Japanese Inflation Accelerates, Raising Odds Of Another Rate Hike

Fresh food prices propelled inflation higher in January

Japan’s consumer price inflation accelerated to 4.0% year on year in January, in line with market consensus (vs 3.6% in December), as fresh food surged 21.9% (vs 17.3% in December). Rice prices skyrocketed 70.9%. Excluding fresh food, core CPI rose faster than expected to 3.2% (vs 3.0% in December, 3.1% market consensus). Costs of eating out have been on the rise for the past three months. Inflation rose 0.5% month on month, seasonally-adjusted, with goods up 1.0% and service costs unchanged. We believe that the BoJ is likely to focus on core trends rather than headline inflation. Though in line with BoJ projections, price dynamics support the central bank’s rate normalization strategy.

JPY rising as market expectations for a rate hike increase

A variety of factors have market expectations pivoting toward rate hikes: recent hawkish comments from BoJ officials; stronger-than-expected GDP data; and a rising CPI. As such, 10Y Japanese government bond (JGB) yields rose significantly, while the JPY surged against the USD over the past week.

We believe that the BoJ prefers to avoid any sudden moves in market rates, as the currency reaction could dampen economic sentiment and activity. A sudden jump in long-term yields would increase uncertainty about corporate and government funding. Sharp JPY appreciation may hurt earnings. So, the BoJ will try to limit the extremes of market reactions. This morning, Governor Ueda told parliament that the BoJ will keep JGB buying operations flexible. Trading in the JPY and JGBs seemed to calm down somewhat after his remarks.

Flash PMIs advanced in February

Japan’s flash purchasing managers indexes showed services are helping to drive the economic recovery, while manufacturing remains sluggish. Overall, both indices improved from the previous month. The service PMI rose to 53.1 in February from 53 in January, marking the fourth consecutive month of expansion. The manufacturing PMI edged up to 48.9 from 48.7, but has remained in contractionary territory for eight months. Output and new orders were up. We are concerned that US tariffs will eventually dampen the economy. But so far, the negative impact hasn't materialised.

Inflation outlook uncertain

Tokyo inflation data, due out next week, is expected to ease modestly in February. Food prices are likely to rise further, but renewed energy subsidy programmes should offset some gains. We also believe the government is likely to introduce measures to stabilise rice prices, which could tame broader food costs. Yet with Trump's tariff policies intensifying, the BoJ will remain quite cautious going forward.

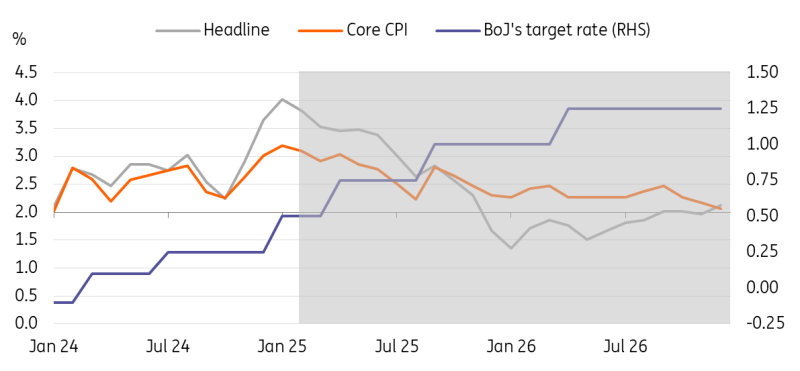

Core inflation is likely to stay above 2% for a considerable time, which allows the terminal rate to reach 1.25% by 2026

Source: CEIC

More By This Author:

Polish Investment Recovers And Wage Pressures EaseFX Daily: Fiscal Risk Premium To Go Into The Euro

The Commodities Feed: EU Agrees On Another Russian Sanctions Package

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more