Japanese Export Growth Slowed In March, And US Tariffs Are Sure To Accelerate The Downshift

Image Source: Pexels

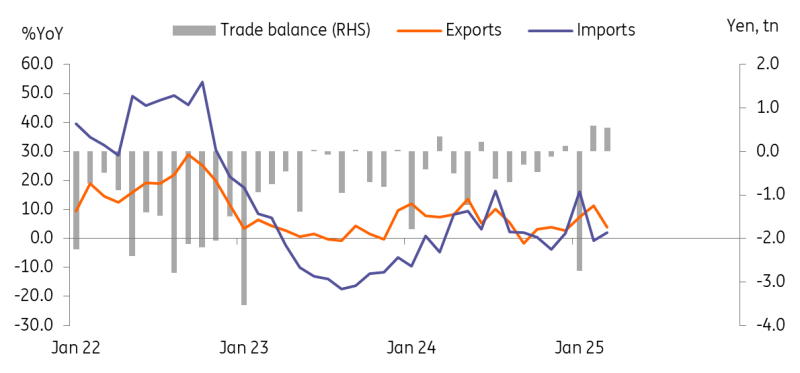

Exports rose for a sixth straight month in March, but at a slower pace

Japanese exports rose 3.9% in March year on year (vs 11.4% in February, 4.4% market consensus), partly due to the early effects of US tariffs.

By destination, exports to the US still gained 3.1% despite tariffs on iron, steel and aluminium. Indeed, exports of iron and steel (-16.6%) declined, but they only account for 1.3% of total exports. So far, the overall impact is muted. Major export items such as electrical machinery (6.1%) and transportation equipment (1.0%) gained, likely boosted by frontloading.

Meanwhile, exports to Asia grew 5.5%, which highlights some interesting dynamics. Exports to China, Japan’s second-largest export partner, dropped -4.8%, while shipments to Hong Kong (19.7%), Taiwan (19.5%), and South Korea (11.5%) all recorded double-digit increases. Also, semiconductors and chip-making machinery exports to China dropped significantly. This is likely due to the rerouting of exports within Asia to avoid tariff conflicts with the US. Since China is the largest producer of semiconductors, we’re concerned about a downward cycle in the sector.

Trade balance remained in the surplus zone for a second month

Source: CEIC

Markets closely watching trade negotiations between the US and Japan

Trump claimed “big progress” on his Truth Social platform after discussions with Japan, but no details have been revealed yet. As expected, the US linked tariff talks to a Japanese spending increase for US troops in the country. Potentially, Japan is expected to commit to purchasing more US goods, including LNG and agricultural products, and increase direct investment in the US. The Japanese yen lost ground against the US dollar this morning on news the currency rate wasn't discussed, at least not yet. We expect the JPY to be one of the outperformers in the FX market. Volatility is likely, though, depending on trade discussions.

We believe a strong JPY is likely to alleviate some of the inflationary pressures for the Bank of Japan (BoJ). Yet, the BoJ is likely to keep its policy normalization strategy, as its 2% inflation target is likely to be met with strong wage growth and a recovery of household consumption. Also, the BoJ is cautious about sending dovish signals to the market. This could trigger JPY weakness and attract criticism from the US.

More By This Author:

Bank Of Canada Pause Shouldn’t Last LongWeak Pricing In Czech Industry Among Mounting Uncertainty

FX Daily: Updates On Repatriation, China UST Holdings And The Fed

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more