore maintain our forecast that the year-end deficit will be in the range of 4.5-5.0% of GDP. Although the debt-to-GDP ratio may rise as a result, this alone will not trigger a downgrade, according to the latest communication from the rating agencies.

Budget performance (year-to-date, HUFbn)

Source: Ministry of Finance, ING

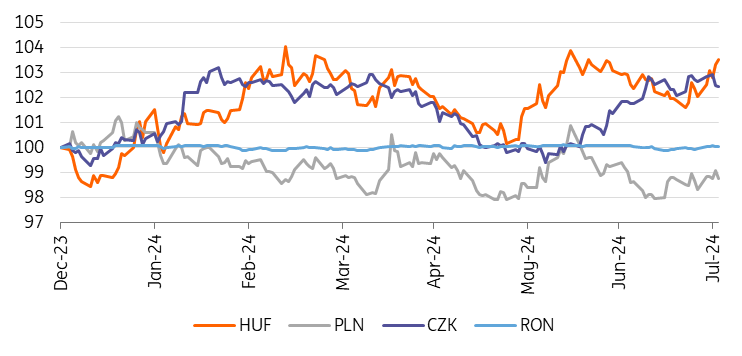

Forint at the top of its range and NBH solving puzzle again

The forint has weakened by 1.8% against the EUR since the last NBH meeting and EUR/HUF is near this year's highs. The NBH traditionally follows inflation and FX closely. But at the same time, FX tracks the NBH as well. Therefore, we continue to see the 385-400 EUR/HUF range as the main playing field for the rest of the year. The NBH's openness to cutting rates further in conjunction with a weaker-than-expected economy indicates to us that the play will be more in the upper half of the range with the risk of a temporary upside crossing of the 400 boundary. The good news for HUF is that the market is already pricing in two to three rate cuts for this year, more than we expect. While still a realistic alternative, the scope for further pricing of rate cuts is limited in our view.

On the other hand, the HUF market likes to get excited about NBH rate cuts, which we know from the past, and some temporary terminal rate undershooting is possible. But rising inflation should keep market expectations in check and with that limit further HUF depreciation. Conversely, from current levels, it should be easier for the NBH to push against expectations and help the HUF to later start appreciating lower within our range, unless we see further downside inflation surprises. Overall, we thus believe that the current HUF depreciation is close to the end unless inflation surprises to the downside again and if the NBH starts to push against aggressive rate cut expectations due to concerns about weak FX, HUF will see some gains later.

CEE FX performance vs EUR (29 December 2023 = 100%)

Source: NBH, ING

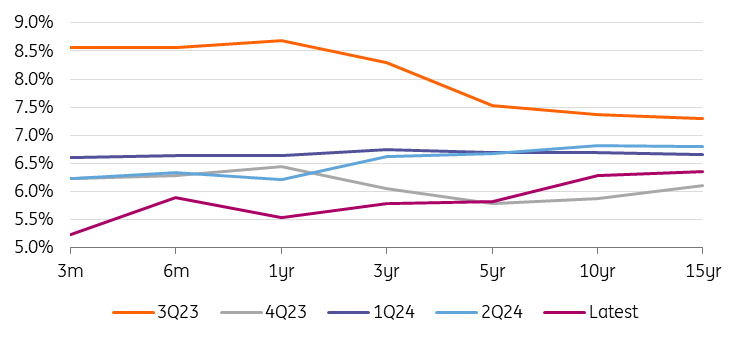

The long end of the curve still has room to go down despite the current rally

The HUF curve rallied in the first half of July with expectations of NBH rate cuts, however, the meeting itself did not add further fuel to the rally and we saw further movement only with weaker GDP data last week. The rest of the move down is more of a global rally. Even so, the HUF curve remains the steepest within the CEE peers and the only one with a positive slope. That is not likely to change given the expected NBH cutting cycle in the future.

At the short end of the curve the terminal rate has fallen to 4.95% in mid-2025, which seems way too low to us, but we were already here in January this year and it is hard to go against in the current conditions. On the other hand, the long-end with the 5y5y IRS at 6.15% currently and core markets in rally mode has good potential to go further down with the prospect of a weakening economy and lower rates in the longer term.

Hungarian sovereign yield curve (end of period)

Source: GDMA, ING

With a positive outlook for the long end of the IRS curve and improvement on the fiscal side, we still see good value in Hungarian government bonds (HGBs). The debt agency significantly frontloaded the HGBs issuance on concerns of a higher deficit but now with about 75% of the issuance covered and the introduction of measures to keep the fiscal under control, the HGBs picture looks very attractive – in particular, the long end through wider ASWs. Of course the debt agency will look to pre-fund next year, but compared to other CEE peers we see no need to push supply here against a saturated market, plus auction results still show the most interest from investors here within the CEE region.

Forecast summary

*Quarterly data is eop, annual is avg. Source: National sources, ING estimates

More By This Author:

Turkey Sees Big Drop In Annual Inflation On Base Effects But July Prices Remain High

Retail Sales Show That Household Spending Is Driving The Czech Economy

The Commodities Feed: Oil Plunges Along With Other Risk Assets

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more