It’s Starting To Dawn On People There Is No Global Economic Dawn Lit By China

Xi Jinping’s earlier “stimulus” promises had originally stimulated the Keynesian-addled imaginations of Western observers and Economists. Hearing only that single word, they didn’t appear much interested in any of its details. Like how Emperors facing increasingly grave difficulties historically tend to stimulate their own capacity for remaining Emperor above everything else.

For a very brief moment, as Shanghai reopened, there were thoughts of recovery from China spreading well beyond. It would be, the mainstream dreamed like it once had been; the Chinese retaking their place at the head of the global growth paradigm by employing the Economic principles Western journalists and Economists hold dearest. A technocratic ending to COVID.

What Xi actually said was very different, national security spending. A far cry, obviously, from the ancient Economic textbook still sadly widely read outside of China.

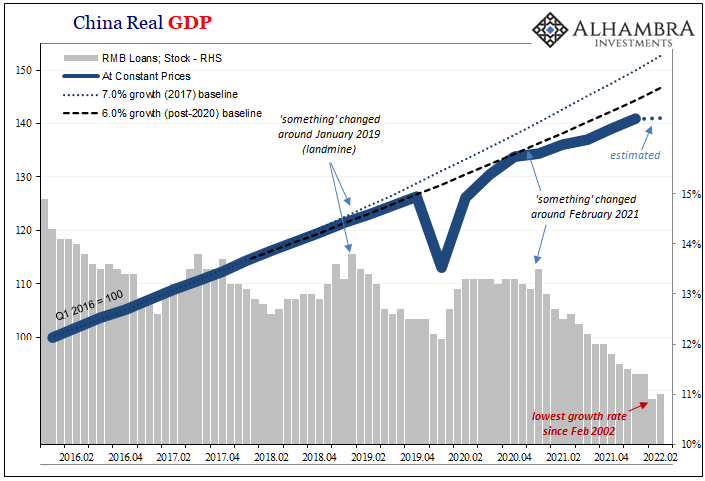

The CCP is not going to ride to the global economy’s rescue. In fact, the Communists are paralyzed, unable to ride to their own economy’s rescue, a very different reality that still-dazed Economists here are only now trying to come to terms with.

Only a few weeks ago, the reopening honeymoon looking less lovely, Economists at UBS and JP Morgan started things off:

UBS on Tuesday cut its year-on-year gross domestic product growth forecast to 3% from 4.2%, citing the impact of Covid Zero. While the economy will likely rebound in the third and fourth quarters as the government refines its restrictions and reduces disruptions to transport and supply chains, that easing likely won’t be as rapid as it was in 2020 given the nature of the omicron variant, the UBS economists wrote.

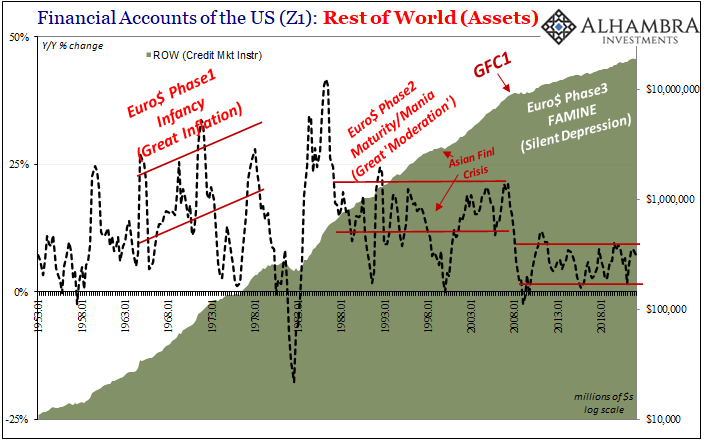

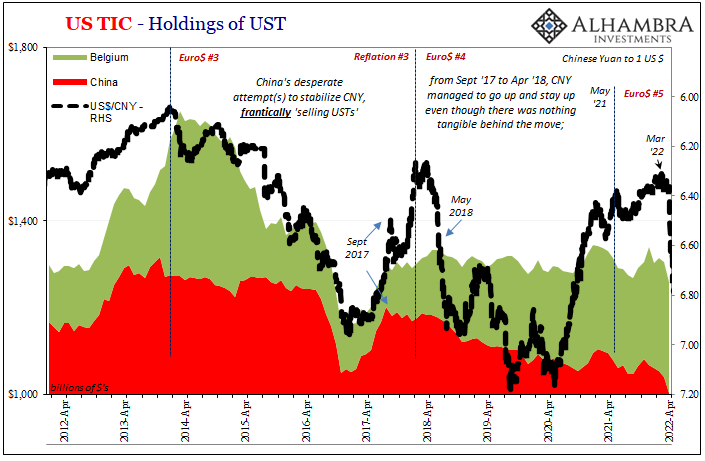

The “nature of the omicron variant?” No, the long run nature of unrelenting Euro$ Famine. UBS may want to remain head-in-the-clouds, yet the openly public, determined response to the famine since the 19th Party Congress has been unyielding throughout. Other Economists followed UBS over the past few weeks, several of whom were less enthusiastic to tap dance around these far-reaching negative implications.

Think World Bank President David Malpass and his “for many countries, recession will be hard to avoid” quote.

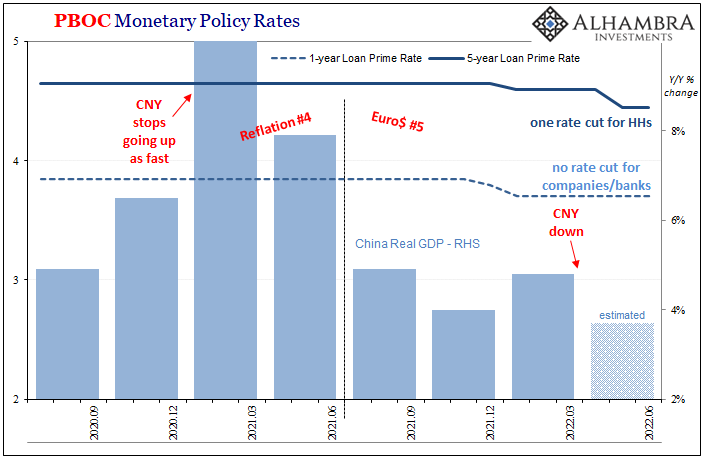

Insofar as Chinese authorities are concerned, even now they are doing exactly what they’ve said all along. There is no major “stimulus” planned or pushed, the PBOC primary among their many “strangely” (not really) silent.

Despite China’s NBS just recently reporting that housing prices across the country’s 70 major and middle-tier cities had declined year-over-year in May for the first time since 2015, over the weekend the PBOC held the 5-year LPR steady anyway with only last month’s cut to represent anything like intervention.

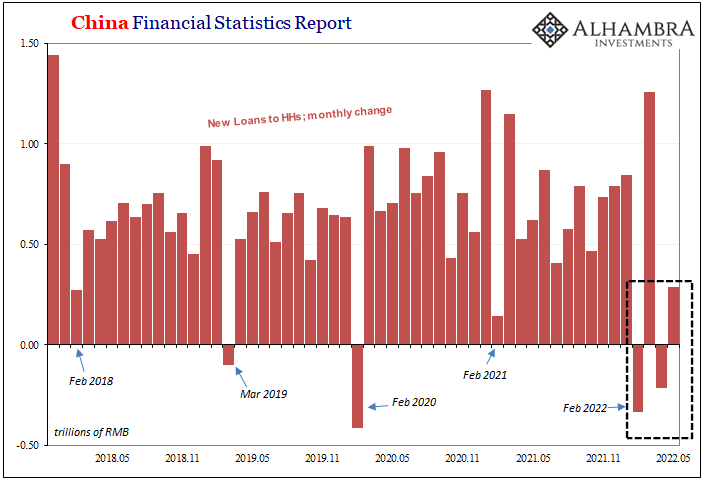

Home prices now falling, household lending in shambles, and this is right when Keynes said it’s most crucial to take charge. Authorities there really are, but only in the otherworldly sense of still trying to manage this managed decline.

The 1-year LPR was left on hold, too, even as economic growth diminishes there by the month and global potential spilling back into China falls with the growing pile of recessionary indications overseas.

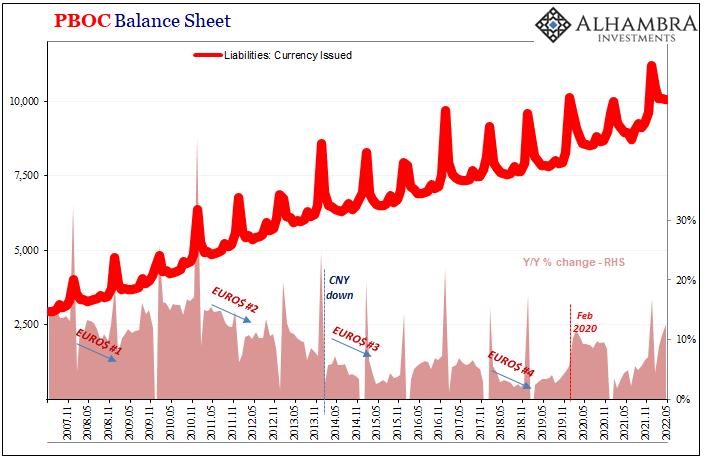

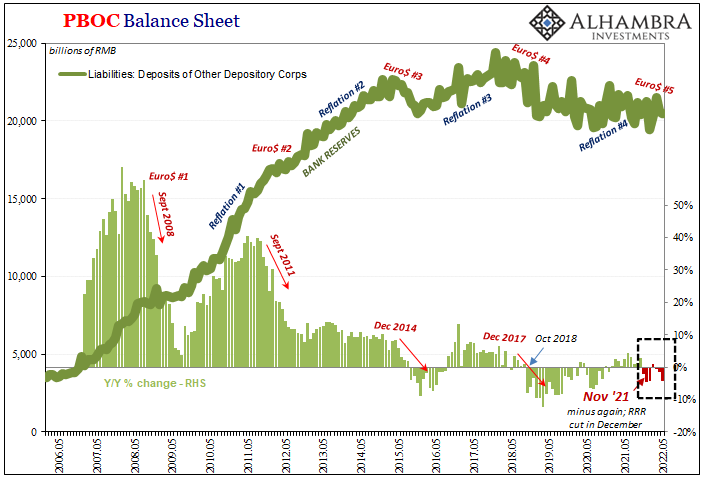

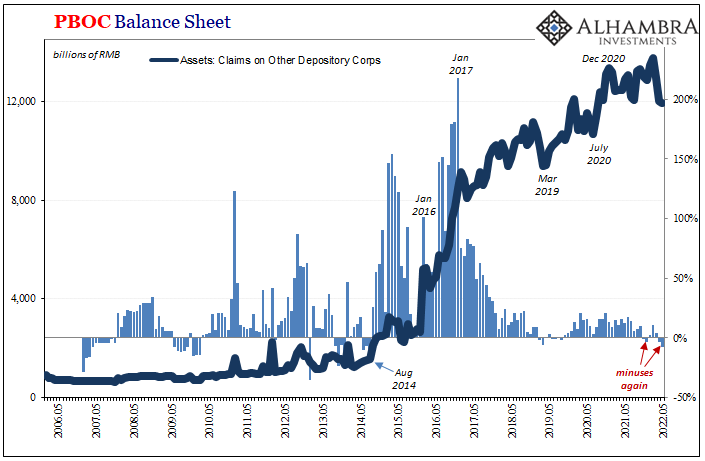

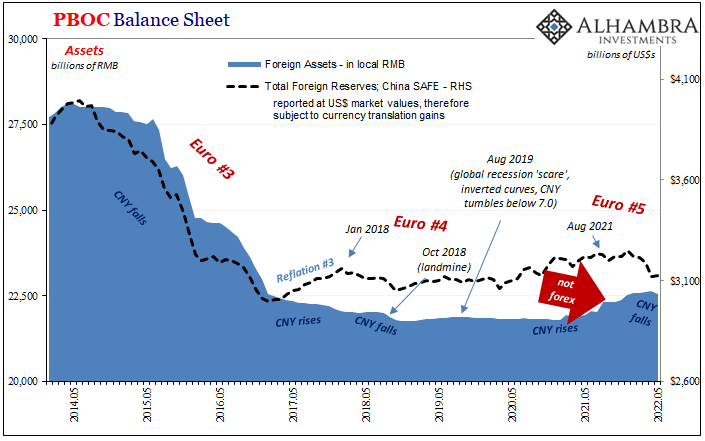

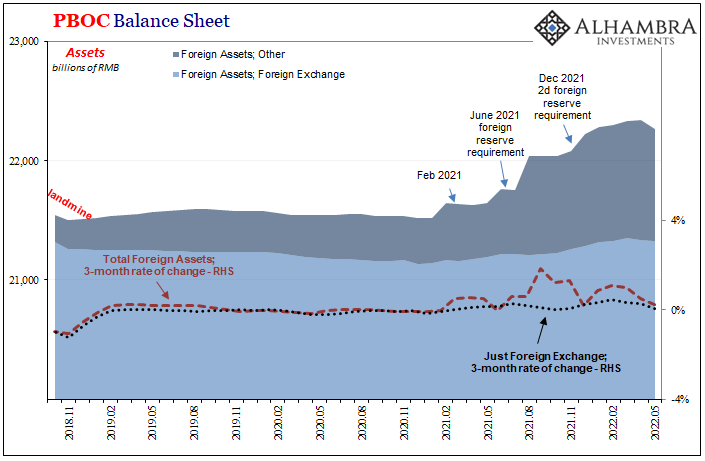

On the PBOC balance sheet itself, you can observe Xi’s “magic”; a preference for hand-to-hand currency issued (“common prosperity”) while the banking system is shut out of bank reserves thanks to the indirect asset-side effect of Euro$ #5 not adding foreign exchange assets. Part of the retrench of bank reserves is enforced at the expense of the MLF (filed under the line “Claims on Other Depository Corporations”) which is tied to the 1-year LPR.

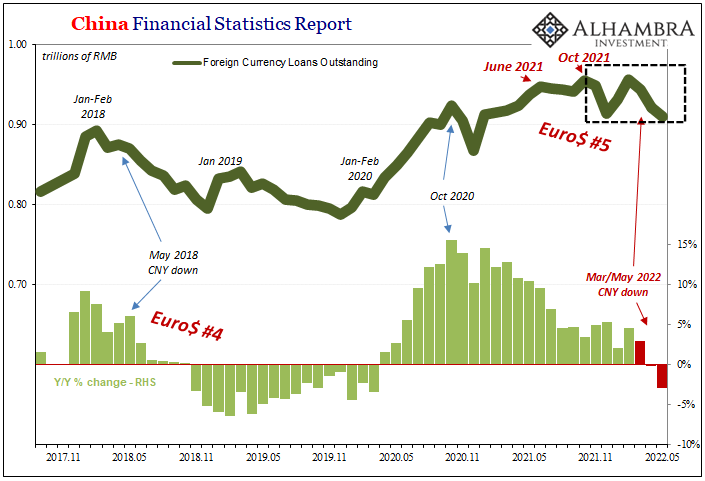

More directly thanks to Euro$ #5, the entire financial system is suffering the loss of foreign currency loans, too.

And the Communists aren’t doing anything about any of it. They’re managing for continued decline regardless of COVID, and that’s already been a huge part of the world’s ongoing, rising recession risks. Since the former isn’t going to change, so much the latter.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more