Malaysian Stocks: Valuation Above Average, Growth Below Average

Video Length: 00:03:48

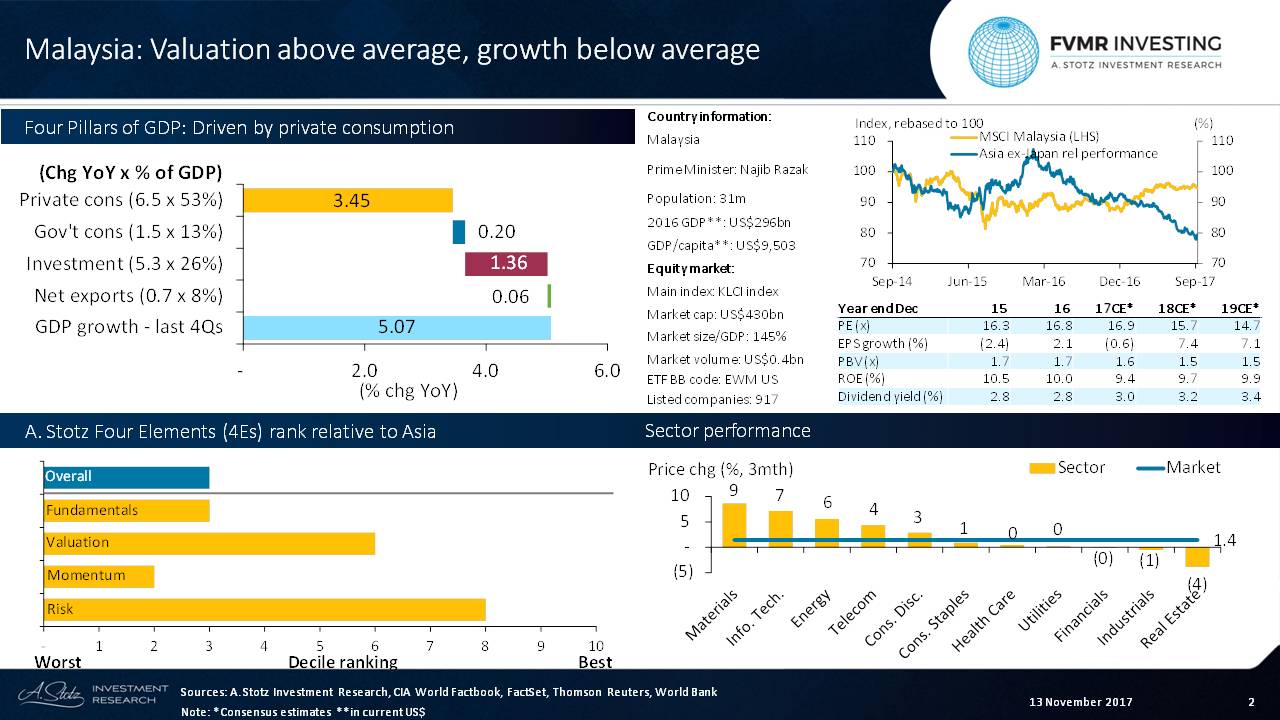

Four Pillars of GDP: Private consumption and investments

Malaysia’s GDP has been growing at a steady clip just above 5% over the last four quarters. Private consumption has been the main contributor to GDP growth, contributing almost 70% of it, but investments have also lent its hand.

Valuation above average, earnings growth below average

Malaysia is slightly more expensive as a whole, considering its price-to-earnings (PE) ratio relative to Asia, which is at about 17x for 2017CE*.

Earnings are the primary problem for the market, with analysts expecting a slight fall for the overall market in 2017. But investors may have been persuaded to stay with the attractive 3% dividend yield.

(Click on image to enlarge)

A. Stotz Four Elements: Malaysia’s rank relative to Asia

Overall, Malaysia is ranked as relatively unattractive, considering all our four elements: Fundamentals, Valuation, Momentum and Risk.

Fundamentals: Malaysia offers a low ROE below 10%.

Valuation: The price-to-book value is relatively cheap, and the dividend yield is above average.

Momentum: The market features poor earnings growth and poor price momentum.

Risk: The market has a low volatility profile.

Weak performance in the top 3 largest sectors in 3Q17

Top 3 largest sectors: Financials: 21% of the market; Industrials: 16%; Consumer Staples: 11%.

Best sector & stock: Materials: +8.6% & Press Metal Aluminium Holdings Bhd: +42.5%.

Worst sector & stock: Real Estate: -3.8% & Sunway Bhd: -45.0%.

Disclaimer: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and ...

more