Maximizing HSI Trend With Hang Seng Index ETF

Image Source: Pixabay

The Hang Seng Index ETF is a financial instrument that offers investors exposure to the Hong Kong stock market. It specifically tracks the performance of the 60 largest companies listed on the Hong Kong Stock Exchange. These companies include prominent companies in a diverse range of sectors, from real estate and financials to technology and consumer goods.

Investing in the Hang Seng Index ETF is akin to harnessing the collective economic momentum of these top-performing companies. It’s a strategy that reflects the market’s overall health and the vibrancy of Asia’s financial nerve centre. The ETF structure allows for a straightforward investment, mirroring the index’s movements and providing a transparent, liquid vehicle for those looking to invest in Hong Kong’s robust market.

Currently, the market presents a compelling opportunity. Following the wisdom of Machiavelli, who understood the value of strategic action in reasonable times, the sharp pullbacks we’ve observed have placed the Hang Seng Index ETF in a highly oversold position on the monthly chart. This signals a potentially auspicious moment for long-term investors. Much like the ebb and flow of history that Machiavelli chronicled, the market’s cycles offer moments of advantage that the astute investor can seize. Now, with the market’s retreat, the ETF stands as a beacon for those looking to invest with a long-term horizon, promising a blend of resilience and potential growth.

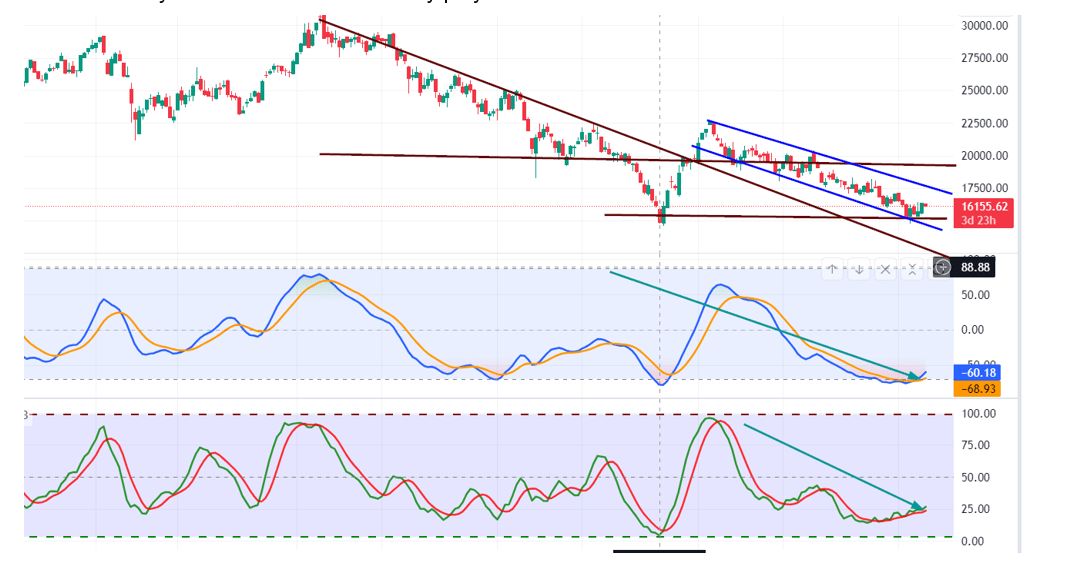

Hang Seng Index ETF: Analyzing Potential Breakouts and Oversold Conditions

It has been unable to close at or above 17,100. But it has now generated a buy on the weekly charts, which means the odds of testing the 18,200 to 18,600 range have risen significantly. If the pattern on the Monthly charts improves, further gains are a real possibility. One such development would be a monthly close or above 18,000. Such a development would pave the way for a test of the 22,700 to 23,500 range with a possible overshoot to 26,400. Market Update January 15, 2024

The weekly charts triggered a second buy signal on January 22 (the weekly chart is shown below), and let’s see if this gives it a boost and pushes it higher. Although the current performance might not be dazzling, this index has a track record of throwing in a few head fakes – deceptive signals that mislead on the upside and downside before ultimately moving in the expected direction. Think of these head fakes as a way to weed out the less sturdy players in the Market.

For a strong indication that it’s poised to challenge the 18,200 to 18,600 range, potentially overshooting to 19,000, a weekly close at or above 17,200 (ideally 17,255) is required.

Curiously, the Hang Seng index and the Chinese markets are trading in the highly oversold range on the quarterly charts. This presents an anomaly, although neither trades as profoundly into the oversold zone as Palladium.

Conclusion: Strategic ETF Investments Amidst Hang Seng Volatility

As the Hang Seng Index navigates a tumultuous period, with recent activities falling short of the pivotal 17,100 mark, investors are looking for prime ETFs to leverage potential gains. The market is abuzz with opportunity, with a buy signal ignited on the weekly charts and anticipating an ascent towards the 18,200 to 18,600 band. Noteworthy ETFs such as the iShares Core Hang Seng Index ETF (3115. HK) and the Hang Seng TECH ETF (3032. HK) are gaining attention for their potential to capitalize on these movements. The strategic positioning of these funds could serve investors well, aiming to exploit the expected rally that could challenge and potentially surpass the 19,000 echelons.

The index’s recent history of misleading signals has weeded out the timid, leaving a field ripe for the steadfast. With both the Hang Seng Index and broader Chinese markets exhibiting oversold conditions on the quarterly charts, the stage is set for a calculated investment approach, mirroring the resilience of assets like Palladium yet with the unique potential of Hong Kong’s market.

More By This Author:

Stock Investing For Kids: Surefire Path To Success!I Keep Losing Money In The Stock Market: Confronting The Stupidity Within

List At Least One Factor That Contributed To The Stock Market Crash And The Great Depression

The Tactical Investor does not give individualised market advice. We publish information regarding companies we believe our readers may be interested in, and our reports reflect our sincere opinions. ...

more