Japanese Yen Retreats Further From One-Week Top Against USD Despite BoJ Rate Hike Bets

Image Source: Pixabay

The Japanese Yen (JPY) extends intraday retracement slide from a one-and-a-half-week low, touched against a weaker US Dollar (USD) this Wednesday, and refreshes its daily low during the first half of the European session. The initial market reaction to reports that the Bank of Japan (BoJ) is ramping up rate hike messaging turns out to be short-lived, as the prospect for further policy tightening in December or January is still finely balanced. Moreover, concerns about Japan's ailing fiscal position on the back of Prime Minister Sanae Takaichi’s pro-stimulus stance, along with the prevalent risk-on environment, turn out to be key factors undermining the safe-haven JPY.

Meanwhile, data released earlier today underscored the BoJ's view that a tight job market will keep pushing up wages and service-sector inflation. This reaffirms expectations for an imminent BoJ rate hike, which marks a significant divergence in comparison to the growing acceptance that the US Federal Reserve (Fed) will lower borrowing costs again in December. The latter keeps the USD depressed near a one-week low and might contribute to capping the USD/JPY pair amid speculations that authorities might intervene to stem any further JPY weakness. Traders now look to more delayed US macro data for a fresh impetus later during the North American session.

Japanese Yen drifts lower as fiscal concerns and positive risk tone offset BoJ rate hike bets

- Reuters reported this Wednesday that the Bank of Japan, over the past week, has intentionally shifted messaging to highlight the inflationary risks of a persistently weak Japanese Yen, suggesting that a December rate hike remains a live option. The change followed a key meeting between Prime Minister Sanae Takaichi and BoJ Governor Kazuo Ueda last week, which appeared to remove immediate political objections to rate hikes from the new administration.

- Japan's cabinet approved a ¥21.3 trillion economic stimulus plan last Friday, marking the first significant policy initiative under Prime Minister Sanae Takaichi. This also represents the largest stimulus since the COVID pandemic, which fueled anxiety about the supply of new government debt and had been a key factor behind the recent steeping of Japan's yield curve. This, along with the risk-on environment, prompts some intraday selling around the Japanese Yen.

- Meanwhile, data from the BoJ showed that the Services Producer Price Index, which tracks the price companies charge each other for services, rose 2.7% in October from a year earlier. This marked a notable slowdown from a revised 3.1% increase recorded in the previous month, though it suggests that Japan was on the cusp of durably meeting its 2% inflation target. This backs the case for further BoJ policy tightening and could offer some support to the JPY.

- The US Dollar (USD), on the other hand, slides to a one-week low in the aftermath of unimpressive US macro data released on Tuesday, which reaffirmed market expectations for another interest rate cut by the US Federal Reserve in December. Adding to this, Fed Governor Stephen Miran echoed the dovish view and said in a television interview on Tuesday that a deteriorating job market and the economy call for large interest rate cuts to get monetary policy to neutral.

- The prospect of lower US interest rates boosts investors' appetite for riskier assets amid hopes for a peace deal between Russia and Ukraine. President Volodymyr Zelenskiy said on Tuesday that Ukraine is ready to advance a US-backed framework for ending the war with Russia. This might cap the safe-haven JPY as traders look to the delayed release of US Durable Goods Orders, along with the US Weekly Initial Jobless Claims, for a fresh impetus around the USD/JPY pair.

USD/JPY could extend intraday recovery move and aim to reclaim 157.00

The USD/JPY pair now seems to have found acceptance below the 100-hour Simple Moving Average (SMA) and the 38.2% Fibonacci retracement level of the recent move up from the monthly low. Moreover, negative oscillators on hourly charts back the case for additional losses. However, technical indicators on the daily chart are holding in positive territory, suggesting that any further slide is more likely to find decent support near the 155.30 region, or the 50% retracement level. This is followed by the 155.00 psychological mark, which, if broken decisively, will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

On the flip side, momentum back above the Asian session high, around the 156.35 region, might have already set the stage for additional gains and should allow the USD/JPY pair to reclaim the 157.00 round figure. Some follow-through buying might then set the stage for additional gains toward the 157.45-157.50 intermediate hurdle en route to the 158.00 neighborhood, or the highest level since mid-January, touched last week.

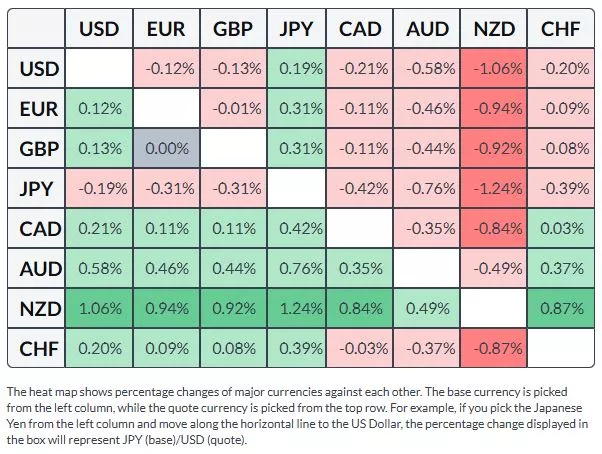

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

More By This Author:

Gold Rises On Firming Fed Rate Cut Bets And Weaker USD, Positive Risk Tone Might Cap GainsSP500 Elliott Wave Update: Is The Correction Over?

USD/JPY Slips As Yen Gains On Intervention Talk, US Data Disappoints

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more