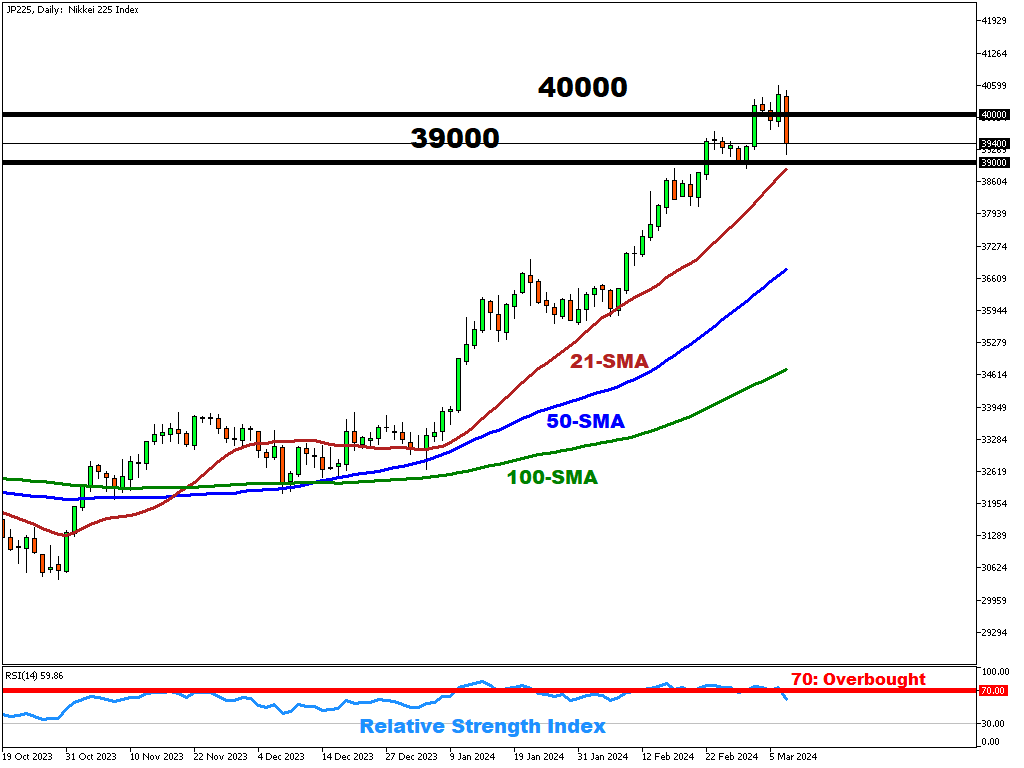

JP225 Slides Below Its 40000 Milestone

After reaching an all-time high on March 6 (40407), JP225 has dropped towards the lows of last Friday.

Depreciation of the Index comes amid the growing speculation that the Bank of Japan (BoJ) may raise its interest rates for the first time since 2007, with some implying that BoJ may act as early as in March-April.

Higher interest rates may potentially translate into a weakening stock market while strengthening the local currency.

The potential for the interest rate hike is further supported by recent higher-than-expected wage reading and an expected agreement between the management and union federation.

This year, the unions have demanded a 5.85% increase in wages (vs 4.49% in 2023).

From the technical perspective …

- Current price is trading above major simple moving averages (SMAs), implying a bullish signal

- To the downside, the 39000 round number followed by the 21-peiod SMA (~38850.8) are set to provide an immediate support, while to the upside the 40000 threshold is a prime target and a major resistance level for the JP225 bulls

- An RSI indicator (Relative Strength Index) is well below the upper boundary at 59.86 (>70 – oversold, <30 – overbought), underscoring a neutral market condition

More By This Author:

AUDUSD To Close Above 21-Period SMA?Bitcoin Near $70,000

Brent Reaches Week's High (~$83/bbl) Amid Neutral US PCE Reading

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more