Japan Splits Management Of The Impossible Trilemma: MOF For The Currency, BOJ For The Yields

Image Source: Pixabay

Observing the cartoonish circus that is Japan's central bank and ministry of finance, Bloomberg's Masaki Kondo writes that Japan’s hesitation to let go of the yen means the BOJ is managing monetary policy amid an almost impossible trinity of outcomes. In the end, the yen will probably take precedence over bonds with 10-year yields likely to climb toward 1%.

The Mundell-Fleming trilemma stipulates a nation can’t achieve the free flow of capital, independent monetary policy, and a fixed exchange rate simultaneously. The fact that Japan’s apparent reluctance to let JPY weaken despite the nation’s open capital account is putting the BOJ in this trilemma, to a certain degree.

This difficulty is pronounced by the BOJ’s bond-purchase operation; the central bank may want to buy more bonds to keep yields low, but concern over further weakness in the yen is preventing the BOJ from doing so. Japan’s way to get around this problem is to split the tasks: the MOF for the currency and the BOJ for yields.

Whether this will work or not remains to be seen. But the initial rebound higher for USD/JPY after Tuesday’s slide suggests Japan’s authorities need to be even more convincing.

* * *

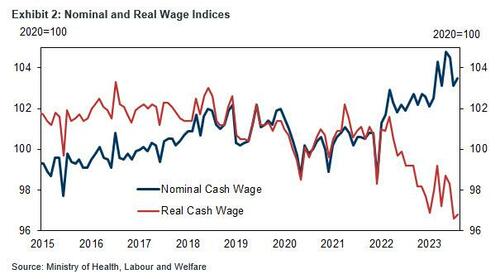

Meanwhile, continued yen weakness means one thing: inflation will keep rising and rising as real wages keep falling and falling... and just hit a record low.

And there will come a point when even the world's most compliant and sheepish society says enough.

More By This Author:

Happy 15th Birthday To The QE EraJobless Claims Hovers Near 2023 Lows Despite ADP Weakness

84% Of CEOs Expect A Recession In 2024 (& 0% Of Fed Staff)

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more