Korea: Fourth Quarter 2024 GDP Up Just 0.1 Percent Yet The Worst Seems To Be Over

Image Source: Pexels

South Korea grew by 0.1% quarter-on-quarter seasonally adjusted in the fourth quarter of 2024 (vs. 0.1% in the third quarter, market consensus of 0.2%). Net exports made a positive contribution to the economy, while domestic growth remained subdued. Both consumer and business sentiment indices have risen, and we believe that at least the worst of the domestic political uncertainty has passed, but the aftermath is likely to weigh on any meaningful recovery in the near term.

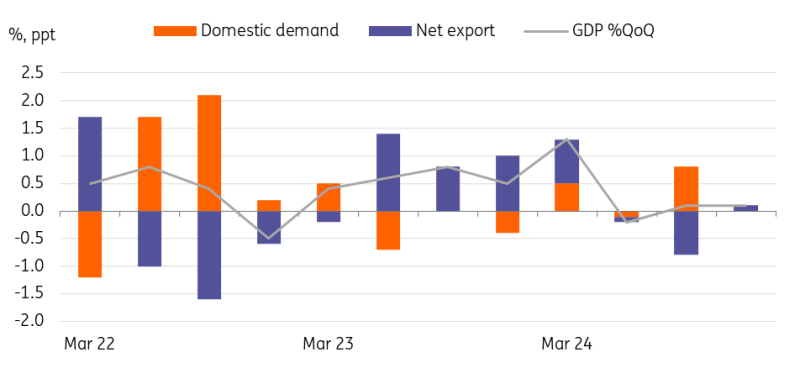

Construction was the main drag on overall growth

By expenditure type, private and government spending contributed positively to the growth in fourth quarter 2024. Private consumption growth decelerated to 0.2% (vs 0.5% in 3Q24), probably due to a sharp decline in December, while government consumption grew 0.5% on the back of increasing healthcare insurance payments. On the investment side, as expected, construction investment (-3.2%) contracted for the third consecutive quarter in 4Q24, which was one of the main reasons for the sluggish growth. Meanwhile, facility investment rose 1.6%, mainly due to strong semiconductor investment. On the external demand side, exports rebounded to 0.3% (vs -0.2% in 3Q24) with solid IT exports, but imports contracted 0.1% with falling car and crude oil imports.

Net exports contributed positively on overall growth

Source: CEIC

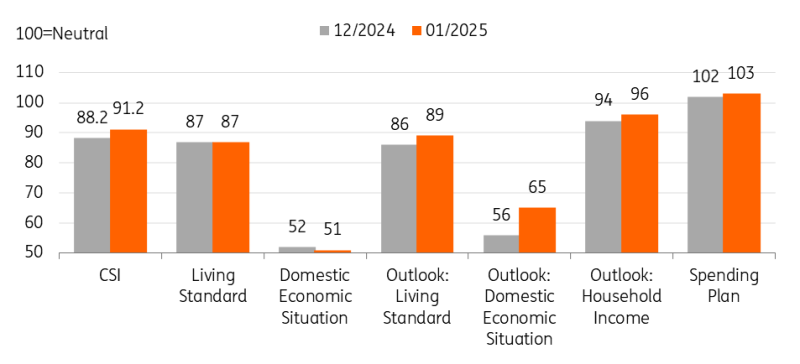

Thankful to see that consumer sentiment hasn’t worsened in January

Korean consumer sentiment index rebounded to 91.2 in January after a sharp fall in December. As the national mourning period ended in early January and while the political situation has not worsened significantly in January, consumers appeared to be somewhat relieved. Of the six sub-components, the outlook indicators rebounded the most, suggesting that the economy may be bottoming out. However, the headline index remains well below its neutral level, thus the recovery is likely to be quite mediocre. There was no significant change in inflation expectations, which edged down to 2.8% from the previous month’s 2.9%.

Consumer sentiment recovered but only marginally so

Source: CEIC

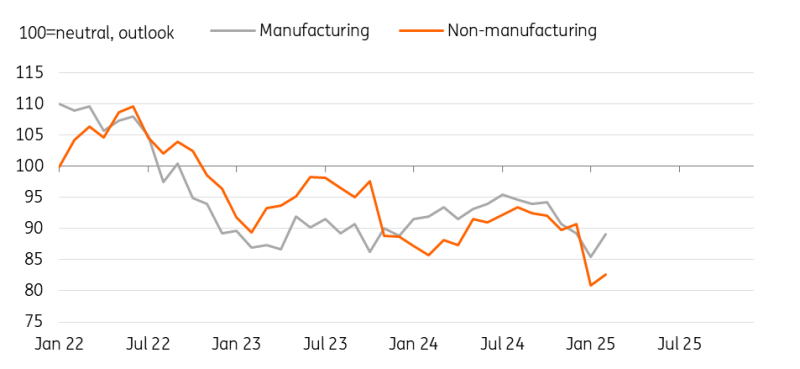

Business confidence outlook recovered, driven mainly by the manufacturing sector

The Composite business sentiment index in all industries for Korea was down by 1.4 points from December while that for the outlook rose by 2.5 points. Confidence in the manufacturing sector recovered more strongly than in the non-manufacturing sector. Presumably, the non-manufacturing sector has been hit harder by the current domestic situation, so the recovery is likely to be rather limited. On the other hand, manufacturing confidence has recovered to levels close to those before the declaration of martial law. Despite the possibility of rising trade tensions, production and new orders have improved. We should monitor more closely how the weak KRW and the tariff issue will play out in the future, but for now, firms expressed an improved outlook compared to the previous month.

The outlook of business survey rebounded in January

Source: CEIC

Bank of Korea watch

Domestic growth remained weak in fourth quarter 2024 and the recovery is likely to be only gradual in the current quarter and thus we expect the BoK to provide more policy support in the coming months. Overall sentiment hasn't deteriorated further, but the recovery has been rather limited. Also, the recent KRW movement is more supportive for the BoK’s expected cut in February.

More By This Author:

Rates Spark: Lots To Get Excited About… Next WeekBank Of Canada Set To Tread Carefully With A 25bp Cut

Mixed Conditions In Manufacturing Soften Wage Growth In Poland