Marked Decline In Core Inflation In Poland

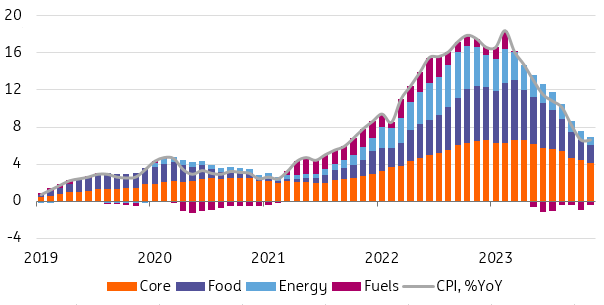

Polish CPI inflation for November was revised to 6.6% YoY from the flash estimate of 6.5%. The bright spot of the StatOffice data is the widespread slowdown of core inflation in many categories. So, while the short-term inflationary outlook is improving, medium-term challenges remain

Factors driving CPI developments in November

November CPI inflation was revised upwards to 6.6% YoY and hence remained unchanged vs October (6.6% YoY). This time, it was services inflation that fell (to 8.6% YoY vs. 9.3% previously ), while goods inflation increased slightly (to 5.9% YoY from 5.7% in October).

The stabilisation of annual CPI inflation is mainly due to the substantial decline in core inflation, which, according to our estimates, fell to 7.3% YoY in November from 8.0% in October. Declines in annual inflation are evident in most of the categories included in core inflation, which is what caused such a large fall of core in YoY terms.

Also, Month-on-Month, core prices have declined slightly(the NBP will publish official data on Monday, 18 December). Excluding the election month of September 2023, we have not seen such low core MoM inflation dynamics since 2020 (although core MoM is seasonal, in seasonally adjusted terms it was already low in July 2023 and the first half of 2021).

In MoM terms, organised tourism prices fell sharply (-3.2% MoM), furniture (-0.6% MoM), house appliances (-0.6% MoM) and telecommunications equipment (-0.7% MoM) also cheapened. In contrast, prices in restaurants and hotels (0.4% MoM), pharmaceuticals (0.8% MoM), rents (0.5% MoM) and footwear (0.5% MoM), among others, increased.

Compared to October, there was a marked increase in fuel prices (8.8% MOM), translating into a slowdown of deflation in this category to -5.7% YoY, following a -14.4% YoY drop in October. November was also the second month in a row when food prices increased on a monthly basis (+0.9% MoM), but food inflation continued to decelerate on an annual basis (to 6.9% YoY in November vs. 7.6% YoY in October).

Consumer inflation unchanged in November vs. October

CPI, %YoY

GUS, ING.

Inflation and monetary policy prospects

Our very preliminary estimate is that CPI inflation will rise slightly in December due to the low reference base from last year when consumer prices rose by merely 0.1% MoM. However, the beginning of 2024 should bring further disinflation. This will largely be due to the prolonged freeze in energy prices (electricity, gas, heating), while in January this year, we saw strong increases in house energy prices due to the reinstatement of VAT rates to 23%. Our baseline scenario also assumes the reintroduction of VAT on food from January next year, as envisaged in September's budget bill (we should know the final decisions of the current government on this issue in the next two weeks).

In general, the short-term inflation outlook has improved in recent weeks due to the favourable developments of energy commodity prices on global markets, the downward pressure on tradable goods and the strengthening of the PLN. In the second part of next year, we may see an increase in inflation due to the fact that the anti-inflation shield will only limit energy price increases until the end of June. Still, the labour market developments are indicating higher prices. Continued high wage growth, additionally fuelled by a substantial increase in the minimum wage from January 2024, will translate into increased upward pressure on service prices and, as a result, higher core inflation.

We assume that the MPC will refrain from changing interest rates until at least March. The NBP's next macroeconomic projection should provide a better assessment of the medium-term inflation outlook than the November round. The central bank's interest rates may be kept on hold until the end of next year (our baseline scenario). Rate rises seem unlikely, while the chances of small reductions next year are increasing.

Abroad, there is a big improvement in the inflation outlook, and central banks in developed countries (ECB, Fed) are preparing for cuts. In Poland, the sustainability of disinflation is more uncertain than in the region due to elevated wage pressures, fiscal expansion, and an overhang of frozen electricity and gas prices. However, the external environment has become more disinflationary, so chances are growing that the NBP will resume the easing cycle, albeit on a small scale.

More By This Author:

China’s Sputtering Recovery ContinuesKey Events In EMEA For The Rest Of 2023

The Commodities Feed: Positive Sentiment Continues

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more