Mixed Data For The German ZEW

If in June we commented on the positive data for the German IFO, during today's session, we have known the important data corresponding to the German ZEW, with regards to investor confidence and in relation to the current situation.

This data is published by the European Economic Research Center in which the sentiment of German institutional investors is determined through a survey of around 350 financial institutions and analysts in relation to their expectations of the next 6 months and the current perception of the situation.

The interpretation of this important indicator is very simple, since if the value is set above zero it is interpreted as optimism and below zero as pessimism.

After the publication of this data we can see a clear disparity between the current situation and investor confidence, since we can observe that the ZEW index of investor confidence in relation to the current situation has not only managed to move into positive territory after two years, but has also been much higher than expected by the market consensus to settle at 21.9 points compared to the expected 5 points.

On the other hand, investor confidence has fallen more than expected after reaching 63.3 points, compared to the 75.2 points expected after reaching 79.8 points the previous month.

The above data, together with the positive data from the IFO in relation to business expectations and business confidence that we discussed in the aforementioned analysis, show that investors are confident of a sustained recovery of the German economy and that therefore the European locomotive will continue to develop a positive evolution during the coming months.

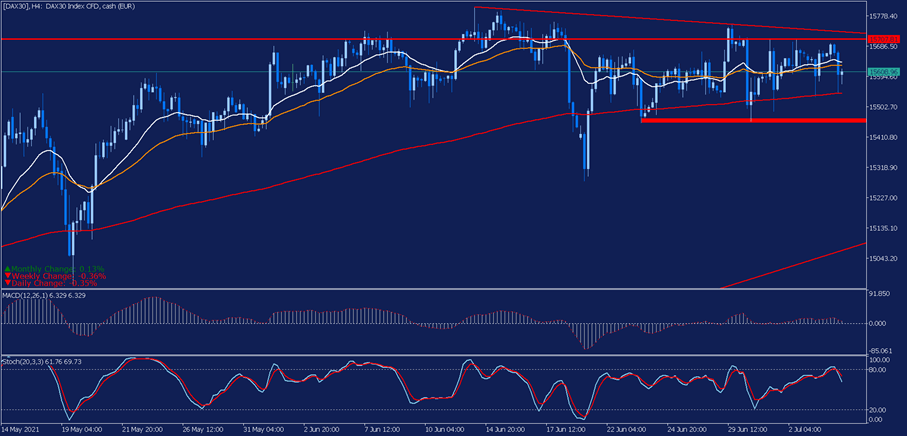

Despite such positive macro data, if we look at the H4 chart, we can see how during the last few sessions, the DAX30 is trading practically flat with a slight rise of 0.10% so far this month.

Technically speaking, we can see how the DAX30, after marking historical highs on June 14, is performing a consolidation in the last few sessions. This has led it to make a bearish average crossing in H4 and temporarily lose its average of 200 in the red, although it finally managed to bounce higher.

Currently, the DAX30 has two important resistance levels, represented by the short-term downtrend line in the red and the resistance level around 15,700 points. The break of these levels could open the door to a new upward momentum in search of its all-time highs. Conversely, if the price loses its average of 200, we could find a further correction up to its next support level in the lower red band.

(Click on image to enlarge)

Source: Admiral Markets MetaTrader 5. H4 chart of the DAX30 Data range: May 14, 2021 to July 6, 2021. Prepared on July 6, 2021 at 13:05 hours CEST. Please note that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 3.6%

- 2019: 25.48%

- 2018: -18.26%

- 2017: 12.51%

- 2016: 6.87%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more