Key Events In EMEA For The Week Of Feb. 13

Image Source: Pexels

The most important piece of data released in Hungary next week will be the fourth-quarter GDP. With the cost-of-living crisis reducing domestic consumption, we expect to see a quarter-on-quarter decline of 1.2%. In Poland, we forecast that headline CPI inflation will increase to 18.1% year-on-year in December, due to adjustments to prices.

Poland: Ongoing economic slowdown

Current account (December 2022): -€1,418m

Our forecasts point to a December 2022 current account deficit of €1,418m amid a sizable trade deficit. We expect a further slowdown in the annual growth of exports and imports to 16.1% YoY and 18.1% YoY, respectively. Our models point to downside risks to trade turnover. At the same time, Poland received a sizable portion of EU funds in December, however, most of this will be recorded under the capital account rather than the current account. If our forecast proves broadly correct, the current account deficit in 2022 would be around 3.1% of GDP vs. 1.4% of GDP in 2021.

Flash GDP (4Q22): 2.3% YoY

The release of the annual 2022 GDP allowed us to estimate that the fourth quarter figure is likely to be slightly higher than 2% YoY. The composition of the headline figure will be unveiled later this month, but annual GDP points to a decline in household consumption in the last three months of 2022, while fixed investment held up surprisingly well. Changes in both inventories and net exports contributed positively to economic growth in the final quarter of last year. All in all, we observe an ongoing economic slowdown and project a weak first half of this year, with a negative annual figure likely in the first quarter.

CPI (January 2023): 18.1% YoY

Forecasting January CPI was a challenge due to uncertainty linked to price adjustments by enterprises at the beginning of the year and changes to regulated prices. We forecast that headline CPI inflation jumped to 18.1% YoY from 16.6% YoY in December 2022. Although pre-tax prices of natural gas were frozen at the 2022 level and electricity prices for households were also kept unchanged up to a certain threshold of consumption, the anti-inflation shield was withdrawn and VAT rates on energy returned to 23%. Despite an increase of VAT on gasoline and diesel from 8% to 23%, retail prices remained stable as pre-tax (wholesale) prices were lowered. The reading will be less comprehensive than usual (similar to the flash release) and full details will be unveiled in March along with the annual update of CPI basket weights that will also bring a revision of the January figure. We still expect inflation to peak at around 20% YoY in February.

Hungary: More proof that Hungary has been in technical recession since mid-2022

The only really important data release in Hungary is going to be the fourth-quarter GDP data. We expect the preliminary reading to prove that the Hungarian economy has been in a state of technical recession since mid-2022. After a 0.4% quarterly drop in the third quarter, we see a 1.2% decline in real GDP in the fourth. The cost-of-living crisis impacted domestic demand, thus we see a significant reduction in consumption, while the higher interest rate environment might slow private investment activity. As the government tried to rationalize its own investment activity, postponing some projects into 2023-2024, we also see this as a downward force on economic activity. The only silver lining could be exports, though the extraordinary gas purchases in the last quarter will limit the upside of this positive contribution, in our view. Regarding the production side, the single most important downward pressure will come from agriculture due to a pretty bad performance on the combination of drought, supply, and productivity issues.

Romania: Accelerated cooling in the economy

January inflation should show signs of consolidation in the downward trend after the 16.8% peak touched back in November. We estimate the headline CPI around 15.4%, with risks skewed slightly to the upside due to car fuel prices which might have increased above our estimates after the removal of the 0.5 lei subsidy starting in January. In any case, the bigger trend remains on the downside and we expect headline inflation to reach single digits around September 2023.

The high-frequency data available to date suggest a rather resilient GDP growth in 4Q22, consistent with our current estimate of around a 1.0% quarterly advance. This would take the full 2022 GDP to +5.0%, arguably one of the best outcomes one could have hoped for. Much in line with external developments, there are early signs of an accelerated cooling in the economy in January, with the Economic Sentiment Index falling for the third consecutive month, particularly on the back of lower demand in the service sector.

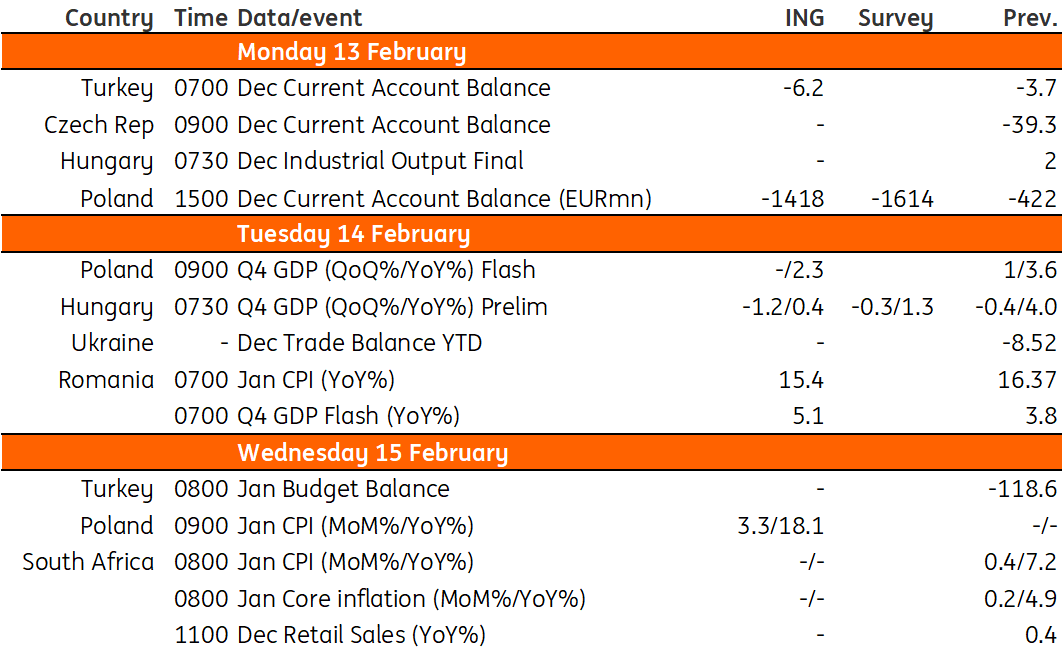

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: The Waiting Game Is On

Riksbank Hikes By 50bp Amid Concerns About Weak Krona

The Commodities Feed: U.S. Oil And Product Stocks Grow

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more