Key Events In EMEA For Week Of August 1

Photo by Sadie Teper on Unsplash

Next Thursday, the Czech National Bank will hold its first monetary meeting under a new governor and a new board composition. We believe the interest rate will remain unchanged. In Hungry, we expect retail sales to continue to slow and Turkey's July inflation will likely be lower due to price cuts in gasoline.

Turkey: Relatively lower monthly inflation in July

While we have seen significant price adjustments in heavy-weight products like medicines, cigarettes, and bread, as well as the further impact of currency weakness, monthly inflation will likely be relatively lower in July at 2.3% in comparison to previous months this year thanks to price cuts in gasoline. Accordingly, we expect annual inflation of 79.5%.

Czech Republic: central bank meets under new governor

On Thursday, the Czech National Bank (CNB) will hold its first monetary policy meeting under the leadership of a new governor and with a new composition of the board, including the presentation of the central bank's new forecast. Not much has changed in our view since the last meeting at the end of June. We believe the new governor will deliver what he promised when he was appointed, and interest rates will remain unchanged for the first time since the first post-Covid rate hike in May last year. The new forecast will, in our view, deliver a less hawkish outlook than we have been used to in the past, but should still point to further rate hikes.

Hungary: Retail sales expected to continue to slow

Next week we are getting the last few puzzle pieces to get (an almost) full picture of second-quarter economic activity in Hungary. We expect retail sales to continue their slowdown as rising inflation is reducing the real disposable income of households, though it still looks like a soft landing. The flexibility of manufacturing (especially among car makers) was on full display in May, when the sector showed a significant rebound as producers were able to find supplementing sources for spare parts. We expect this positive development to fuel the industry further, though the raw data of year-on-year growth will show a significant slowdown due to a lower number of working days. When it comes to the third quarter, the July manufacturing PMI reading will provide a sneak peek, and based on the remarkably high stock of orders, we see more optimism for the economy.

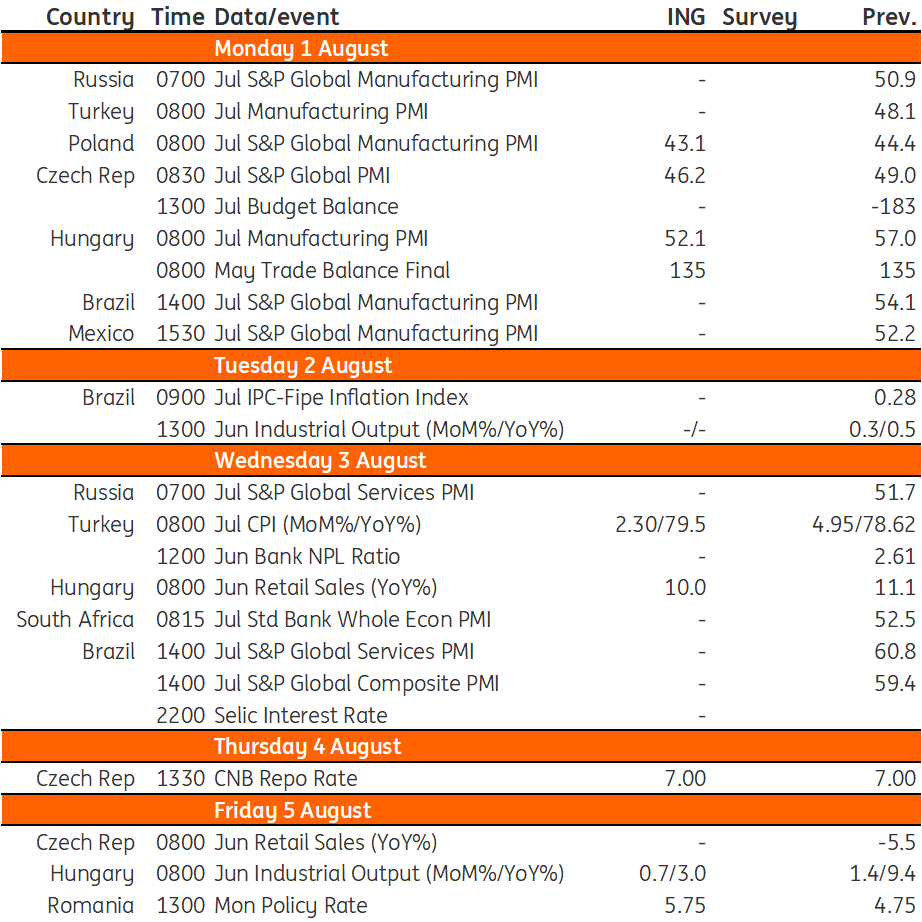

EMEA Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Data Sensitivity To Keep FX Volatility High

Asia Week Ahead: Central Bank Decisions, Inflation And Manufacturing Reports

FX Daily: The Dollar’s “Pivot” Hasn’t Arrived Yet

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more