Key Events In EMEA For The Week Of March 27

Image Source: Pexels

We expect both the Czech Central Bank and the National Bank of Hungary to keep interest rates unchanged next week, with officials maintaining their hawkish tone.

Hungary: No change to the current status quo

After two relatively quiet data weeks in Hungary, the upcoming one will be more interesting, specifically Tuesday. We are going to see the January wage growth data, which used to be a strong anchor for the full-year average increase in salaries based on the past five years of data. We see a 16% gross wage increase on a yearly basis due to a combination of a 14-16% minimum wage increase (for unskilled and skilled labor), the labor shortage, and high-flying inflation.

Based on high-frequency data, we expect a minor improvement in the fourth quarter's current account deficit compared to the previous quarter.

And at Tuesday's March rate-setting meeting, we expect a no-change situation despite the recent market turmoil. Considering the vulnerability of the forint, a rate cut will be premature, exposing the local currency to a sell-off. Against this backdrop, we see an all-around status quo at the upcoming meeting: no rate change, only incremental revisions to the central bank’s forecasts and an unchanged (hawkish) tone of the forward guidance.

Czech Republic: Rates will remain unchanged

The Czech central bank is likely to keep interest rates unchanged on Wednesday. We expect the official statement will keep its hawkish tone, which means maintaining the current level of interest rates until there are clear signs that inflation is returning to the central bank's 2% target. Even the soft recession has not brought relief to the labor market, which still remains very tight, with the unemployment rate being the lowest in the EU, which poses a risk to inflation expectations.

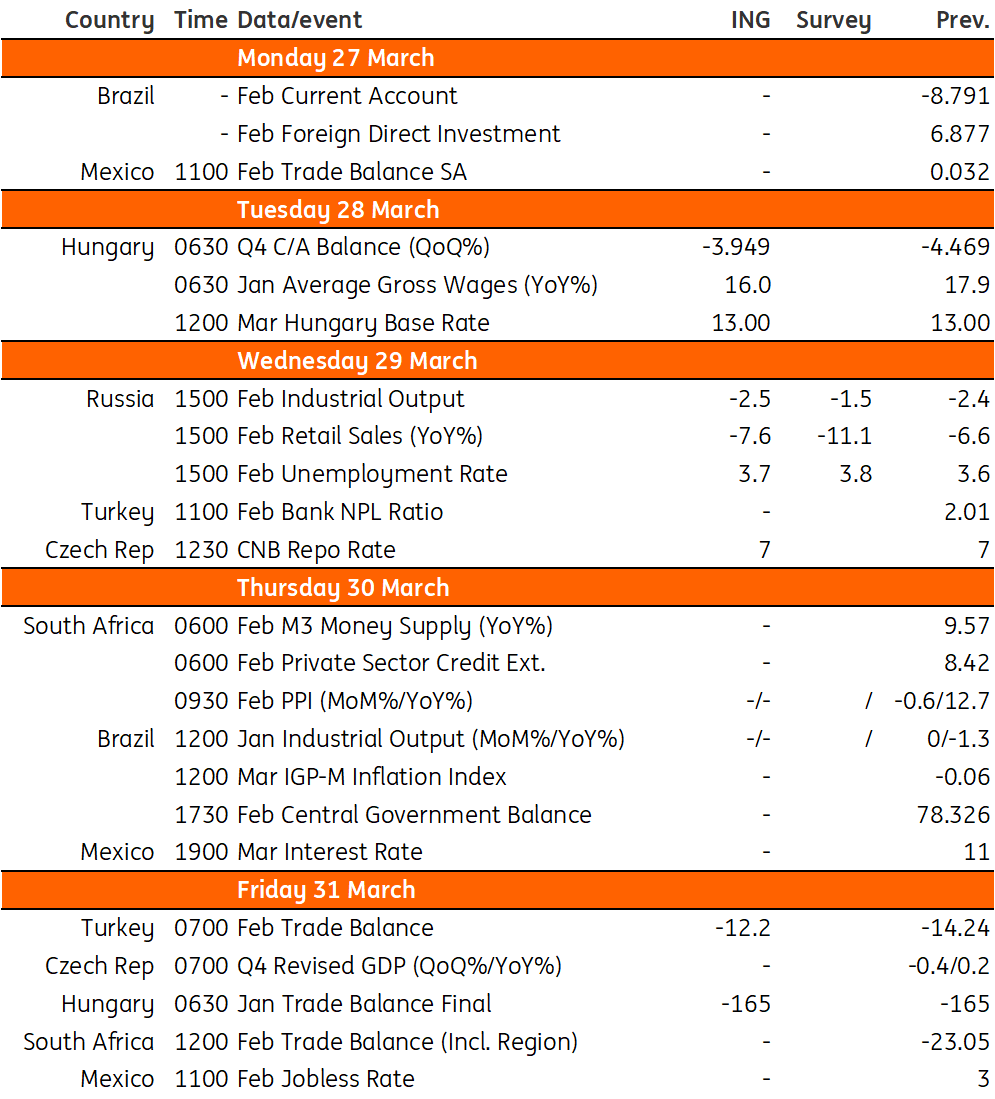

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Trading Places

Central Bank Of Turkey Keeps Policy Rate On Hold

Bank Of England Tightening Likely Done As It Hikes By 25bp

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more