Key Events In EMEA For The Week Of Aug. 14

Image Source: Pixabay

There will be essential data releases in Poland next week with CPI expected to fall and GDP to decline for the second consecutive quarter. In Hungary, all eyes will be on the preliminary release of second-quarter GDP growth as it is expected to break a streak of three consecutive quarters of negative growth.

Poland: CPI and Flash GDP to be released

CPI (July): 10.8% YoY

The StatOffice is expected to confirm its flash estimate of July CPI inflation at 10.8% year-on-year. According to preliminary estimates, the price of food and non-alcoholic beverages fell by 1.2% month-on-month, the price of energy sources for housing was unchanged vs. in June, while gasoline prices increased by 0.4% MoM. We estimate that core inflation moderated to 10.5%YoY from 11.1%YoY in the previous month. In August, annual inflation will be close to single-digit levels and will certainly fall below 10%YoY in September.

Flash GDP (2Q23): -0.3% YoY

According to our forecasts, the second quarter of 2023 was the second consecutive quarter of GDP declines in annual terms. We think the economy shrank at a similar scale as in the first quarter, with an even deeper annual decline in household consumption (close to -3%YoY), while fixed investment continued to expand. We judge the positive contribution of net exports was higher than the drag from a change in inventories. A more decisive improvement in economic activity is projected for the fourth quarter.

Hungary: Second quarter GDP growth expected to turn positive

The main event of the next week in Hungary is the preliminary release of second-quarter GDP growth. After being in a technical recession for three quarters, we see Hungary ending this streak with a boom.

Our forecast shows quarter-on-quarter GDP growth of 0.8%, with the main drivers being agriculture and the services sector. The performance of the former will be helped by the exceptionally favorable weather conditions. Combine this with an awfully weak agricultural year in 2022, and the contribution of agriculture to the year-on-year growth could be close to a record high.

In contrast, with domestic demand still struggling, we expect construction and industry to be a major drag on growth. As last year’s economic activity was spurred by government transfers during the first half of 2022, the base effect in general will be unfavorable. Against this backdrop, we see the GDP shrinking further on a yearly basis by 1.2% in the second quarter of 2023.

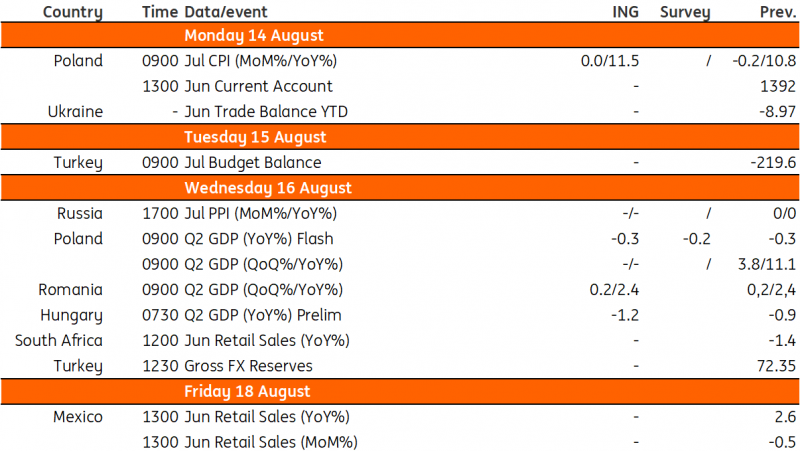

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

France’s Solid Labor Market Is Starting To Cool

FX Daily: Dollar Benefits From A Lack Of Alternatives

U.S. Inflation Boosts Case For No Further Rate Hikes

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more