Wednesday, August 10, 2022 4:26 AM EST

Robust labor market conditions appear to be supported by solid consumer activity following the reopening of the economy. However, the unemployment rate is likely to rise over the next few months as the initial impulse gradually dissipates.

Unsplash

Unemployment rate stays at 2.9% in July, in line with market consensus

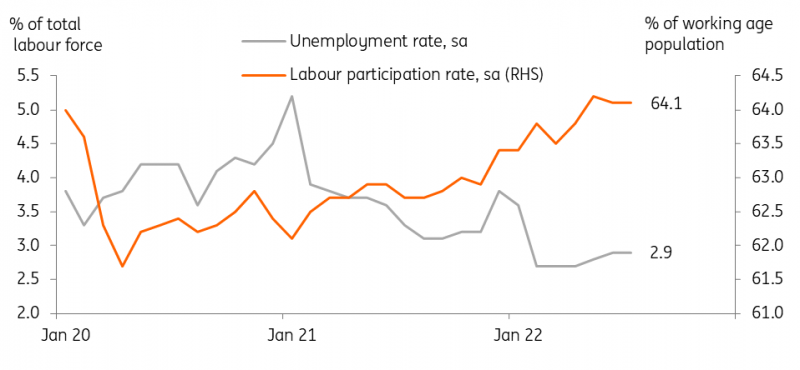

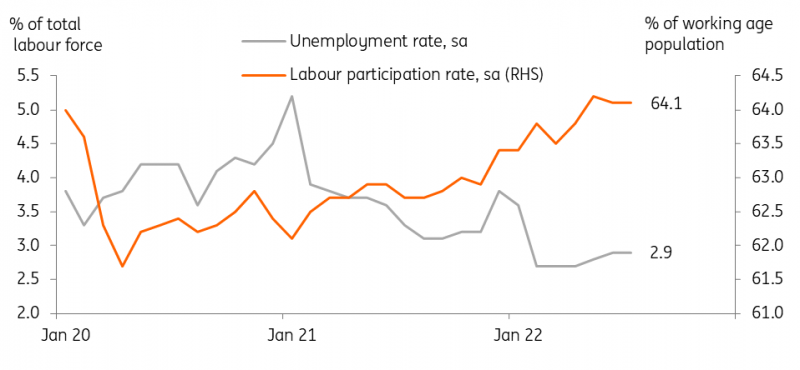

Despite the recent re-emergence of COVID-19 cases, the impact on people's mobility and consumption activity appears to be very limited. Labor market conditions have remained relatively healthy, benefiting from the reopening of the economy. Meanwhile, the labor participation rate stood at 64.1% for the second month, returning to the pre-pandemic level. Therefore, we believe that additional advances in labor participation should be limited from now on.

Both unemployment rate and labor participation rate unchanged in July

Source: KOSTAT

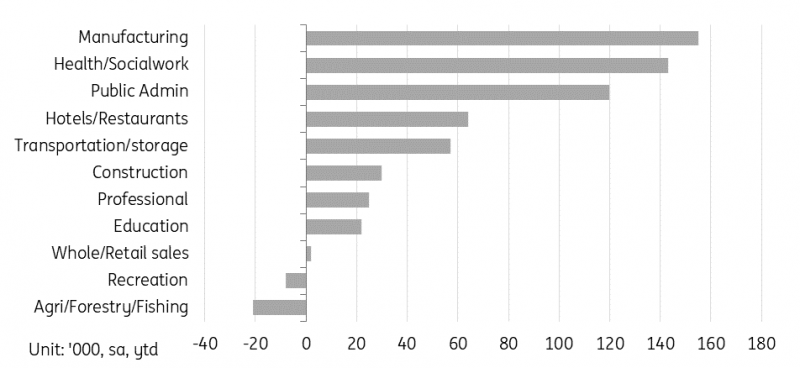

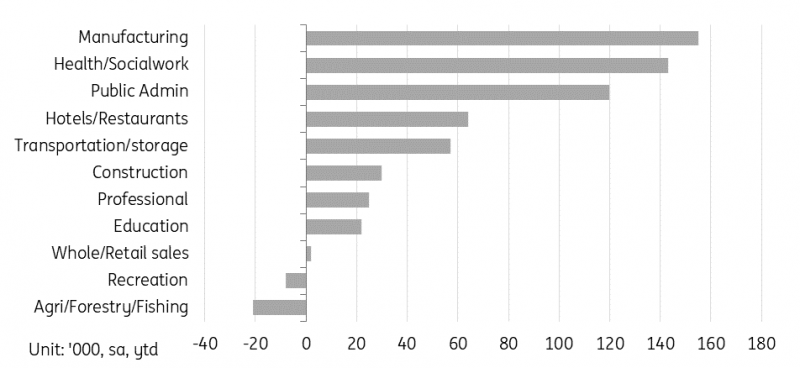

By industry, manufacturing added jobs for the second month while construction shed jobs the most in August probably due to the temporary suspension of a large-scale housing construction site. Among the services sector, hotels/restaurants continued to add jobs, but the recreation and transportation sectors lost jobs unexpectedly despite the holiday season. By employment type, the number of regular workers (with a contract of 12 months or longer) increased significantly, while that of daily workers (with a contract of less than one month) decreased. As such, we believe employment stability improved in July.

Manufacturing added jobs the most YTD 2022

Source: KOSTAT

Bank of Korea is expected to deliver 25bp hike in August

Today's labor market report shows that the economy remains resilient amid growing concerns at home and abroad. However, the recovery of consumption is expected to weaken and employment in major service sectors declined slightly amid a cloudy outlook. Therefore, we expect the Bank of Korea to return to its usual 25bp hike mode in August.

However, the main risk factor notable to our current BoK outlook is the price of fresh food. With recent bad weather and the full-moon holiday in September, fresh food inflation is likely to rise more than expected in the coming months. If August CPI inflation rises above the current 6.3% year-on-year rate (August ING forecast: 6.1%), we could consider a further 25bp increase in November or a 50bp increase in October.

More By This Author:

Hungarian Inflation Continues To Climb

Rates Spark: Following The US Data Cues

FX Daily: Window Of Carry Sees Renewed Interest In EMFX

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.