Japanese Yen Declines Against A Broadly Firmer USD And Pushes USD/JPY To Mid-152.00s

Image Source: Pixabay

The Japanese Yen (JPY) attracts some intraday sellers following an Asian session uptick on Wednesday, which, along with some US Dollar (USD) buying, assists the USD/JPY pair to recover nearly 100 pips from the vicinity of mid-151.00s. Expectations that the Bank of Japan (BoJ) could resist early tightening in the wake of Japan's new Prime Minister Sanae Takaichi's aggressive fiscal spending plans keep a lid on any meaningful JPY gains. Furthermore, the US-China trade optimism turns out to be another factor undermining demand for traditional safe-haven assets, including the JPY, amid some repositing trade ahead of the crucial FOMC decision.

Meanwhile, comments from Japan’s Economics Minister Minoru Kiuchi on Tuesday revive fears about a possible government intervention to stem any further JPY weakness. Moreover, the outcome of a high-profile meeting between US President Donald Trump and Japan’s Takaichi could act as a tailwind for the JPY. Adding to this, supportive remarks from US Treasury Secretary Scott Bessent, along with bets for an imminent BoJ rate hike, should help limit the downside for the JPY. Traders might also opt to wait for the outcome of a two-day FOMC meeting later this Wednesday, which will be followed by the latest BoJ policy update on Thursday.

Japanese Yen turns lower amid receding safe-haven demand, ahead of key central bank events

- On Wednesday, US Treasury Secretary Scott Bessent urged Japan's government to allow the Bank of Japan policy space to keep inflation expectations anchored and avoid excess exchange rate volatility. The remarks revived market expectations that the US may continue to press Japan to tighten monetary policy more quickly.

- This follows a verbal intervention from Japan’s Economics Minister Minoru Kiuchi on Tuesday, emphasizing the importance of stable FX moves that reflect economic fundamentals. Kiuchi added that he plans to assess the impact of FX changes on Japan’s economy and that it is important to avoid rapid, short-term fluctuations.

- Furthermore, US President Donald Trump and Japan’s new Prime Minister Sanae Takaichi signed an agreement laying out a framework to secure mining and processing of rare earths and other critical minerals. This contributes to the Japanese Yen's relative outperformance during the first half of the Asian session on Wednesday.

- Meanwhile, Takaichi's pro-stimulus stance to revitalize the economy could further delay the BoJ's tightening plan. Traders, however, seem convinced that the central bank will eventually hike interest rates in December or early next year. This marks a significant divergence in comparison to dovish Federal Reserve expectations.

- The US central bank is universally anticipated to lower borrowing costs by 25-basis-points at the end of a two-day meeting later today. Moreover, traders have been pricing in a greater chance of another rate cut in December. The US Dollar, however, attracts some buyers and triggers an intraday short-covering move around the USD/JPY pair.

- Apart from the crucial Fed rate decision, market participants will closely scrutinize the latest BoJ policy update on Thursday. A further hawkish signal would be enough to further boost the JPY. However, a surprisingly dovish tilt, though unlikely, would negate any positive outlook for the JPY and prompt aggressive selling.

USD/JPY could extend the intraday recovery towards reclaiming the 153.00 mark

This week's failure near the 153.25-153.30 hurdle, or the monthly swing high, constitutes the formation of a bearish double-top pattern on the daily chart and backs the case for a further depreciating move for the USD/JPY pair. That said, oscillators on the said chart are holding in positive territory, suggesting that any further slide could find some support near the 151.10-151.00 region. A convincing break below the latter, however, should pave the way for deeper losses towards the 150.00 psychological mark with some intermediate support near the 150.45 zone.

On the flip side, any meaningful recovery beyond the Asian session peak, around the 152.20 area, is more likely to attract fresh sellers and remain capped near the 152.90-153.00 region. Some follow-through buying, leading to a further strength beyond the 153.25-153.30 zone, will be seen as a fresh breakout and allow the USD/JPY pair to reclaim the 154.00 mark. The momentum could extend further towards the next relevant resistance near mid-154.00s en route to the 154.75-154.80 region and the 155.00 psychological mark.

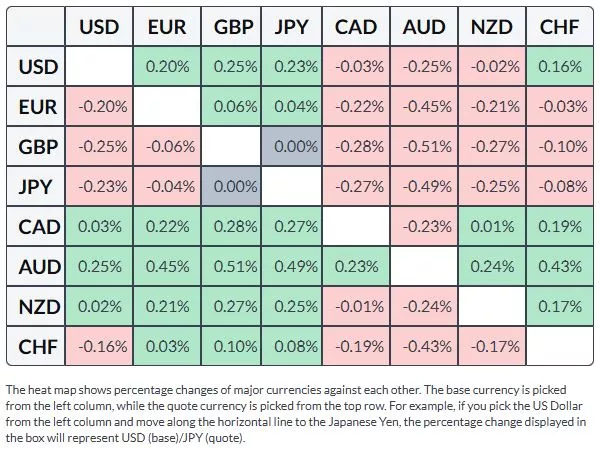

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

More By This Author:

WTI Oil Declines On OPEC+ Production Hike, Russia Sanctions Offer Partial SupportJapanese Yen Sticks To Gains Amid Intervention Fears, Ahead Of Fed/BoJ Rate Decisions

USD/JPY Holds Near Eight-Month Peak As Fed, BoJ Rate Decisions Loom

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more