Masayoshi Son Picks Odd Time To Bet Big On OpenAI

Masayoshi Son may be about to pull off his signature move – doubling down. Having already invested over $1.5 billion into OpenAI, the SoftBank boss could throw another $25 billion into the artificial intelligence company, according to a Financial Times report on Thursday. Previous double dips like WeWork and Uber have yielded distinctly mixed results, but the timing of the Japanese investor’s latest gambit deserves its own level of weird.

As recently as last week, OpenAI might have seemed a sensible bet. The group run by Sam Altman, which launched ChatGPT in late 2022 and touted 100 million weekly active users within a year, was in the AI box seat.

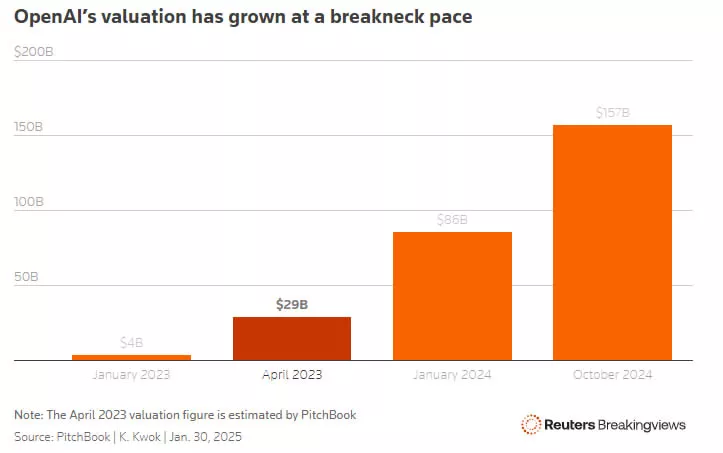

Venture investors have so far poured $24 billion in OpenAI, according to PitchBook, valuing the company at $157 billion in its last funding round. That’s 13 times the revenue the New York Times has reported as likely this year. Nvidia, the AI darling stock, trades at 15 times the revenue analysts expect it to generate in 2025, using LSEG data.

Admittedly, a better benchmark for OpenAI is probably $2.4 trillion Alphabet, because they overlap in terms of launching web searching tools and AI models. Still, Alphabet trades at 4 times its likely 2029 revenue. If OpenAI could grow its top line to $100 billion by then, in line with what people familiar with the matter have told the New York Times, the company would be worth $400 billion – and Son would double his money.

All that said, the arrival of DeepSeek, a Chinese artificial intelligence company that has created a powerful AI model much more cheaply and with far fewer chips, flips the script. It raises doubts over the business of building large language models with huge amounts of capital.

DeepSeek’s comparable performance to OpenAI and Amazon-backed Anthropic shows new techniques for developing AI models that are cheaper to train. It costs a lot less to use than those from Western rivals – OpenAI’s ChatGPT Pro subscriptions, which solves advanced questions like those related to theoretical physics, charges $200 a month.

Perhaps Son is banking on exploiting OpenAI’s new vulnerability to buy in at a bargain level. Or maybe Altman can conjure up a riposte to DeepSeek which calms investors down, and data security issues offset the appeal of the Chinese model and other freely available so-called open source equivalents. Then a SoftBank OpenAI punt might turn out like Uber.

But even before DeepSeek’s bombshell, OpenAI had to perfectly execute its revenue projections to justify its valuation. After it, the task looks much more daunting. SoftBank investors may well be nervous that this latest gambit gets filed in the cabinet of Masayoshi’s duds.

Context News

SoftBank is in talks to invest up to $25 billion in ChatGPT owner OpenAI, Reuters reported on Jan. 30 citing a person familiar with the matter. SoftBank could invest $15 billion to $25 billion directly into Microsoft-backed OpenAI, some of which may be used to pay for OpenAI’s commitment to Stargate, the person said.

SoftBank’s investment would be on top of the $15 billion it has already committed to Stargate, the person said, adding the talks are at an early stage. The latest OpenAI investment talks were initially reported by the Financial Times earlier on Jan. 30.

More By This Author:

S&P 500 Earnings Dashboard 24Q4 - Friday, Jan. 31

Russell 2000 Earnings Dashboard 24Q4 - Friday, Jan. 31

S&P 500 Earnings Dashboard 24Q4 - Thursday, Jan. 30

Disclaimer: This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Refinitiv ...

more