Key Events In EMEA For The Week Of July 31

Image Source: Pixabay

There are no rate changes expected at the Czech National Bank meeting next week, but we will get new forecasts as market expectations turn dovish. Annual inflation in Turkey is expected to end its downtrend in July and increase to 45.2%. And June economic activity data is to be released in Hungary.

Czech Republic: No change in rates and new CNB forecast in the pipeline

The Czech National Bank's monetary policy meeting will take place on Thursday next week and a rate change is not on the table, in our view. However, we think it should be one of the most interesting sessions this year.

This is because rapid disinflation has opened up the question of a first-rate cut, while the record weak koruna, in turn, has raised the question of intervention and postponement of rate cuts. The CNB will also release a new forecast that may be the central bank's last attempt to reverse very dovish market expectations.

Since the decision itself does not have much potential to surprise, the main focus will be on the governor's press conference and the new forecast. While it cannot be ruled out that some members will still vote for a rate hike, our baseline scenario assumes a unanimous decision to leave rates unchanged.

Turkey: Expect annual inflation to end its downtrend in July and increase to 45.2%

Recent lira depreciation (around 30% since end-May), large mid-year wage adjustments (a 34% hike in the minimum wage and 73.5% on average in civil servant salaries) and revenue-raising measures to offset some of the fiscal pressures related to wage hikes and earthquake reconstruction will be inflationary in the period ahead.

Given this backdrop, we expect annual inflation to end its downtrend in July and increase to 45.2% (with a 7.6% month-on-month reading) from 38.2% a month ago, while risks are on the upside.

Hungary: June economic activity data

Next week’s highlight is the June economic activity data in Hungary. We are going to see whether there is any momentum change. With real wage growth stuck in negative territory, we see the impact of reducing purchasing power negatively affecting consumption and domestic demand-driven subsectors in the industry. Hence, the downtrend will continue with month-on-month drops in retail sales and industrial production volumes, in our view. The only thing that will help optically is the base effect. As a result, the year-on-year indexes will show improvements, a false promise of a turnaround.

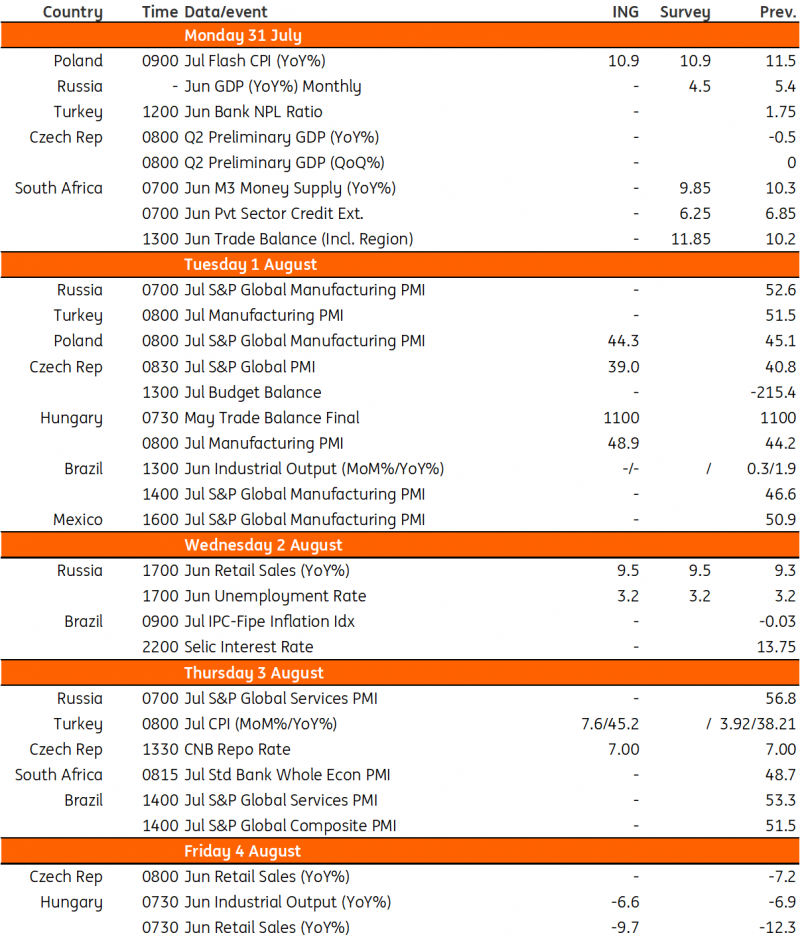

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

Eurozone Economic Sentiment Indicator Confirms Weak Start To Third Quarter

FX Daily: Diverging G3 Trends Dominate

Goldilocks GDP Feeds The US Soft Landing Narrative

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more