Is The Sovereign Debt Crisis Finally About To Hit?

Trouble is brewing in the U.K. again.

Back in September 2022, which now seems so long ago, the global financial system nearly entered a debt crisis.

The first country to “get to the brink” was the United Kingdom or U.K. At that time, the U.K.’s new government, led by Prime Minster Liz Truss, introduced a tax cutting program that neither the bond nor the currency markets could stomach.

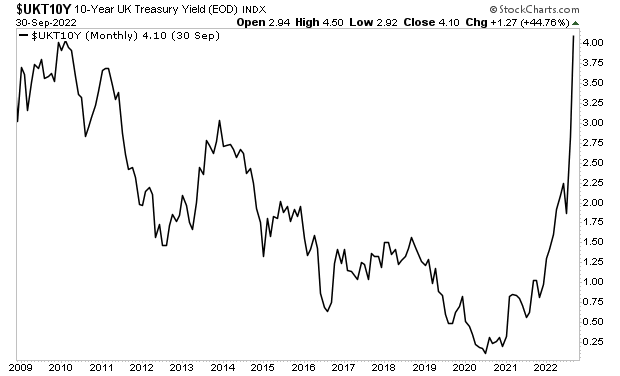

The yield on the 10-Year U.K. Government bond went vertical signaling default risk.

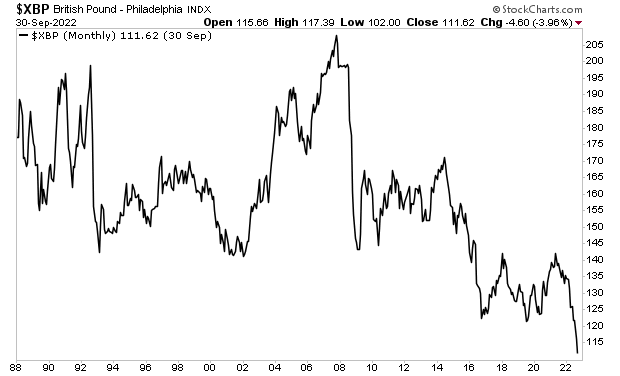

While the British Pound imploded, collapsing to a 30+ year low.

In the simplest of terms, the U.K. appeared to be the first country to enter a sovereign debt crisis. Then, suddenly, in the span of a few weeks, this ENTIRE PROBLEM went away.

The official narrative sold to the public concerning the “solution” to this issue was that Prime Minster Truss resigned and a new government was formed.

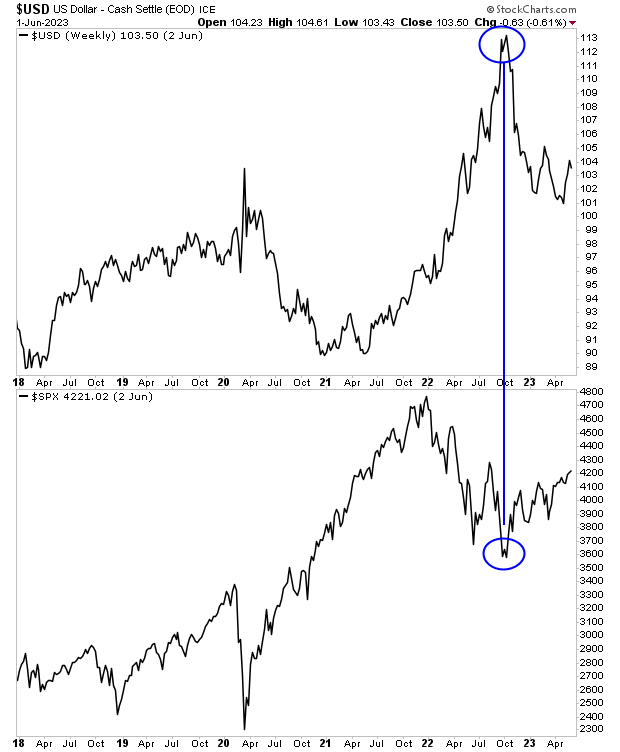

However, it’s rather odd that TWO WEEKS before Ms. Truss resigned, the $USD suddenly rolled over and started to collapse while risk assets like stocks caught a bid. Indeed, the entire global financial system entered one of its most aggressive “risk on” chapters in recent history. And it did this on a dime in mid-October 2022.

Perhaps something or someone else was responsible for this incredible turn of events. Perhaps global central banks coordinated a “behind the scenes” intervention that forced bond yields lower so stocks could catch a bid. We’ll never know the true story, but the global financial system sure as heck wasn’t “saved” by Prime Minister Truss resigning.

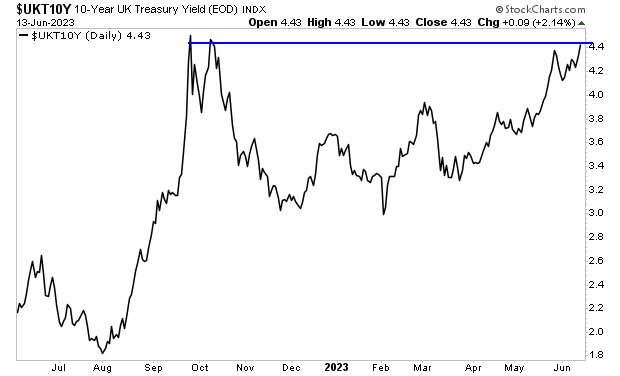

I mention all of this because once again the U.K.’s debt markets are blowing up with yields on the 10-Year U.K. Government bond getting dangerously close to the levels at which things started to break in 2022.

More By This Author:

Guess Who is Driving Inflation Now (And Minting Profits For Smart Investors)

How To Profit From The Fed’s Massive Mistake

Two Charts That Can Help You See What’s To Come For The Markets