Japanese Consumer Inflation Rose In June

The actual figures slightly missed market consensus, but showed that inflationary pressures are building on both the supply and demand sides. We think a reacceleration in service prices should give more confidence to the Bank of Japan.

Yen. Image Source: Pixabay

Headline CPI inflation stayed at 2.8% YoY in June for a second month (vs 2.8% in May, 2.9% market consensus)

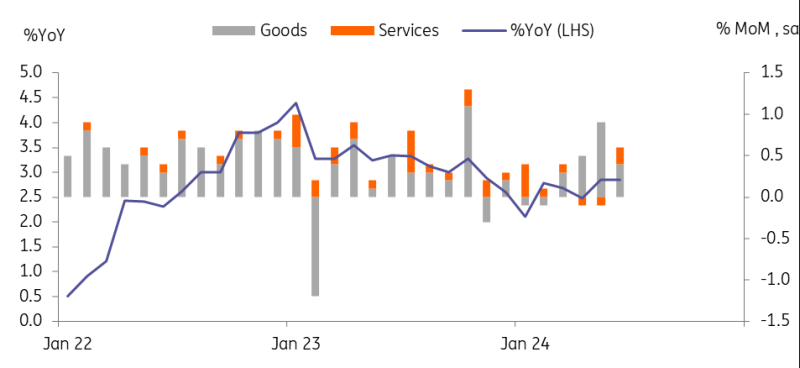

Core inflation excluding fresh food, the BoJ’s preferred measure, accelerated to 2.6% in June (vs 2.5% in May, 2.7% market consensus) from 2.2% in April. Utilities (7.5%) rose the most as an energy subsidy programme ended. In a monthly comparison, inflation grew by 0.3% MoM sa (vs 0.5% in May) with both goods and services up by 0.4% and 0.2% respectively. In our view, the weak JPY is partly adding to supply-side pressures, while solid wage growth is supporting demand-side pressures.

Going forward, the government plans to renew energy subsidy programmes from August to October to counteract the heatwave during the summertime. This could lower the overall inflation figure, but as it is temporary, the Bank of Japan is not expected to be too concerned.

Services prices rebounded in June

Source: CEIC

BoJ preview

The Bank of Japan is scheduled to meet on 30 and 31 July. The Bank of Japan will unveil a roadmap for its Quantitative tightening programme and release its quarterly economic outlook report. Given the recovery in consumption, solid wage growth, and the potential for further inflationary pressures from a weaker yen, we believe the Bank of Japan is likely to raise its policy rate by 15bp.

More By This Author:

FX Daily: USD/JPY Caught Between Carry And PoliticsThe Commodities Feed: Rangebound Crude

Asia Week Ahead: China’s Loan Prime Rates And Singapore’s Monetary Policy, Alongside More Regional Data Releases

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more