Japan’s Inflation Struggle: How New Stimulus Measures May Shape The Economy

Image source: Pixabay

- Inflation in Japan has exceeded the BOJ’s 2% target for 38 months.

- The ¥39 trillion stimulus includes energy subsidies and cash handouts for households.

- Critics warn the plan may worsen Japan’s debt as the BOJ considers raising rates.

Inflation in Japan remains a pressing issue, affecting household budgets, government policy, and everything in between.

Rising prices have prompted bold fiscal and monetary responses. Recently, the Japanese government unveiled a massive economic package aimed at easing the financial strain on its citizens while trying to stabilize the economy.

At the same time, the Bank of Japan is facing mounting pressure to recalibrate its long-standing policies as inflation exceeds its target.

How is inflation impacting households?

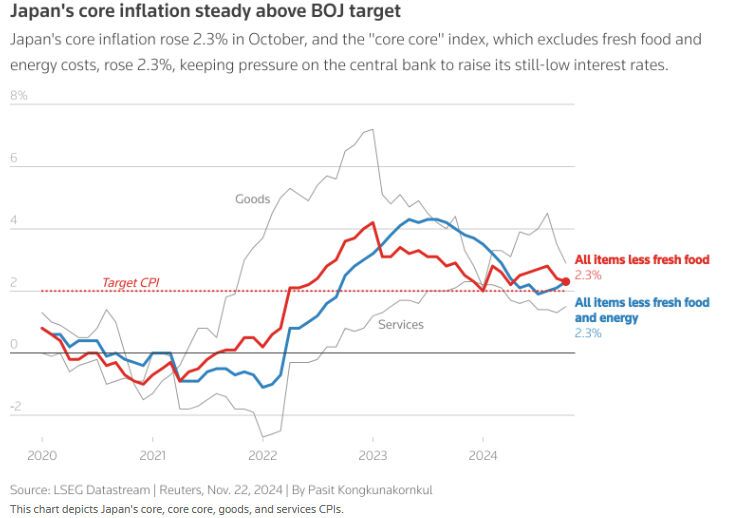

Inflation in Japan has exceeded the Bank of Japan’s (BOJ) 2% target for 38 straight months, with October’s core consumer price index (CPI) rising by 2.3% year-on-year.

A separate index that excludes volatile fresh food and fuel prices—seen as a better gauge of demand-driven inflation—also climbed by 2.3%, up from 2.1% in September.

In Tokyo, inflation is expected to rise further to 2.1% in November, according to a Reuters poll.

Source: Reuters

The rising cost of food and energy has placed significant pressure on households.

Rice prices surged by 58.9% in October, pushing up overall food costs.

Meanwhile, reductions in government fuel subsidies have caused electricity, gas, and gasoline prices to climb.

These increases have tightened budgets for many families, prompting some to cut back on discretionary spending.

To alleviate these challenges, the government has allocated ¥12.7 trillion of its new ¥39 trillion stimulus package to measures designed to curb inflation’s impact.

This includes subsidies to stabilize energy costs, which are some of the main drivers of rising living expenses.

Additionally, cash handouts of ¥30,000 will be provided to low-income households, with an extra ¥20,000 per child for families.

These steps aim to provide immediate relief to households facing financial strain, particularly as education costs also continue to rise.

Despite these efforts, questions remain about whether these measures can deliver meaningful and sustained improvements.

Inflation is showing little sign of easing, fuelled in part by the yen’s depreciation, which increases the cost of imports in Japan’s resource-poor economy.

As households struggle with tighter budgets, the government’s stimulus package has become a critical intervention—but its long-term effectiveness is yet to be seen.

How does the government plan to fund the package?

The ¥39 trillion package includes ¥13.9 trillion from the general account, an increase from the ¥13.2 trillion spent on last year’s stimulus.

Local governments and private funding will add to the total.

However, Japan’s fiscal health is under scrutiny, as its public debt is already more than twice the size of its economy.

Critics argue that the package could strain finances further, particularly with the country moving away from ultra-low borrowing costs as the BOJ gradually shifts its monetary policy.

The opposition Democratic Party for the People (DPP) pushed for a higher tax-free income threshold as part of the negotiations.

This change is projected to boost disposable income for workers, but it could cost up to ¥8 trillion annually in lost tax revenue, according to the Finance Ministry.

The government is now facing the challenge of having to balance fiscal responsibility with the need for economic stimulation.

What’s next for monetary policy?

The BOJ is under pressure to tighten its monetary policy further. Analysts widely expect the central bank to raise short-term interest rates from 0.25% to 0.5% during its December 18–19 policy meeting.

October’s inflation data, coupled with the yen’s renewed depreciation, has strengthened the case for a rate hike.

Service prices, which reflect rising labor costs, increased by 1.5% in October compared to 1.3% in September.

This is a critical factor for the BOJ, as it indicates that wage growth is driving some inflation. If domestic demand continues to show resilience, the BOJ may view this as an opportunity to continue normalizing its monetary policy.

Can the stimulus boost growth?

The government expects the package to drive up Japan’s inflation-adjusted GDP by 1.2 percentage points annually while lowering consumer prices by 0.3 percentage points.

A significant portion of the funding, ¥19.1 trillion, will be used to stimulate the economy, including a multiyear ¥10 trillion investment in the semiconductor and artificial intelligence sectors.

These investments are aimed at positioning Japan as a global leader in high-tech industries, a strategy that aligns with its long-term growth goals.

However, the short-term impact on consumer sentiment remains uncertain.

Higher wages, though promising, may not be enough to offset the immediate burden of rising prices.

What does this mean for households and businesses?

The combination of fiscal and monetary measures offers mixed signals for households and businesses.

On one hand, the subsidies and cash handouts will provide temporary relief, particularly for low-income families.

On the other hand, the potential for higher interest rates could increase borrowing costs for businesses and households alike.

For businesses, especially those in manufacturing and services, rising labor costs are becoming a concern.

However, sectors such as semiconductors and AI stand to benefit significantly from government support, which could create new opportunities for innovation and growth.

The bigger picture

Japan’s current situation highlights the complexity of managing inflation in an environment of global economic uncertainty.

With its fiscal health already in question and its monetary policy gradually tightening, the country faces a difficult balancing act.

The stimulus package is a bold move to support households and promote growth, but its success will depend on the government’s ability to sustain public support while addressing long-term financial risks.

More By This Author:

Solana Price Prediction: Here’s Why SOL Token Will Hit $8,000Dow Jones, S&P 500 Rise On Strong US Manufacturing Data; Gap Jumps 15%, While Alphabet And Nvidia Slide

TJX Sees Opportunity In Trump’s Tariff Chaos As Rivals Brace For Price Hikes: Here’s Why

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more