MIOFX: A Fund For Profiting From Foreign Market Strength

Image source: Pexels, Photo by Monstera

International stocks have shown on-again, off-again performance over the last 10 years or so. So far in 2025, the pattern is continuing, and it is an 'on' year. I like the Marsico International Opportunities Fund (MIOFX), highlights Brian Kelly, editor of MoneyLetter.

Several factors have been driving this: Fiscal stimulus in Germany, corporate reforms in Japan and South Korea, a weakening US dollar, signs of stabilization in China, and an improving policy environment in Europe.

Over the first five months of this year, the MSCI Europe (+20.6%), MSCI Europe, Australasia, and Far East EAFE (+17.3%), and MSCI All Country World Index ACWI ex-USA (+14.4%) indices have all seen solid gains, while the S&P 500 Index has only witnessed an increase of around +1.1%.

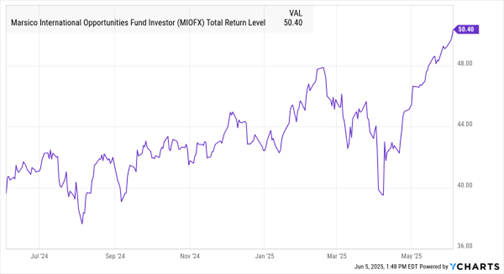

Marsico International Opportunities Fund (MIOFX) Chart

Data by YCharts

International stocks continue to be in a good position as we approach mid-year 2025. Their valuations are generally lower compared to US stocks, and many international companies have domestic businesses that are not affected by US policy changes. Looking at the currency markets, lower interest rates here in the US should make the dollar less attractive in the months ahead. A lower dollar is beneficial to US investors holding international stocks.

It should also be noted that Germany, Europe’s largest economy, announced a significant fiscal stimulus in March, consisting of defense and infrastructure spending. This stimulus is expected to benefit Europe and could lead to a stronger industrial cycle over the next three years. However, it will take time for the stimulus to be implemented and have an impact.

The MIOFX fund invests primarily in foreign securities, such as common stocks of foreign companies that are selected for their long-term growth potential and other foreign securities, whether traded in the US or in foreign markets or both. The fund’s fundamental investment approach combines “top-down” macroeconomic analysis and investment theme development with “bottom-up” company and security analysis to identify attractive opportunities.

My recommended action would be to consider buying the Marsico International Opportunities Fund.

About the Author

Brian Kelly has enjoyed a long career in newsletter publishing and has maintained involvement with MoneyLetter continuously since 1984. He has been a member of the MoneyLetter Investment Committee for over 30 years.

As vice president and product manager for IBC/Donoghue Inc., and IBC USA (Publications) Inc., Mr. Kelly was responsible for all aspects of the MoneyLetter group of products including planning, marketing, fulfillment, customer service, and public relations.

More By This Author:

BYD & Buffett: Why Sometimes Doing Nothing Is The Better ChoiceAs Tariff Saga Unfolds, Where Will Bond Yields Head?

EPD: A Sterling Dividend Stock For The Long Term

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more