Saturday, October 5, 2019 7:46 PM EDT

JAPANESE YEN TALKING POINTS:

- The global picture looks quite supportive for the Yen as a new quarter gets under way

- Weaker global growth, trade worries and falling stocks all support such haven assets

- However they’ll also trigger a policy response, which may not

The Japanese Yen’s ties to global risk appetite have seen it gain in the past week as global trade and growth fears mount again, but there’s still reason to suspect that the currency might not prosper into year-end.

For one thing the very pace of the slowdown seen in much economic data may add an urgency to trade negotiations which had previously been lacking. Equity markets’ obvious fragility could do the same.

It’s now very obvious from the numbers that both China and the US could really use at very least an interim trade settlement, with the recent slide in US manufacturing only underlining the point. Such a thing would boost risk appetite and weigh on low-yield havens like the Yen. Central bank stimulus is also likely to be ramped up, to similar effect.

Moreover, the Japanese currency has been unable to hope for much domestic monetary policy support for many years now. Not only is that most unlikely to change anytime soon, it could become more acute. Japanese inflation has slowed to an annualized rate of just 0.3%. The Bank of Japan’s ‘sustained 2%’ target looks as unreachable as ever and will all-but certainly requite yet more stimulus to shore up. This will render the Yen unattractive in all but the most straightened global circumstances, but the BoJ is committed to doing so under its current mandate nevertheless.

Of course, risks may yet mount, trade talks may fail and central banks may underwhelm. But the Yen may not be as comfortable as it now looks.

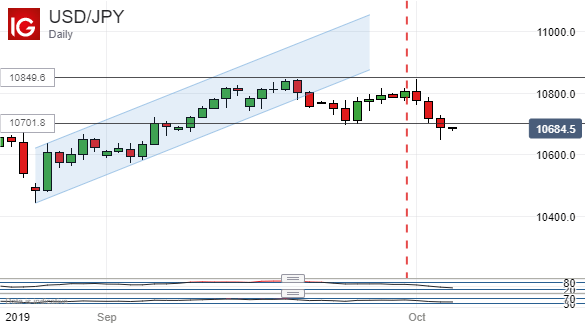

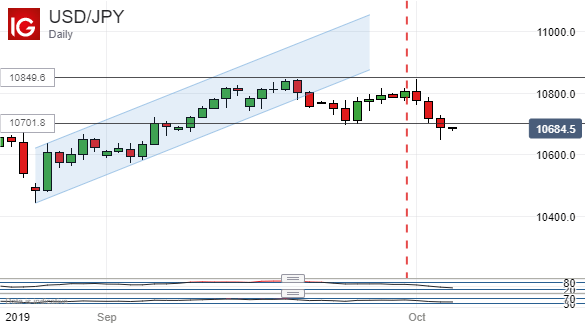

The Yen has gained on the US Dollar as the fourth quarter has got under way, but there’s a way to go yet.

Disclosure: Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our

more

Disclosure:

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our

trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold

educational and analytical webinars and offer trading guides, with one

specifically aimed at those new to foreign exchange markets. There’s also a

Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.