Key Events In Developed Markets For Week Of May 16

With UK inflation set to rise above 9% in next week's data, the Bank of England is becoming increasingly likely to pause the rate hike cycle later this year. In the US, data is expected to show that the domestic economy remains in a good position.

US: Solid retail sales and industrial production numbers expected

The Federal Reserve has laid out a clear path of 50bp hikes at the June and July Federal Open Market Committee meetings, and with inflation proving to be very sticky, we are forecasting a further 50bp hike in September before the Fed switches back to 25bp moves from November. This is a touch more aggressive than the consensus, but we certainly feel that, at least in the near term, the risks are skewed towards the Fed taking more aggressive action. #

This week’s data is expected to show that the domestic economy remains in a good position, with retail sales expected to post strong gains thanks to firm auto sales and the fact that retail sales are a nominal dollar value amid an environment of decent consumer demand and rising prices. Wages are rising quickly, but they are not keeping pace with the increases in the cost of living so there is a squeeze on spending power. However, households have built up significant cash savings buffers during the pandemic and we remain hopeful that this will allow consumer spending to remain robust through this period until inflation starts to slow and positive real wage growth materializes.

Industrial production numbers should be ok with manufacturing surveys holding up reasonably well amid a long backlog of orders that remain on their books. Gas and oil output should also contribute positively given a big increase in drilling activity in the wake of surging energy prices. Housing data will also be closely followed to see if there has been any negative impact on activity stemming from the sharp acceleration in mortgage rates and declining mortgage application data.

UK inflation to test Bank of England’s patience

Headline UK inflation is set to rise by more than two percentage points, reflecting the 54% rise in household energy prices that came through at the start of the month. Having revisited our numbers, we think there are probably enough factors to push inflation slightly above 9% in April. It’s worth saying though that this is already baked into the Bank’s forecasts, which anticipate a double-digit reading later this year. We’re less sure it will get as bad as that, but then again inflation has consistently surprised to the upside. And another fall in the unemployment rate next week is likely to underscore the tightness of the jobs market right now, adding to wage and price pressures.

Still, it’s becoming increasingly clear that the Bank of England committee is divided on how worried we should be about further wage pressures. The latest forecasts made it clear that policymakers think aggressive tightening probably won’t be needed, and we think the committee is more likely to pause the rate hike cycle after another increase in June and August.

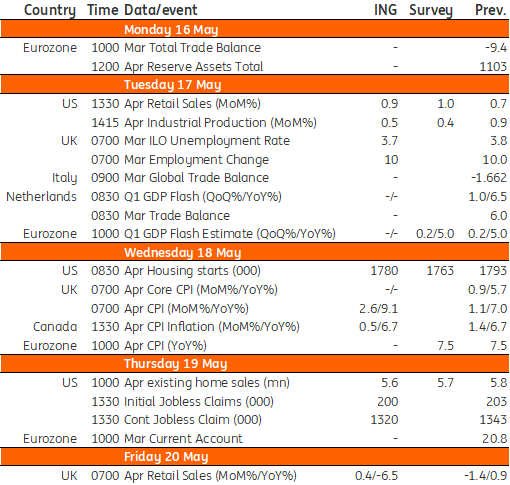

Developed Markets Economic Calendar

(Click on image to enlarge)

Refinitiv, ING, *GMT

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more