Japanese Yen Remains On The Back Foot As Traders Await BoJ Governor Ueda's Comments

Image Source: Pixabay

The Japanese Yen (JPY) attracts some intraday sellers on Thursday after the Bank of Japan (BoJ) decided to maintain the status quo, though it lacks follow-through. Traders seem reluctant to place aggressive bets and opt to wait for more cues about a rate hike in December or early next year amid expectations that Japan's new Prime Minister Sanae Takaichi will pursue aggressive fiscal spending plans.

Hence, the focus will remain glued to the post-meeting press conference, where comments from BoJ Governor Kazuo Ueda could infuse some volatility around the JPY crosses. In the meantime, the emergence of fresh US Dollar (USD) selling, despite the US Federal Reserve's (Fed) hawkish tilt, contributes to capping the upside for the USD/JPY pair, warranting some caution before placing fresh directional bets.

Japanese Yen bulls remains on the sidelines ahead of BoJ Governor Ueda's post-meeting presser

- The Bank of Japan, as was widely expected, decided to keep interest rates steady at the October policy meeting on Thursday amid the uncertainty over the impact of US trade tariffs and Japan's new Prime Minister Sanae Takaichi's pro-stimulus stance.

- Meanwhile, US Treasury Secretary Scott Bessent on Wednesday urged Japan's government to allow the BoJ space to avoid excess exchange rate volatility, suggesting that the US may keep pressuring Japan to tighten monetary policy more quickly.

- Hence, the market focus will remain glued to the BoJ's communication on the future pace of rate hikes, which will influence the near-term trajectory for the Japanese Yen. In the meantime, reviving safe-haven demand could offer some support to the JPY.

- US President Donald Trump will meet Chinese leader Xi Jinping after months of turmoil over trade issues between the world's two largest economies. This, in turn, keeps investors on the edge and underpins the JPY during the Asian session.

- The US Dollar shot to an over two-week top on Wednesday after the Federal Reserve pushed back against market expectations for another interest rate cut in December. Earlier, the US central bank lowered borrowing costs by 25 basis points.

- The US central bank also said it would stop reducing the size of its balance sheet as soon as December, marking the end of its quantitative tightening. Moreover, economic risks stemming from the US government shutdown weigh on the USD.

USD/JPY remains below the 153.25-153.30 pivotal resistance

The USD/JPY pair struggles to find acceptance above the 153.00 mark and remains below the 153.25-153.30 supply zone, or the monthly peak retested earlier this week. The subsequent fall favors bearish traders, though positive oscillators on the daily chart back the case for the emergence of dip-buyers near the 152.00 round figure. A convincing break below the said handle would expose the overnight swing low, around the 151.55-151.50 region, before spot prices extend the slide further towards the 151.10-151.00 pivotal support. Some follow-through selling would confirm a fresh breakdown and pave the way for deeper losses.

On the flip side, the 153.00 round figure now seems to act as an immediate hurdle ahead of the 153.25-153.30 region, above which the USD/JPY pair could aim to reclaim the 154.00 mark. The momentum could extend further towards the next relevant resistance near mid-154.00s en route to the 154.75-154.80 region and the 155.00 psychological mark.

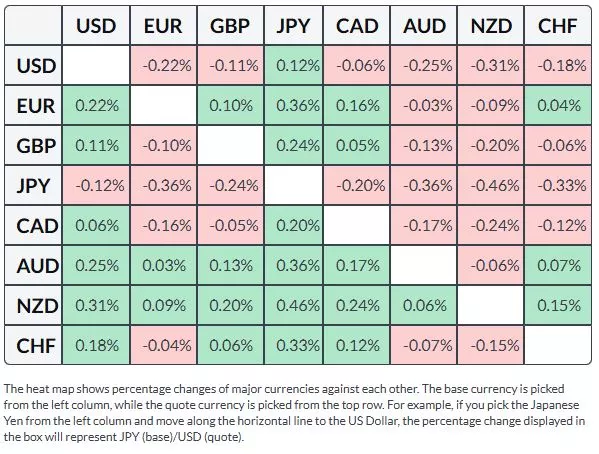

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

More By This Author:

Amazon Q3 2025 Earnings Preview: Three Scenarios That Could Shape AMZN’s Next Big MoveGold Trades Slightly Higher As Fed Interest Rate Decision Takes Center Stage

NZD/USD Price Forecast: Resistance At 0.5805 Is Likely To Hold Bulls

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more