Japanese Investment Shows US Treasuries Are Getting More Attractive

Japanese investor flow data from the Bank of Japan highlights the growing attraction of USD assets. We expect US Treasuries to remain a favourite of foreign investors over EUR bonds, especially if sentiment falters.

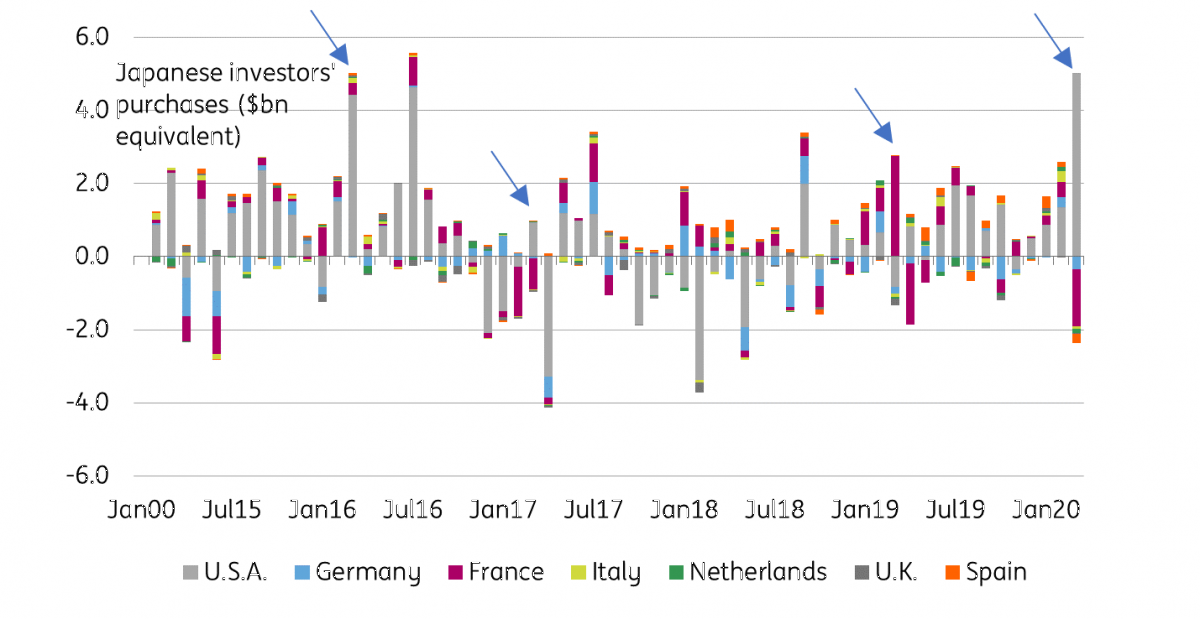

Japanese investors selling EGBs and buying USTs

Portfolio investment flow data from the Bank of Japan (BOJ) is not the most timely, but it has one merit: it is granular. According to the central bank, Japanese investors sold $2.3 billion equivalent of European Government Bonds (EGB) in March, and bought $5 billion of US Treasuries. This buying flow was the greatest since at least 2015.

To be sure, large fluctuations in portfolio composition ahead of Japan's year-end are not unusual. The reason it is notable this year is that it coincided with US Treasuries becoming more attractive to foreign investors due to the drop in FX-hedging costs. We use 3 month FX forwards to calculate them. The Federal Reserve cut interest rates by 150 basis points in March, which should have immediately affected FX hedging costs. However, the initial rise in USD Libor fixings, and subsequent fall, have delayed that full benefit for foreign investors until May.

Change in the pecking order: USTs now cheaper on an FX-hedged basis

Source: Bloomberg, ING

US Treasuries to attract more inflows

When comparing the yield of 10Y government bonds from major developed markets, US Treasuries have now become more attractive than JGBs. This is the first time since early 2018 that this is the case. On an FX-hedged basis, UST yields are also approaching the level of 10Y OAT, an old favourite of Japanese investors. The improvement in relative FX-hedge costs between USD and EUR (with USD Libor crashing down and Euribor remaining stubbornly high) means future Japanese flows into foreign bonds should benefit USD assets the most, in our view. This is particularly significant as the government's pension fund has increased its target allocation to foreign bonds. It is also possible that the drop in FX hedging costs reduces Japanese investors' appetite for FX-unhedged positions.

Tightening potential: UST-EGB spreads

Source: Bloomberg, ING

USD-EUR yield spread could tighten further

This has implications for relative USD and EUR yield movements. The dip in FX hedging costs means US-EU spreads have more leeway to tighten in the event of a global rates rally, for instance in the event of a second leg lower in stock markets. This also means that the sharp increase in US Treasury issuance should find support not only from the Fed, but also from foreign buyers.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more