Japanese Yen Sticks To Intraday Gains Near One-Week Top Against A Bearish USD

Image Source: Pixabay

The Japanese Yen (JPY) remains on the front foot against a bearish US Dollar (USD) for the second straight day and climbs to a one-and-a-half-week high during the Asian session on Tuesday. Investors now seem convinced that the Bank of Japan (BoJ) will raise interest rates this week. This, along with a generally weaker tone around the equity markets, contributes to the safe-haven JPY's outperformance. This also marks the fourth day of a positive move for the JPY in the previous five, though bulls might refrain from placing aggressive bets ahead of the highly anticipated two-day BoJ meeting starting Thursday.

In the meantime, worries about Japan's deteriorating fiscal condition, on the back of Prime Minister Sanae Takaichi's massive spending plan, might keep a lid on any further JPY appreciation. The US Dollar (USD), on the other hand, struggles near a two-month low, touched on Monday, amid rising bets for more interest rate cuts by the US Federal Reserve (Fed). This marks a significant divergence in comparison to hawkish BoJ expectations. This suggests that the path of least resistance for the lower-yielding JPY remains to the upside and backs the case for an extension of the USD/JPY pair's one-week-old downtrend.

Japanese Yen remains on the front foot amid firming BoJ rate hike expectations

- Traders ramped up their bets for an imminent Bank of Japan rate hike following Governor Kazuo Ueda's comments last week, saying that the likelihood of the central bank's baseline economic and price outlook materialising had been gradually increasing.

- Moreover, a quarterly survey of major Japanese manufacturers released on Monday showed that business sentiment improved to its best level in four years. This backs the case for further BoJ policy tightening and continues to underpin the Japanese Yen.

- Meanwhile, private-sector surveys released this Tuesday showed that Japan's manufacturing activity contracted at a slower pace and the service sector lost some steam in December. This, however, does little to dent the bullish sentiment around the JPY.

- The defensive mood keeps Asian equity markets under pressure amid valuation concerns and fears of the AI bubble burst. This is seen as another factor benefiting the JPY's safe-haven status and weighing on the USD/JPY pair amid a bearish US Dollar.

- Despite the Federal Reserve's cautious outlook, traders are pricing in the possibility of two more rate cuts in 2026. This, in turn, keeps the USD Index (DXY), which tracks the Greenback against a basket of currencies, depressed near its lowest level in over two months.

- Moreover, expectations for a dovish replacement of Fed Chair Jerome Powell weigh on the USD and drag the USD/JPY pair below the 155.00 psychological mark. Traders, however, might opt to wait for important US macro data and the central bank event risk.

- This week's busy US economic docket features the delayed Nonfarm Payrolls (NFP) report for October, due later during the North American session. This, along with the flash US PMIs, might influence the USD and provide a fresh impetus to the USD/JPY pair.

- The market attention will then shift to the latest US consumer inflation figures on Thursday, which will be looked for more cues about the Fed's future rate-cut path and drive the USD. Nevertheless, the divergent BoJ-Fed policy expectations favor the JPY bulls.

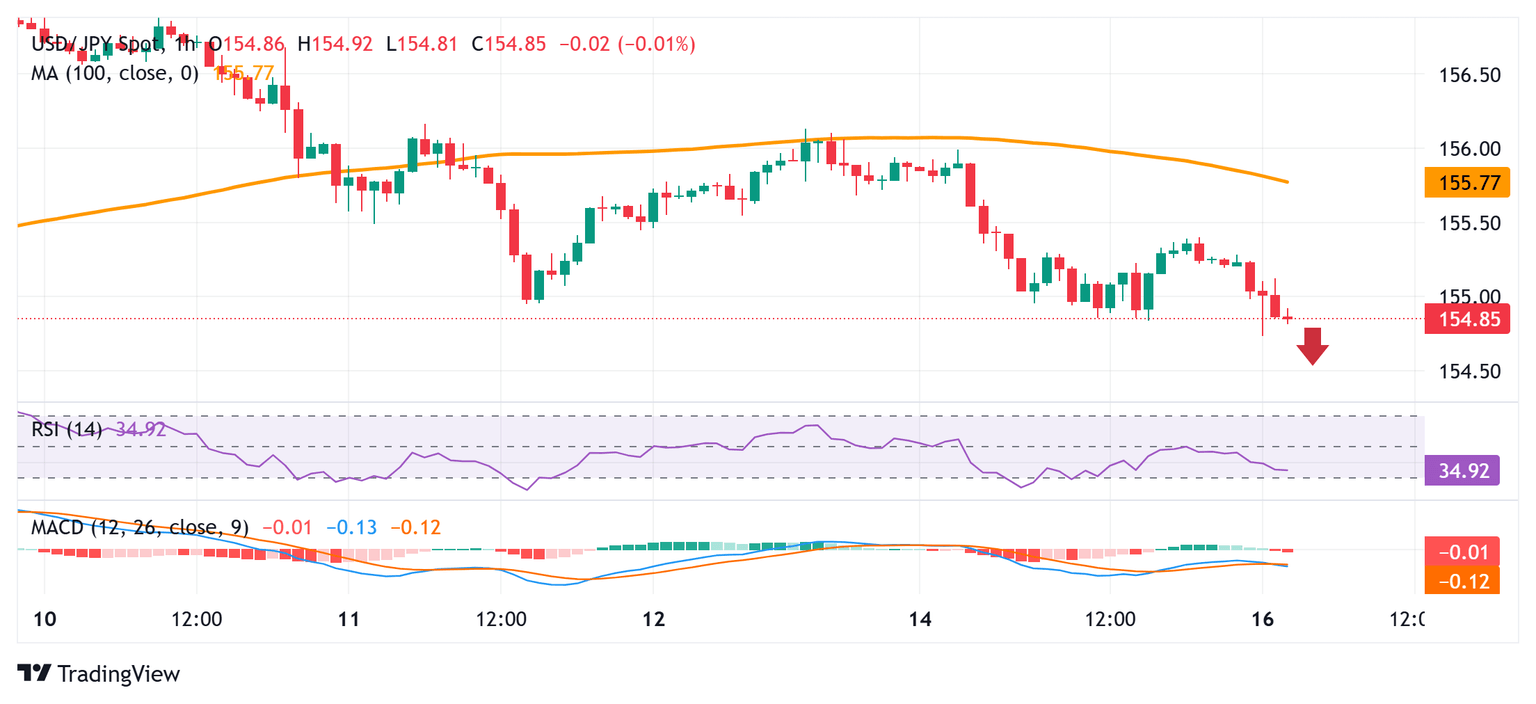

USD/JPY bears have the upper hand while below the 155.00 psychological mark

The recent repeated failures near the 100-hour Simple Moving Average (SMA) and a subsequent breakdown below the 155.00 mark favor the USD/JPY bears. Moreover, negative oscillators on hourly/daily charts back the case for a further near-term depreciating move towards the monthly swing low, around the 154.35 region. This is followed by the 154.00 round figure, which, if broken decisively, should pave the way for a further near-term depreciating move.

On the flip side, any meaningful recovery attempted might now confront an immediate hurdle near the 155.40-155.45 region, above which the USD/JPY pair could aim to challenge the 100-hour SMA, currently pegged around the 156.00 mark. Some follow-through buying might trigger a short-covering move and lift spot prices to the 157.00 neighborhood, or the monthly swing high, touched last week.

Japanese Yen Price This week

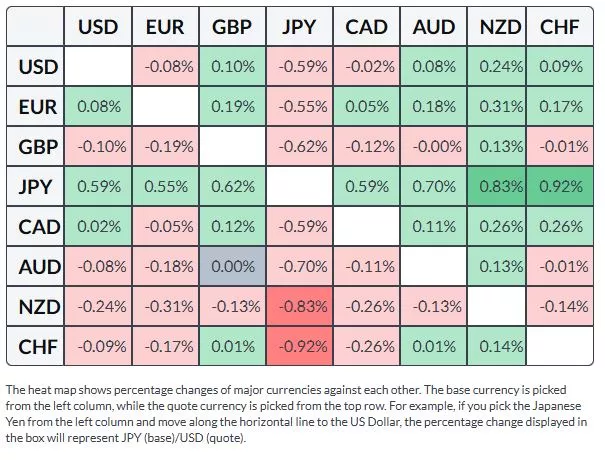

The table below shows the percentage change of Japanese Yen (JPY) against the listed major currencies this week. Japanese Yen was the strongest against the Swiss Franc.

More By This Author:

AUD/USD Remains Depressed Below Mid-0.6600s; Downside Seems Limited Ahead Of US NFP ReportEUR/USD Rallies With US Manufacturing Data And Fed Speakers In Focus

Gold Nears Record Highs As Dovish Fed Outlook Underpins Demand

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more