Japanese Yen Depreciates As Global Bond Yields Reduce Safe-Haven Demand

Image Source: Pixabay

- The Japanese Yen edges lower due to the interest rate differential between the US and Japan.

- BoJ Governor Kazuo Ueda stated that the central bank may increase rates if underlying inflation accelerates as expected.

- The US Dollar gains ground due to the upward correction in US Treasury yields.

The Japanese Yen (JPY) edges lower against the US Dollar (USD) on Tuesday as depreciation in global bond yields reduced safe-haven demand for the JPY. Additionally, the interest rate differential between the US and Japan continued to pressure the Yen, underpinning the USD/JPY pair.

Bank of Japan (BoJ) Governor Kazuo Ueda said on Tuesday that the central bank will conduct "nimble" market operations if long-term interest rates spike, signaling the BoJ's readiness to ramp up bond buying when necessary. Ueda also stated that the BoJ will adjust the degree of monetary support if underlying inflation accelerates in line with its forecast, per Reuters.

US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six other major currencies, edges higher with the improvement in US Treasury yields. This uptick can be linked to a prevalent risk-averse mood before the release of Wednesday's ADP Employment Change and ISM Services PMI data. Despite expectations that the Federal Reserve (Fed) won't pursue further interest rate hikes, putting downward pressure on US Treasury yields, this could potentially weaken the Greenback.

Daily Digest Market Movers: Japanese Yen depreciates due to investors’ caution

- Reuters reported on Tuesday that Japan's government will highlight the challenges a weak Yen poses for households in this year's long-term economic policy roadmap. This focus on the Yen's impact is expected to maintain pressure on the Bank of Japan to either raise interest rates or reduce its extensive bond-buying program.

- The ISM Manufacturing PMI unexpectedly dropped to 48.7 in May, down from April's reading of 49.2 and below the forecast of 49.6. The US manufacturing sector experienced its second consecutive month of contraction, marking the 18th time in the last 19 months.

- Reuters reported on Monday that Japanese Economy Minister Yoshitaka Shindo announced that the government will “continue efforts for primary balance to reach within surplus territory in FY 2025.” Shindo also expressed optimism, stating that “Real economic growth of 1.3% in FY 2025 is not so unrealistic.”

- Japan's Tokyo Consumer Price Index (CPI), released on Friday, rose to 2.2% year-over-year in May, up from April's 1.8% rise. If nationwide inflation in Japan were to decline, it would likely deter the Bank of Japan (BoJ) from raising interest rates.

- In an interview with Fox Business on Thursday, Atlanta Fed President Raphael Bostic stated that he does not think additional rate increases are necessary to achieve the Fed's 2% annual inflation target. Furthermore, New York Fed President John Williams stated as per Reuters that inflation is currently too high but should start to decline in the second half of 2024. Williams believes that monetary policy action is not urgently needed.

Technical Analysis: USD/JPY tests the key level of 156.50

The USD/JPY pair trades around 156.40 on Tuesday. Analysis of the daily chart shows a symmetrical triangle pattern, signaling a period of consolidation. However, the 14-day Relative Strength Index (RSI) remains slightly above 50 level, a decline may suggest a potential momentum shift toward a bearish bias.

Regarding potential price movements, if the USD/JPY pair breaks above the psychological barrier of 157.00 and surpasses the upper boundary of the symmetrical triangle, it could find support to retest 160.32, its highest level in over thirty years.

Conversely, if the pair breaches the lower boundary of the symmetrical triangle, it may face downward pressure, approaching the psychological level of 156.00. Further downside could lead to testing the 50-day Exponential Moving Average (EMA) at 154.69.

USD/JPY: Daily Chart

Japanese Yen price today

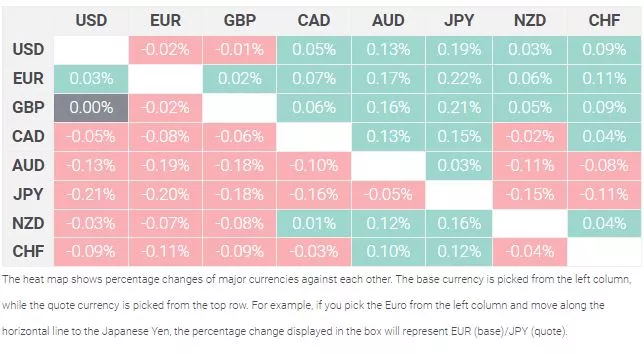

The table below shows the percentage change of the Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the US Dollar.

More By This Author:

WTI Drops Below $74.00 As OPEC+ Plans To Ease Oil Production CutsAustralian Dollar Stays Calm As Traders Adopt Caution Ahead Of US PCE

WTI Drops To Near $79.00 Ahead Of Key US Economic Releases

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more