Key Events In EMEA For Week Of Sept. 19

Image Source: Pexels

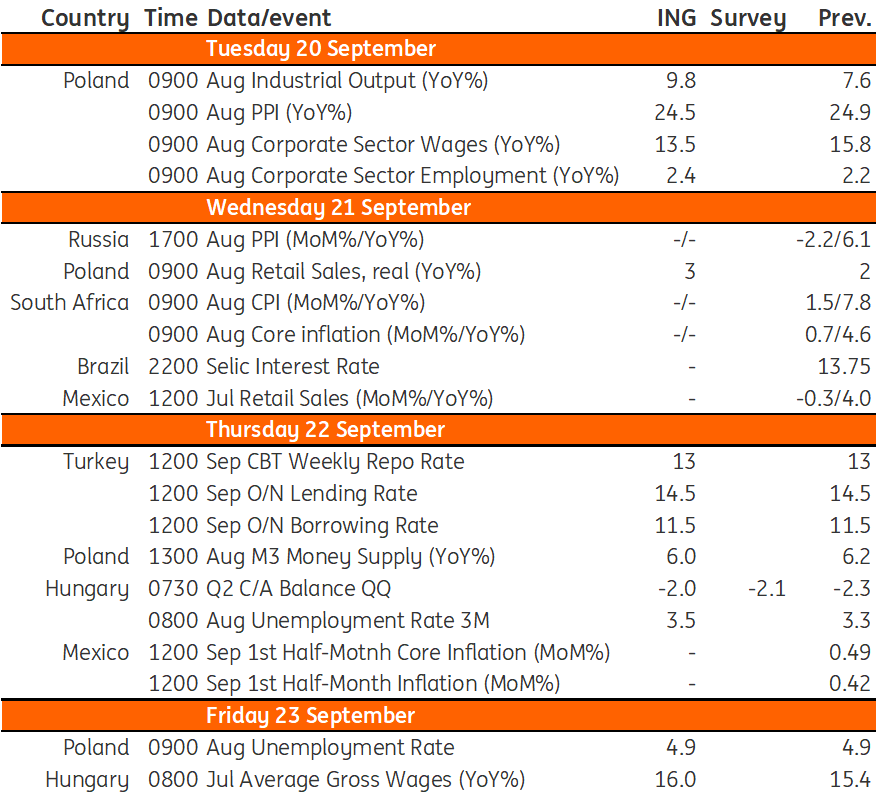

Despite the Central Bank of Turkey implying in its forward guidance that further rate cuts are ahead, we believe it will keep the policy rate unchanged for now to assess the impact of recent moves. For Poland, we forecast that unemployment will remain at 4.9% whilst PPI inflation will decline to 24.5%.

Turkey: Expecting the CBT to keep rates unchanged this month

While the Central Bank of Turkey (CBT) cut the policy rate last month in a surprise move, it did issue forward guidance implying further rate cuts were ahead, citing some loss in economic momentum. The CBT moves will likely be determined by FX developments, as the tourism season comes to end, as well as the growth outlook. We expect the CBT to keep the policy rate unchanged this month to see the impact of recent moves, though the risks are on the downside.

Poland: Key data for the week ahead

Industrial output: Annual growth of industrial production moderated to a single-digit pace in July (7.6%), but is projected to improve somewhat in August (9.8%) amid the less negative impact of the number of working days in year-on-year terms. The output should be supported by shorter summer production halts in the automotive industry and house appliances plants. Electricity production was also rather solid. Output was reduced in some energy-intensive industries due to the soaring price of natural gas.

PPI inflation: We forecast that PPI inflation declined to 24.5%YoY in August from 24.9%YoY in July as prices in the manufacture of coke and refined petroleum products eased. Annual growth of metal products manufacturing also declined. Unless we see yet another upswing in energy and industrial commodities, the producers’ prices should continue to decline. We believe that the peak is most likely behind us.

Enterprise wages: In July, enterprise wages jumped by 15.8%YoY boosted by one-off payments and compensations for high inflation in the mining, energy, and foresting sectors. In August, growth is expected to be lower, albeit still at a double-digit level. Nevertheless, real wages in the enterprise sector are projected to turn negative again. The labor market remains tight, which is what drives wages upwards.

Enterprise employment: Average paid employment went up by 2.3%YoY in July, with the number of posts increasing by 11,000 people versus the previous month. In August we expect a seasonal decline, but smaller than last year, which should drive annual employment growth up to 2.4%YoY. Despite signs of slowing activity, particularly in industry and construction, demand for labor remains solid, especially in services.

Unemployment rate: The labor market is drained of skilled workers and even the inflow of refugees from Ukraine that have assimilated quite well and are active in the labor market is not putting upward pressure on the unemployment rate so far. Since January the number of unemployed people is on a downward path and the registered unemployment rate is projected to remain at 4.9% for the second month in a row in April.

Hungary: Further widening of the current account deficit

The National Bank of Hungary will release the second quarter current account balance and it is expected to be in the same ballpark that we saw during the first quarter. A roughly €2tr deficit is the result of the rising energy bill of the country, deteriorating the balance of goods in an extreme manner. An early estimation of the July balance suggests further widening of the current account deficit. When it comes to the labor market, we see wage growth accelerating further, as the price-wage spiral has started.

More and more companies have announced extra compensation for employees (either one-off or mid-year salary hikes) in the last couple of months, which will be visible in the wage statistics as well. On the other hand, the news has also been about companies planning redundancies in the future (various surveys put the share of these corporates between 25-50%), thus we won’t be surprised if the unemployment rate reflects that development, moves a bit higher compared to the previous month.

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

Bank Of England To Stick To 50bp Rate Hike Despite The Fed And ECB Doing More

The Commodities Feed: Aluminium Supply Woes Grow

US Consumer Caution Lingers On

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more