Japan’s Economy Shows Solid Signs Of Recovery

Industrial production rose unexpectedly in July by 1.0% month-on-month

Industrial production and retail sales improved in July

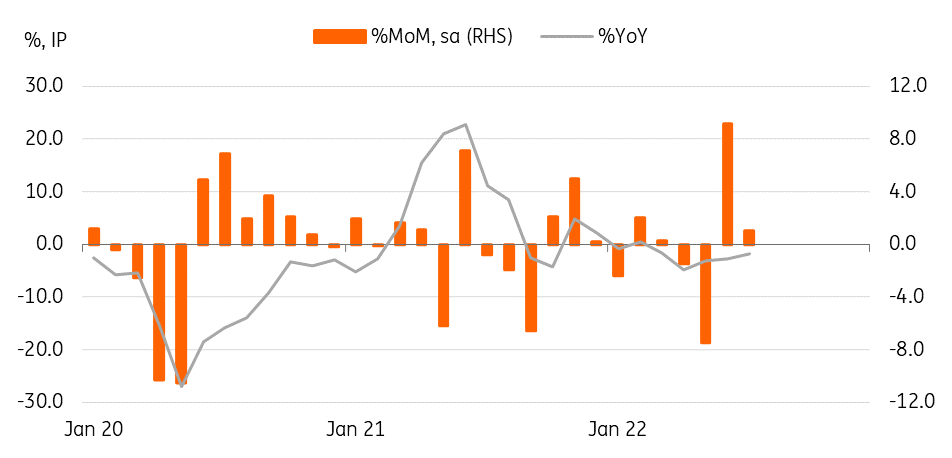

Industrial production rose unexpectedly by 1.0% month-on-month, seasonally-adjusted (vs -0.5% market consensus), following a 9.2% surge in June. Output forecasts for August and September also improved suggesting that solid production is likely to continue this quarter. By industry, automobile production and shipments improved. Keeping up with the production setbacks will normalize in a few months, but the solid gain for two consecutive months shows that the global supply bottleneck is fading and pent-up demand remains strong. Meanwhile, weak production of electronic components and devices suggests that global semiconductors are entering a downcycle for the second half of this year.

Meanwhile, retail sales edged up 0.8% in July (vs -1.4% in June), which was also better than the market consensus of 0.3%. Household consumption remained strong despite the resurgence of Covid cases and high inflation. General merchandise and apparel fell, but more importantly, motor vehicles continued to rise firmly by 4.4% (vs 5.2% in June) for the second month in a row.

Separately, the consumer confidence index rose to 32.5 in August (vs 30.2 in July). Consumers showed a positive outlook as overall livelihood, income growth, employment, and willingness to buy durable goods advanced for the first time in three months.

Today’s reports signal that the Japanese economy continues to recover, mostly due to catch-up production gaps and the reopening effect.

Industrial production rose in July for the second month in a row

Source: CEIC

Outlook for 3Q GDP and Bank of Japan policy

The recent data releases from Japan are positive. Labour market conditions appear to have tightened while the growth outlook for the current quarter is also promising as monthly activity data and survey data have improved more than expected. Currently, we expect third-quarter GDP to grow 0.3% quarter-on-quarter sa (vs 0.5% in 2Q22), but an upside revision is on the way after confirming PMI and core machinery orders in two weeks. As for inflation, if the Japanese yen continues to weaken, hitting the 140 handle, then inflation could climb up to 3.0% year-on-year by year-end.

We believe the recent positive outcomes are not good enough for the Bank of Japan to change its policy stance yet as it believes the recovery is still very fragile. On the other hand, Governor Haruhiko Kuroda pledged over the weekend to maintain the easing policy to support growth. Thus, we expect the Bank of Japan to stay pat at its September meeting.

More By This Author:

Poland: Another Upside CPI Surprise In August

Turkey: Accelerating Growth Momentum In The Second Quarter

FX Daily: Nord Stream Closure Warns Against EUR/USD Bullishness

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more