Wednesday, July 3, 2024 9:50 AM EST

Marine Le Pen’s National Rally took the most votes of all the parties with the first round of voting on Sunday seeing them capture 33.2% of the vote. The New Popular Front achieved 28% of the vote and Macron’s coalition only got 20.8%. Despite the risk premium sending the French 40 lower when Macron called the snap election, the markets have rallied to start the week as the National Rally recorded a smaller margin of victory than some polls had indicated. Furthermore, France’s mainstream parties began looking at ways to keep the far right from securing an absolute majority in next weekends elections. It will not be until Monday July 8th that we see the final result of the vote and the reaction in the CAC 40.

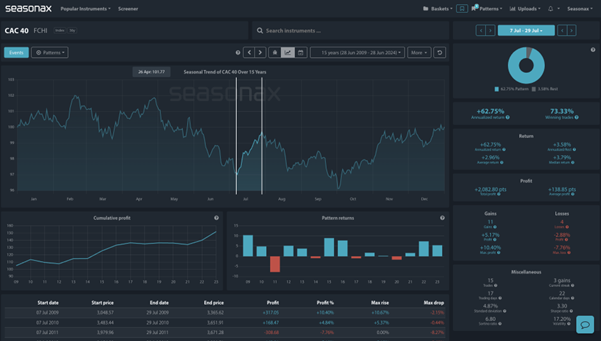

However, one thing to note is that seasonally the French 40 has a seasonal period of strength ahead. Over the last 15 years the CAC 40 has gained nearly 3% on average from July 07 through to July 29. The largest return has been in teh double digits and the largest fall just over 7.5%. So, if Marine Le Pen’s National Rally party fails to gain an overall majority, will we see another rally in the CAC 40?

(Click on image to enlarge)

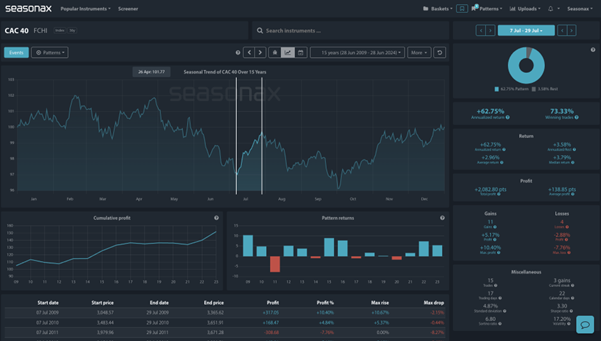

(Click on image to enlarge)

Technically, we can see that the CAC 40 has gapped higher on July 01 after the results of the first round of the French election, so watch this rising window to potentially hold as support this week as marked below from the 7,500 region

The major trade risk here is that previous price patterns do not necessarily repeat themselves each time and if the National Rally do achieve an absolute majority markets will likely perceive that as risk negative and the CAC 40 could fall sharply at the open.

More By This Author:

Is Intel Set To Break Out Of Sideways Range? Hot Stocks For The Hot Summer What Seasonal Clues Do We See Ahead Of The US CPI Print?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.