Koo: China’s Balance Sheet Recession

Image Source: Unsplash

Once real estate bubbles bust, prices typically fall for years, and paying down debt becomes the priority. In the process, slashing interest rates does not entice the hoped-for revival of borrowing, and it takes years to rebuild balance sheets. This is now underway in the world’s second-largest economy. Et tu, Canada?

Richard Koo, senior adviser at CSIS, chief economist at Nomura Research Institute, and pioneer of the “balance sheet recession” phenomenon, explains why he thinks China’s balance sheet recession has already begun. Here is a direct video link.

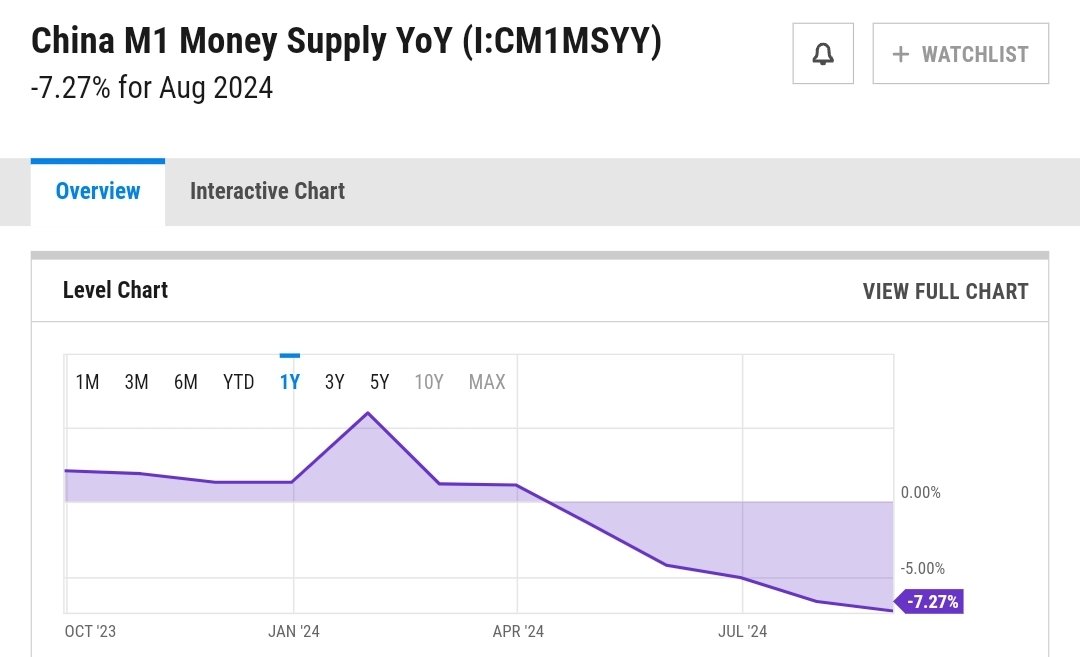

China’s M1 money supply contracted by 7.3% in August, hat tip China Beige Book.

(Click on image to enlarge)

M1 money supply (in black below since 1999) leads producer prices (PPI in red) by about six months and suggests the trend in falling prices has further to run.

(Click on image to enlarge)

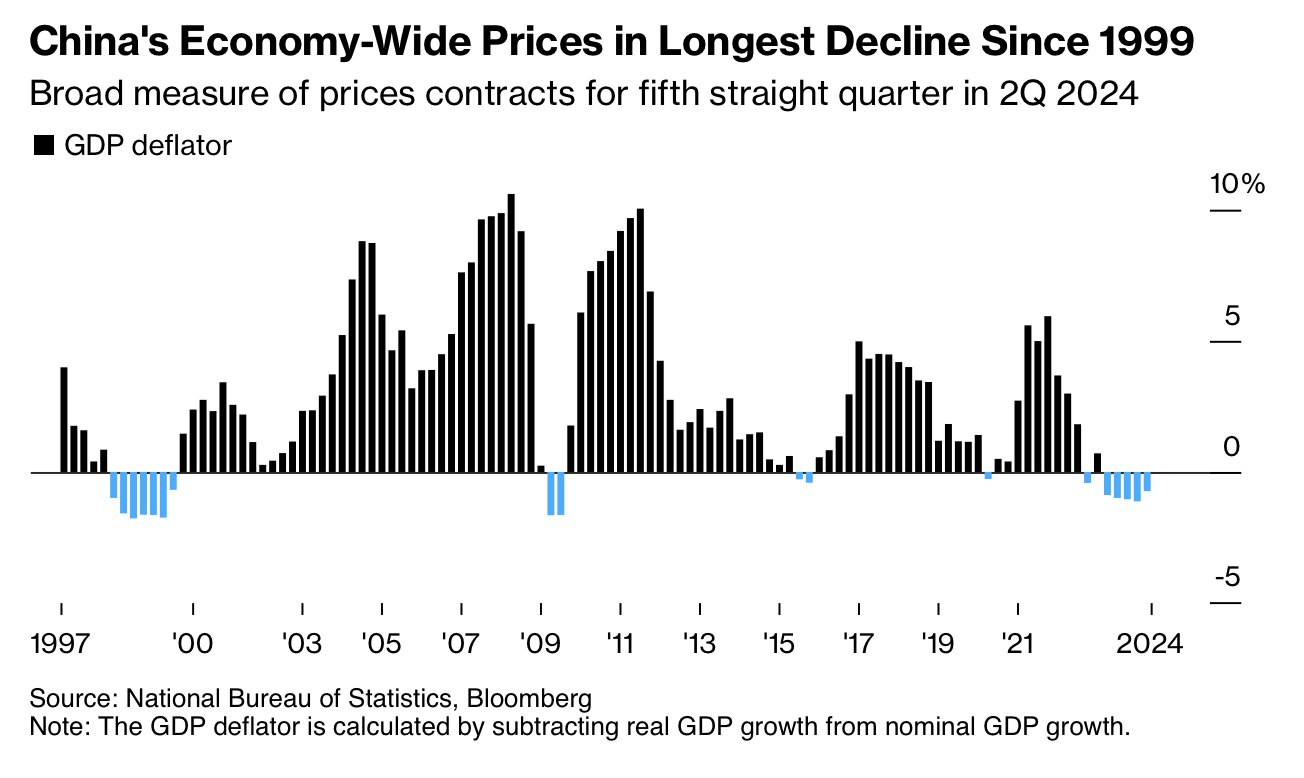

Chinese prices (GDP deflator below since 1997), contracted for the fifth consecutive quarter in the first half of 2024, in the longest period of deflation since 1999 (see blue bars below).

(Click on image to enlarge)

More By This Author:

Recession Warning In Wine, Watches, Art And YieldsDisappointing Demand Is Dominant Theme

Extreme Over-Valuations Suggest Years Of Negative Returns