Is Japan Finally About To Go Bust?

Yen. Image Source: Pixabay

The world is awash in too much debt. And nowhere is this more problematic than Japan.

Japan is the grandfather of monetary insanity. Every crazy monetary policy that central banks have tried in the last 25 years were first introduced in Japan years earlier. The Fed first cut interest rates to zero in 2008. It introduced its first large-scale Quantitative Easing (QE Program) that same year. Japan first cut rates to zero in 1999. And it has been engaged in QE off and on since 2001.

Since that time, the Bank of Japan (BoJ) has effectively nationalized the country’s financial system to the point that it (the BoJ) is now the single largest owner of Japanese stocks and Japanese bonds in the world. Things have gotten so extreme that there are times in which certain Japanese government bonds don’t even trade anymore because the BoJ owns so much of the market.

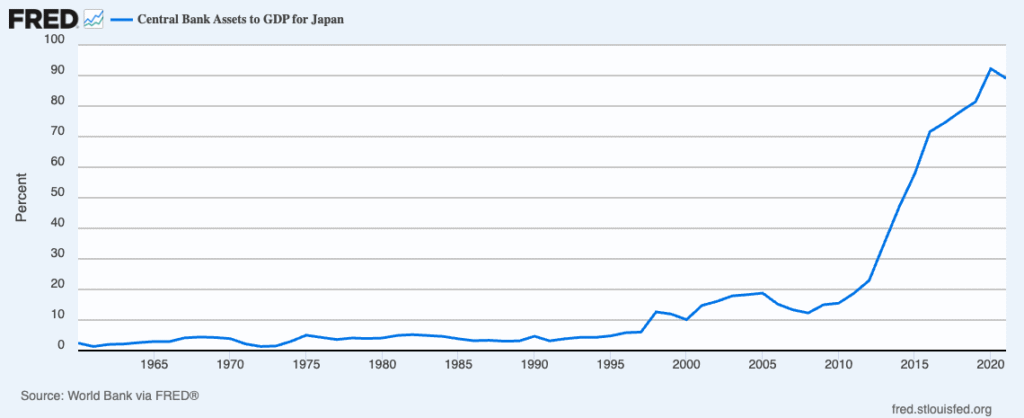

Because of 25+ years of monetary interventions, Japan has reached debt levels that are almost impossible to believe. The country has a Debt to GDP ratio of 234%. And the BoJ’s balance sheet is almost as large as the country’s GDP!

(Click on image to enlarge)

These debt levels are problematic even during ideal situations (Greece’s Debt to GDP was only 134% when it began to blow up). But Japan is sitting on this mountain of debt at a time when bond yields are soaring.

The yield on the 10-Year Japanese Government Bond has EXPLODED higher in the last couple of years. As I write this, yields are at levels last seen in 2008… when the BoJ’s balance sheet was equal to only 15% of the country’s GDP.

By the look of things, this situation is finally becoming to come unhinged. Japan just experienced its worst bond auction since 1987. Investors are beginning to avoid long-term Japanese debt as they realize there is NO WAY for Japan to get out of this situation without a crisis.

There is a limited amount of time to prepare for this. And smart investors are already taking steps to make sure they’re ready for when it hits. One such strategy is to use quantitative tools that have accurately predicted crashes in the past.

More By This Author:

A Debt Crisis Is Coming… The Time To Prepare Is NowThe Fed Is Wrong… And It’s Going To Cost Investors A Fortune

President Trump Just Told Us What’s Coming