Japan's Central Bank Panics

August began with a financial shock in Japan.

The Nikkei experienced a "Black Friday" with a drop of almost -15%.

After 45 years, the index had finally returned to its 1989 level... But in just a few days, it lost almost a third of its value!

It all began when the Bank of Japan (BoJ) decided to raise rates at its last meeting, ending the negative rate policy with an increase to 0.25%.

For years, investors had taken advantage of these zero rates to borrow yen and convert it into US dollars or other currencies, thus gaining almost free leverage. However, with the BoJ rate hike and announced rate cuts in the US and EU, these carry trades are unwinding. The yen strengthened from 160 to 142 yen to the dollar, triggering margin calls and the sale of underlying assets, causing stock markets to plunge.

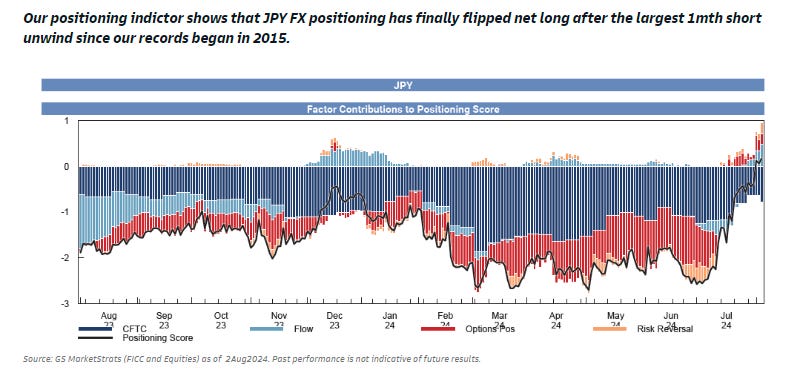

The Japanese currency rebounded strongly against the dollar as the carry trade was unwound. Yen investors quickly reversed their bearish bets into bullish ones in the space of a few weeks:

The Japanese market's fall broke a record: not since 1987 has the Tokyo Stock Exchange experienced such a drop in points and percentage!

The shock was such that it forced the BoJ to intervene at the beginning of the week: the 0.25% hike was already too much. Only a few hours after the rate hike, we witnessed a pure and simple capitulation by the Bank of Japan.

Its governor, Uchida, suddenly adopted a much more conventional stance, declaring: "We won't hike rates when markets are unstable".

In the space of just a few hours, the market turmoil caused the BoJ to change its mind, and the rate hike was brought to a hasty halt.

What could have compelled Uchida to act in this way?

There were rumors of margin calls becoming problematic for a major Japanese bank.

But the problem is probably much bigger than it seems.

In fact, as Deutsche Bank explains, with a gross balance sheet value of around 500% of GDP, or $20 trillion, the Japanese government's balance sheet is, quite simply, a gigantic carry trade.

The Japanese government has also benefited from artificially low interest rates to finance a lifestyle that it would no longer be able to sustain if rates were to rise again:

This is no longer 2008, and banks are no longer the only ones concerned by potential margin calls. This time, the carry trade problem concerns the Japanese government. Under these conditions, it's hard to see how the BoJ governor could have maintained his restrictive policy.

Faced with this situation, the question arises: if the BoJ can't raise rates, what's the point of investing in Japanese debt? How can we avoid a loss of real value on these securities, knowing that they will not be able to keep pace with inflation and the expected depreciation of the Japanese currency due to an inevitably overly accommodating monetary policy?

Under these conditions, is it better to buy Japanese debt or physical gold?

With the BoJ's turnaround, gold in yen maintained its parabolic uptrend; buyers logically repositioned themselves to buy as soon as Uchida backed down:

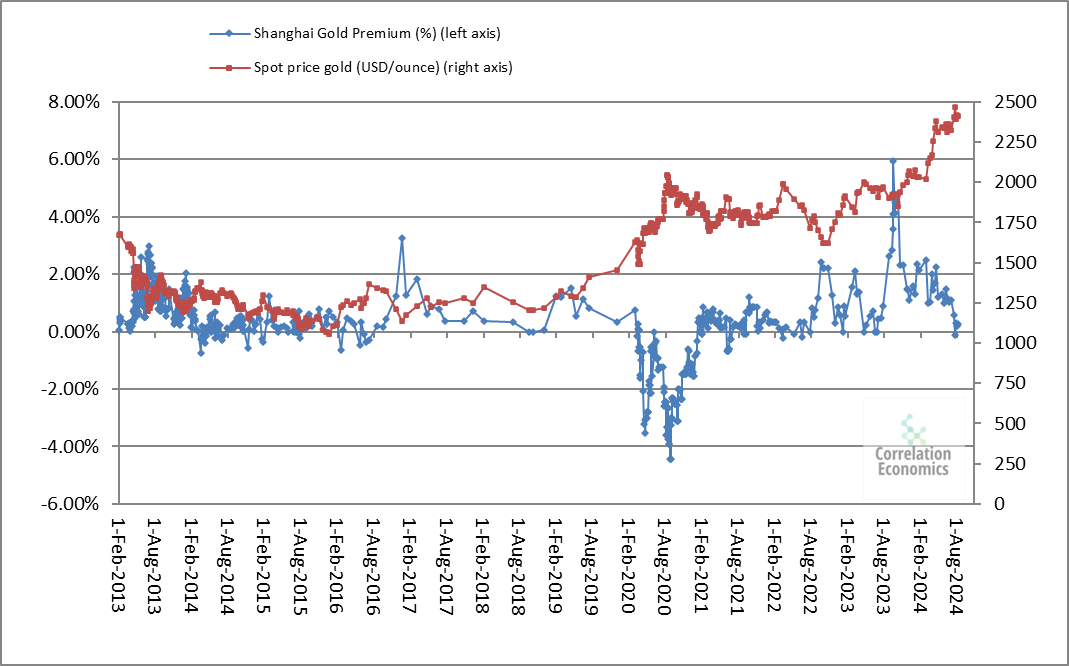

In China, gold premiums are rising again, indicating support for gold prices at these levels:

The fundamentals of the physical precious metals markets remain very positive in July 2024.

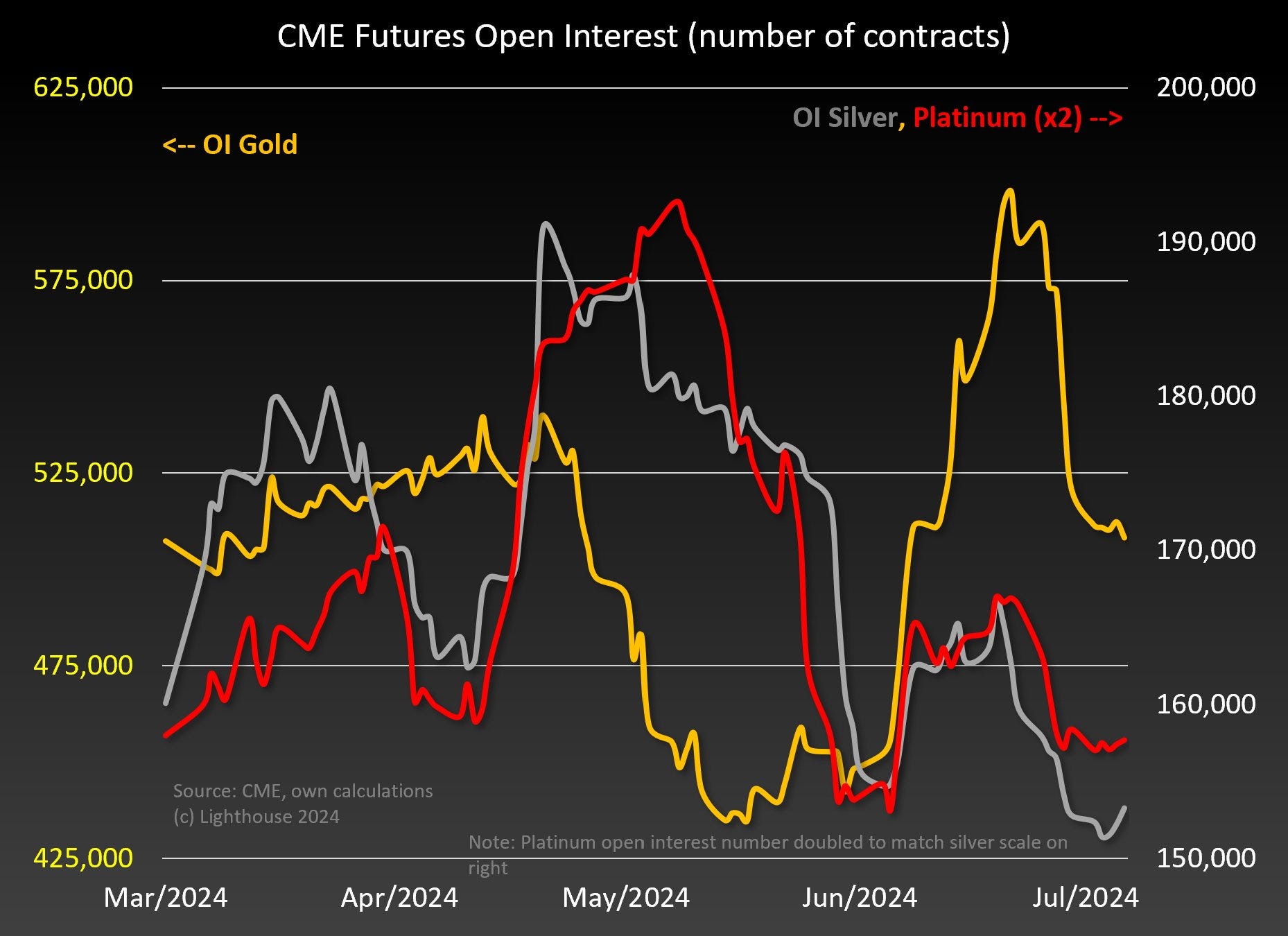

Paper futures markets are much more volatile, notably due to the margin calls observed since the unwinding of the Japanese carry trade at the beginning of August. To compensate for their losses due to the collapse of the equity markets, some participants are forced to liquidate their contracts in order to cover their losses.

The fall in gold and silver on Monday was directly linked to the liquidation of speculations associated with carry trade margin calls: total open interest for gold fell by almost 20,000 contracts, to just 488,000. The total decline since last week exceeds 110,000 contracts, or 20%, from the recent peak of July 18.

Nevertheless, gold's decline remains very moderate compared with previous episodes of margin calls.

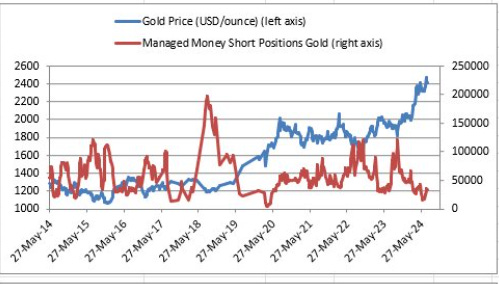

Salesmen have reduced their short positions; the recent fall in gold has led to short covering on their part, which is rather good news for long investors:

Speculation on the precious metals market is declining sharply in the United States:

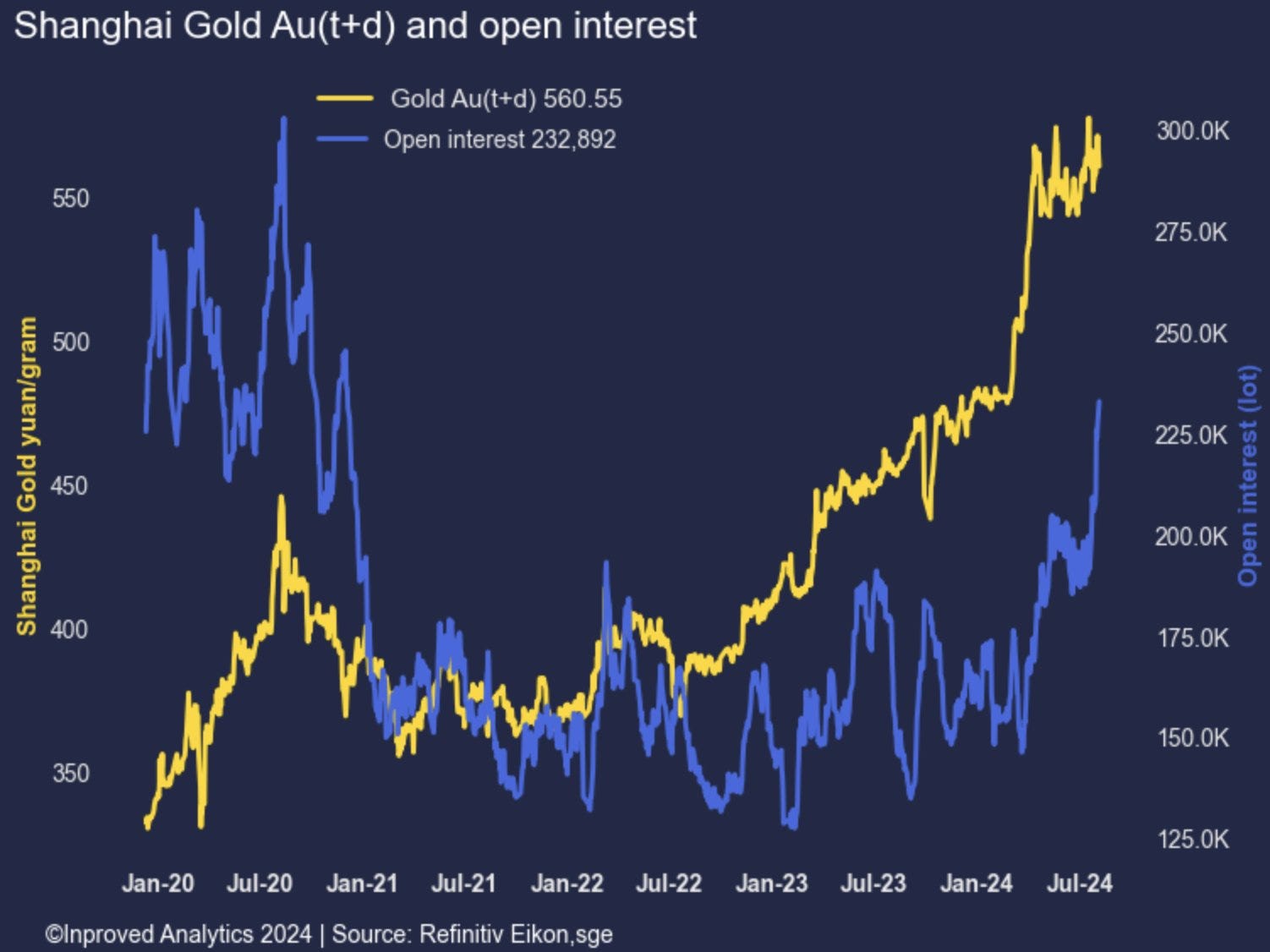

China's gold craze is back on the rise. The number of contracts opened on the Shanghai market has reached a new high since 2021:

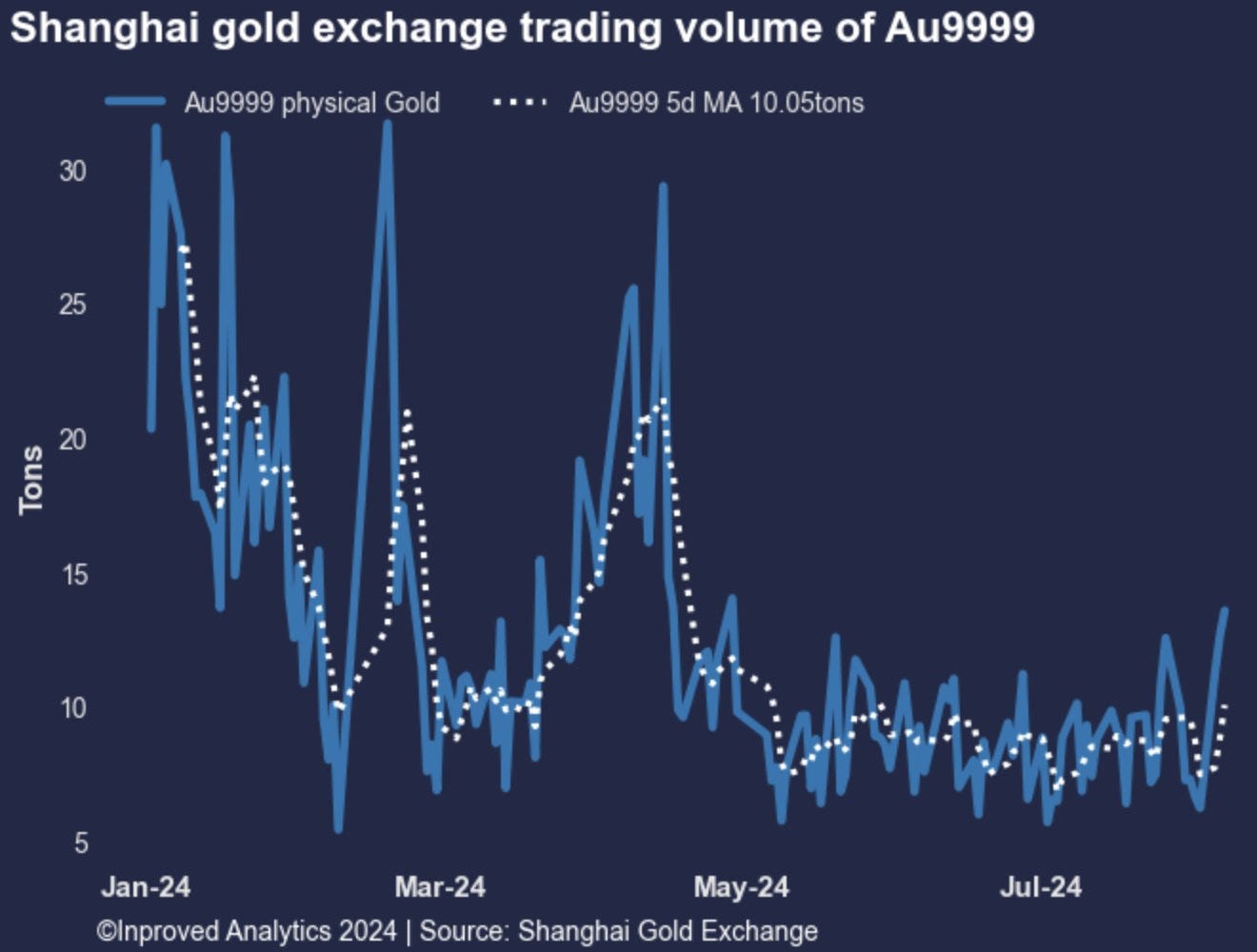

Trading volume in Shanghai futures is also back on the rise. Chinese investors are returning to the gold market after abandoning it last May:

Gold is resisting any correction in all currencies, in an environment where monetary policies remain highly accommodative.

More By This Author:

Gold Poised To Outperform These Consumer Mega-BrandsWill A September Rate Cut Be Enough To Prevent A Nasdaq Correction?

Gold: A Central Currency That Doesn't Say Its Name

Disclosure: GoldBroker.com, all rights reserved.