Key Events In Developed Markets & EMEA Next Week

Strong job numbers, sticky inflation and hawkish rhetoric in the US suggest an appetite for one more interest rate rise. The outcome of next week's jobs report will be critical. Disinflation is expected to continue in Poland and we estimate next week's May flash CPI to be at 13% year-on-year, given the declines in fuel and energy prices.

(Click on image to enlarge)

US: One more rate hike?

Interest rate expectations have shifted meaningfully higher since the Fed raised rates by 25bp on 3 May when the market interpreted the Fed commentary as signalling that there was a high hurdle to getting any further rate hikes. However, since then, strong job numbers, sticky inflation and a raft of hawkish rhetoric have suggested an appetite for one more rate rise, if not at the 15 June FOMC meeting, then by the 26 July meeting.

Our central thesis remains that the combination of higher borrowing costs and less credit availability weighs heavily on business and consumer spending in an environment where sentiment is already at recession levels. Historically, credit growth lags movements in lending conditions by 12 months and unemployment responds similarly. Given lending conditions started tightening rapidly more than 12 months ago and rates have risen by 500bp since March 2022, our best guess has been that the economy will be showing the effects in the second half of this year. But with several Fed officials arguing that interest rates need to be raised further to ensure inflation returns to 2% in a timely manner, we have to accept that our view that interest rates have peaked and we will see aggressive interest rate cuts from the fourth quarter is being challenged.

Next week’s data highlight, the jobs report, and whether we get a deal on the debt ceiling to avert a potentially calamitous default, will be critical in assessing whether we will indeed get a rate hike. A deal and strong jobs numbers would undoubtedly fuel expectations of another rate hike and we will likely end up accepting that is the most likely outcome. However, signs of labour market softening and market angst over the lack of a resolution on the debt ceiling could quickly see those rate hike expectations evaporate.

Other data to look for include the ISM reports, job openings and house prices.

Poland: Disinflation is expected to continue

Poland May Flash CPI: 13.0% year-on-year.

Our estimate points to a further decline in CPI inflation in Poland to 13% YoY. In our view, May brought a substantial monthly decline in fuel prices (especially diesel) and a slight decline in energy costs for housing, while food prices were little changed in monthly terms. Disinflation is expected to continue and at the end of 2023 we are likely to observe single-digit growth in CPI inflation. Further progress towards the National Bank of Poland target of 2.5% will be more difficult though.

Hungary: Eyes on European Parliament session

We don't see next week’s data from Hungary as game-changers for investors, although economists can find a lot of golden nuggets. Firstly, the Statistical Office is going to release detailed GDP data regarding the first quarter’s slump. We expect the details to reveal that the main weakness of economic activity was the drop in domestic demand. High inflation combined with high interest rates means a reduction in consumption and investment activity. The latter is also dragged down by the government’s decision to delay (or freeze) public spending to manage the budgetary situation.

Another interesting data report is the final March trade balance, in which we will see where this positive boost in the external balance comes from. We expect a further reduction in the energy-related trade deficit, while the non-energy balance is enjoying the still-sound export activity of industry (mainly car and electric vehicle battery manufacturing).

Regarding the manufacturing PMI, we would suggest ignoring the data, as it has had nothing to do with reality recently due to a massively overweighted export sector in the index, while the domestic demand-driven manufacturing sector is plummeting in Hungary. What can impact investors' sentiment negatively is the 1 June European Parliament session, where the EP is discussing and likely adopting a resolution that would deprive the Hungarian government of the opportunity to take over the rotating EU presidency in the second half of 2024 because of rule-of-law issues.

Turkey: Outlook ahead is uncertain

Given that early indicators have shown some recovery after initial weakness following earthquakes, we expect first-quarter GDP growth of 3.6% YoY. However, the outlook ahead is uncertain due to many factors: macro-stability risks which are potentially weighing on domestic demand, the loss of momentum in exports with the growth slowdown in the eurozone, a higher risk premium and tightening global financial conditions, as well as the challenging local regulatory environment that is increasing pressure on the corporate sector.

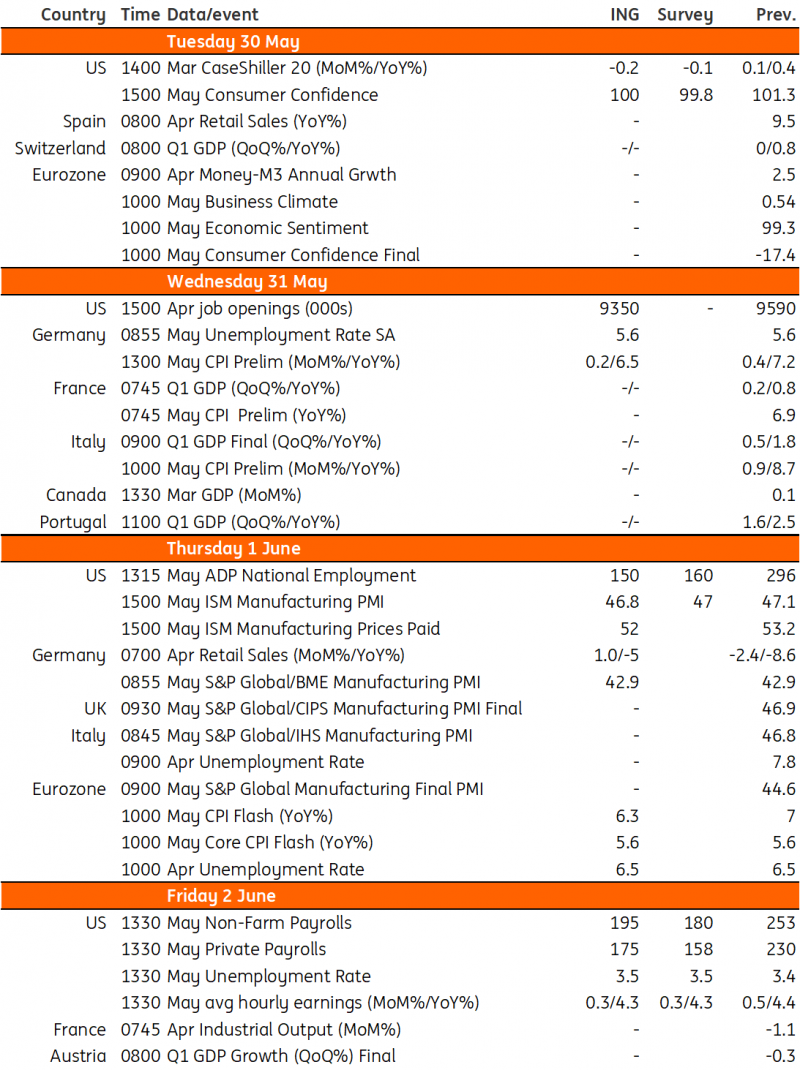

Key events in developed markets next week

(Click on image to enlarge)

Refinitiv, ING

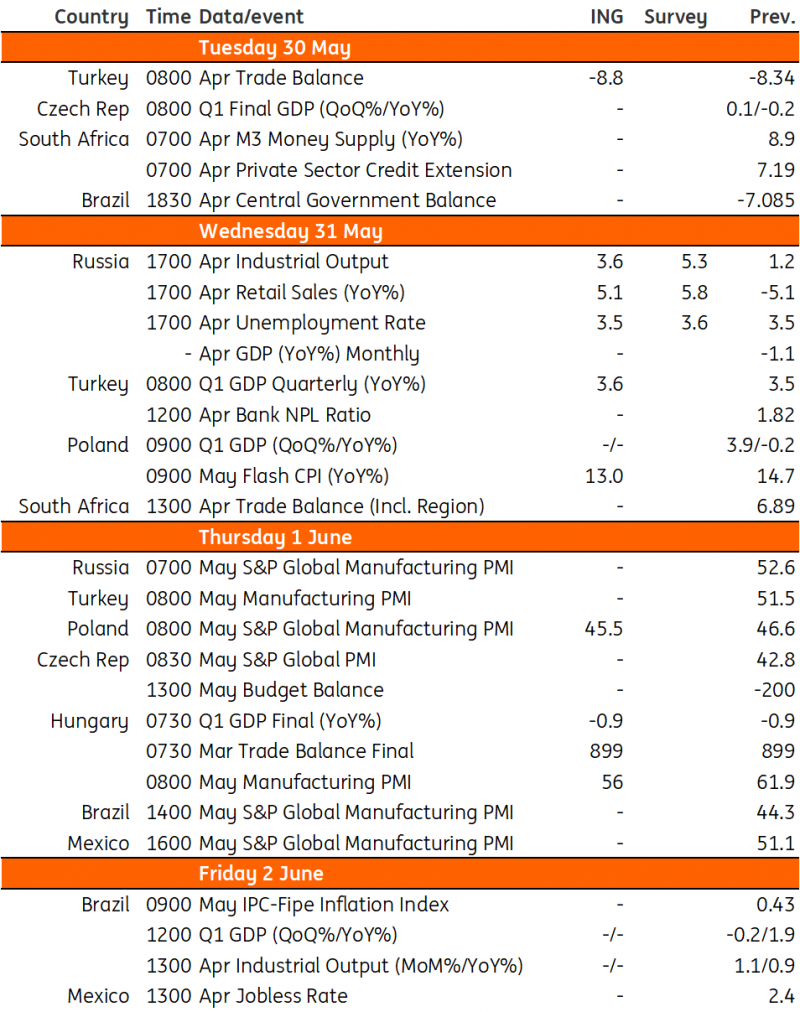

Key events in EMEA next week

(Click on image to enlarge)

Refinitiv, ING

More By This Author:

FX Daily: Emerging Market FX Misfires

U.S. Debt Ceiling Game Of Chicken And Default Risk

The Commodities Feed: Oil Strength, Copper Weakness

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more