Japan: 4Q23 GDP Unexpectedly Contracted For A Second Quarter

Disappointingly, the Japanese economy has fallen back into a technical recession on the back of weak domestic demand. The Bank of Japan (BoJ) will likely now become even more cautious about any policy change. We believe the June rate hike option is still valid but with the growing possibility of a delay until 3Q24

Image source: Pixabay

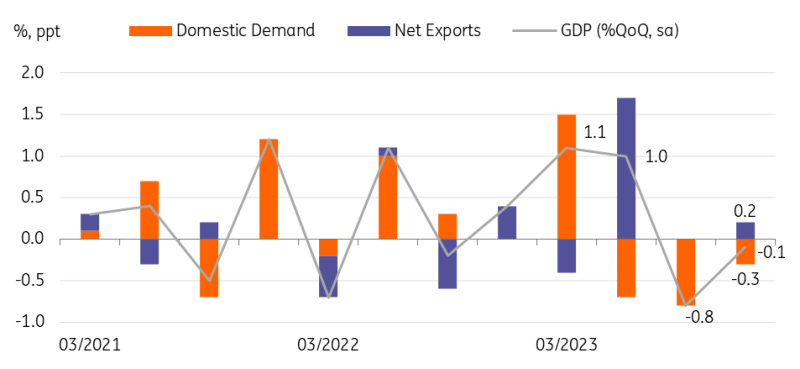

Weak domestic demand was the main reason for the ongoing contraction

Japan’s 4Q23 GDP unexpectedly dropped -0.1% QoQ (0.2% market consensus), while 3Q23 GDP was revised down to -0.8% (vs -0.7% previously). Domestic demand was particularly weak.

Private consumption dropped -0.2% (vs revised -0.3% in 3Q23). Durable goods consumption gained solidly (6.4%) but semi-durable (-1.7%) and non-durable (-0.3%) goods consumption declined. The downside surprise came from service consumption, which fell -0.6%. This could be a temporary drop after having risen for five consecutive quarters, and we expect service consumption to rebound in the current quarter.

On the investment side, business spending also dropped -0.1% (vs revised -0.6% in 3Q23). Residential investment deepened its contraction by -1.0% (vs -0.6% in 3Q23) while non-residential investment dropped by a more modest -0.1% compared to previous quarters (-0.6% in 3Q23, -1.4% 2Q23).

Net exports supported overall growth by adding 0.2 pp to the QoQ growth total. Exports grew 2.6% with both goods (0.2%) and services (11.3%) up. The sudden jump in service exports is related to one-off hikes in royalty fees.

Net exports contributed positively to overall growth

Source: CEIC

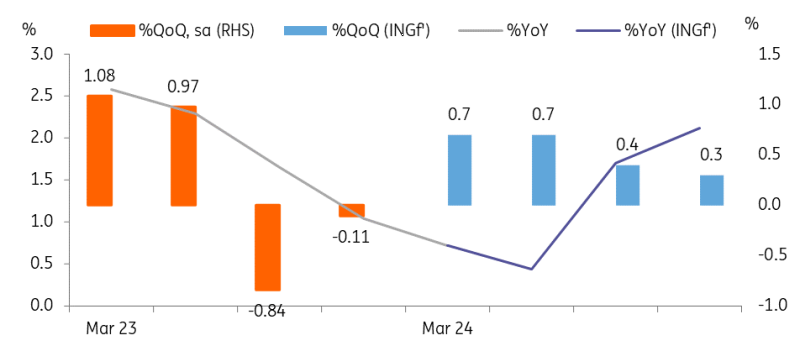

GDP outlook

Despite the disappointing 4Q23 result, we expect 1Q24 GDP to rebound. The negative impact of January's earthquake turned out to be quite limited and short-lived. The latest supplementary budget will also support growth in the current quarter. Furthermore, a wide variety of hard and soft data mostly suggest a recovery. Exports will continue to be the main growth engine in the current quarter. Monthly trade data shows a solid performance in IT and vehicles. And the above-50 manufacturing PMI also suggests an optimistic outlook for exports in the near term. Private consumption should also improve given the slight stabilisation in inflation in 1Q24 and our expectation for solid wage growth in FY24. For investment, we believe that the strong earnings of corporates last year and the recent solid demand for IT will lead to increases in facility investment this year.

GDP is expected to rebound in 1Q24

Source: CEIC, ING estimates

BoJ outlook

However, weak GDP outcomes will complicate the BoJ’s policy decision, especially while the JPY is hovering around the psychological 150 level. We anticipate that the market expectation for a March/April rate hike will die down. But if growth rebounds in the current quarter as we expect, then we believe that the BoJ will deliver its first rate hike in June, though the possibility of a rate hike and ending yield curve control later in 3Q24 is growing.

More By This Author:

Asia Morning Bites For Thursday, February 15

Economic Recovery Comes To An Abrupt Halt In Hungary

The Netherlands Exits Its Shallow Recession