Is Rising UK Wage Inflation A Threat To J Sainsbury’s Share Price?

Image Source: Unsplash

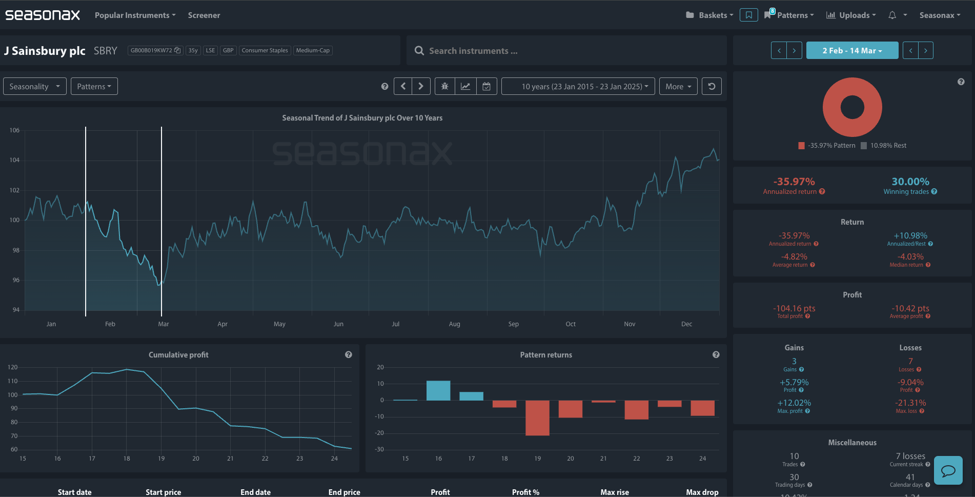

- Instrument: J Sainsbury plc

- Average Pattern Move: -35.97% Annualized Return

- Timeframe: February 2 – March 14

- Winning Percentage: 30%

J Sainsbury Plc (JSNSF), the UK’s second-largest grocer, is facing significant operational and economic challenges. In a bid to address rising costs and tax pressures, the company announced a reduction of 3,000 jobs, including a 20% cut in senior management positions, alongside the closure of all remaining in-store cafes. These measures come as the company grapples with higher payroll levies and inflationary pressures stemming from government tax hikes, which are expected to stoke further price inflation.

Chief Executive Officer Simon Roberts highlighted that the 5% wage increase for staff will now be staggered in two stages, marking a first for the company. This move reflects the need to manage soaring costs, including unprecedented increases in the wage bill due to the higher payroll levy. Roberts noted that inflation is already accelerating, particularly in fresh food, and that the company must balance wage increases with other cost-saving measures.

Sainsbury remains committed to its £1 billion cost-saving target by March 2027, a critical element of its strategy to weather these economic headwinds. Despite these challenges, like-for-like sales rose 2.8% in the 16 weeks to January 4, though the company acknowledged softer-than-expected performance in its Argos catalog business, attributing this to weak toy sales and subdued demand for larger items.

J Sainsbury Plc (Ticker: SBRY) has historically displayed seasonal weakness from February 2 to March 14, with an average annualized return of -35.97% and a winning percentage of only 30% over the past decade. This bearish pattern aligns with the company’s current economic and operational challenges.

(Click on image to enlarge)

Technical Perspective

Technically J Sainsbury PLC sits around major weekly support at 250 and a test of 240 can’t be ruled out if cost cutting measures fail to offset rising wage costs.A break of 235 on a weekly closing basis opens up another potential run to 225.

(Click on image to enlarge)

More By This Author:

How Will A Fed ‘Hold’ This Week Impact The EURUSD?

Does The FTSE 100 Have Another Leg Higher To Come?

Spring Ahead: Can Trump Turbo Charge Seasonal Strength in Consumer Discretionary Picks?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more