Japan’s Non-Manufacturing Sector To Lead Recovery In Near Term

Today's data supports our view that Japan's recovery will be driven mostly by non-manufacturing activity, while sluggish manufacturing could partially hamper the recovery.

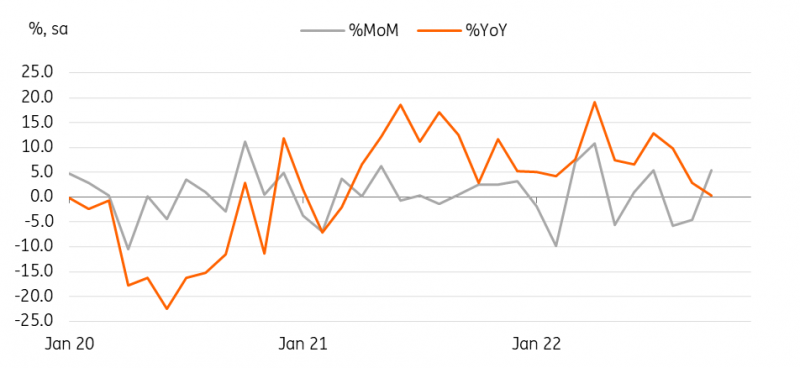

Core machinery orders rebounded in October

Core machinery orders, a forward-looking indicator for investment, rebounded 5.4% month-on-month (seasonally adjusted) in October after dropping for two consecutive months. The gain came mainly from non-manufacturing (14.0%) with a strong rise in construction, transportation and information services while manufacturing orders continued to drop. The weakness in manufacturing investment is more pronounced due to sluggish industrial production. October industrial production was revised down -3.2% MoM (sa) from -2.6% in the new estimate and the weakness in manufacturing production broadened.

Core machinery orders rebounded in October, only partially offsetting the losses from the previous two months

Source: CEIC

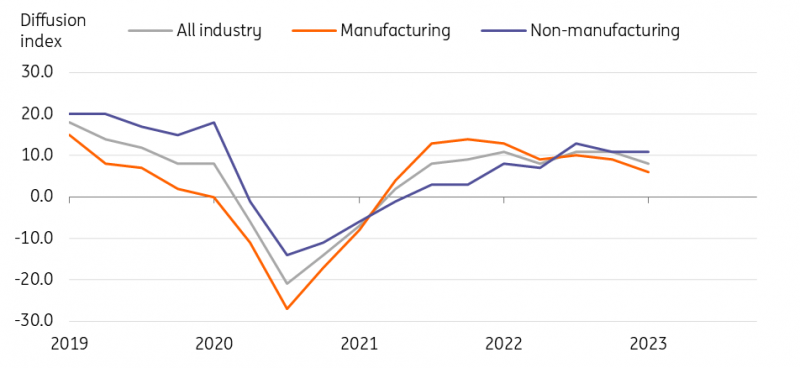

Tankan survey showed gloomier outlook, more so for manufacturing sector

The Tankan survey showed that large companies still foresee positive growth in the coming quarter but the momentum is weakening. The outlook for manufacturing slid to 6 in 4Q from 9 in 3Q while that for non-manufacturing was unchanged at 11, but missed the market consensus of 15. The recent government subsidies on tourism and fuel were expected to boost service activities and business sentiment but companies appear to be more cautious about cost-push inflation. For manufacturing, growing recession fears in the US, EU and China probably hurt the near-term outlook.

Less optimistic outlook for large companies

Source: CEIC

November trade preview

Japan's trade deficit is expected to narrow in November to -1.5 trillion yen (vs -2.2 trillion yen in October). The early November trade data showed that import growth decelerated significantly to 21.0% YoY during the first 20 days of November (vs 49.7% in Oct for the same period), while the slowdown in exports (19.2%) was slightly milder than imports. The decline in global oil prices and the recent appreciation in the yen should have worked in favor of lowering import growth, and this trend is likely to continue in the near future. The unexpected contraction in 3QGDP was mainly due to a surge in service imports. We believe that improvements in net trade contributions will support a rebound in growth in 4Q. The trade deficit is expected to decrease further due to weaker global commodity prices and the strong JPY, and the service balance is expected to improve with the return of foreign tourists.

Bank of Japan watch

The Bank of Japan will meet next Tuesday but it will be another uneventful meeting with no policy changes. Considering the weak October IP and Tankan survey, the growth outlook for coming quarters is weakening, supporting the BoJ's easing policy.

Moreover, the Bank of Japan will likely maintain its current easing policy stance for a considerable time. Some argue that when the current Governor Haruhiko Kuroda ends his second term in April, a policy shift could materialize soon after. But in our view, the BoJ's view on inflation and policy is unlikely to change under the new governorship in 2023.

The JPY is at 135.4 and is expected to appreciate further next year as the US dollar loses strength. The narrowing of the yield gap will likely benefit the currency for the time being. This means that the negative impact of a weak currency on growth and inflation will be reduced over the next few quarters. Thus, discussions on yen weakness and the BoJ's policy response will no longer be the focus of the market next year. The real issue will be whether strong wage growth is agreed upon in the salary negotiation season next spring. Prime Minister Kishida has proposed a 3% increase in wages and incentives for businesses in return for higher wages, but the 3% wage hike is too much for some companies. However, if that happens and fiscal policy also shows hints of normalization, it is possible for the BoJ to adjust its forward guidance and widen the 10-year yield band by the end of 2023, though it is still highly unlikely to raise its policy rate.

More By This Author:

Eurozone Industrial Production Off To Poor Start In Fourth Quarter

FX Daily: Rate Protests And Credibility Hazard

Czech Republic: Inflation Rises Again Despite Government Measures

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more