Is It Time To Buy The A-Shares?

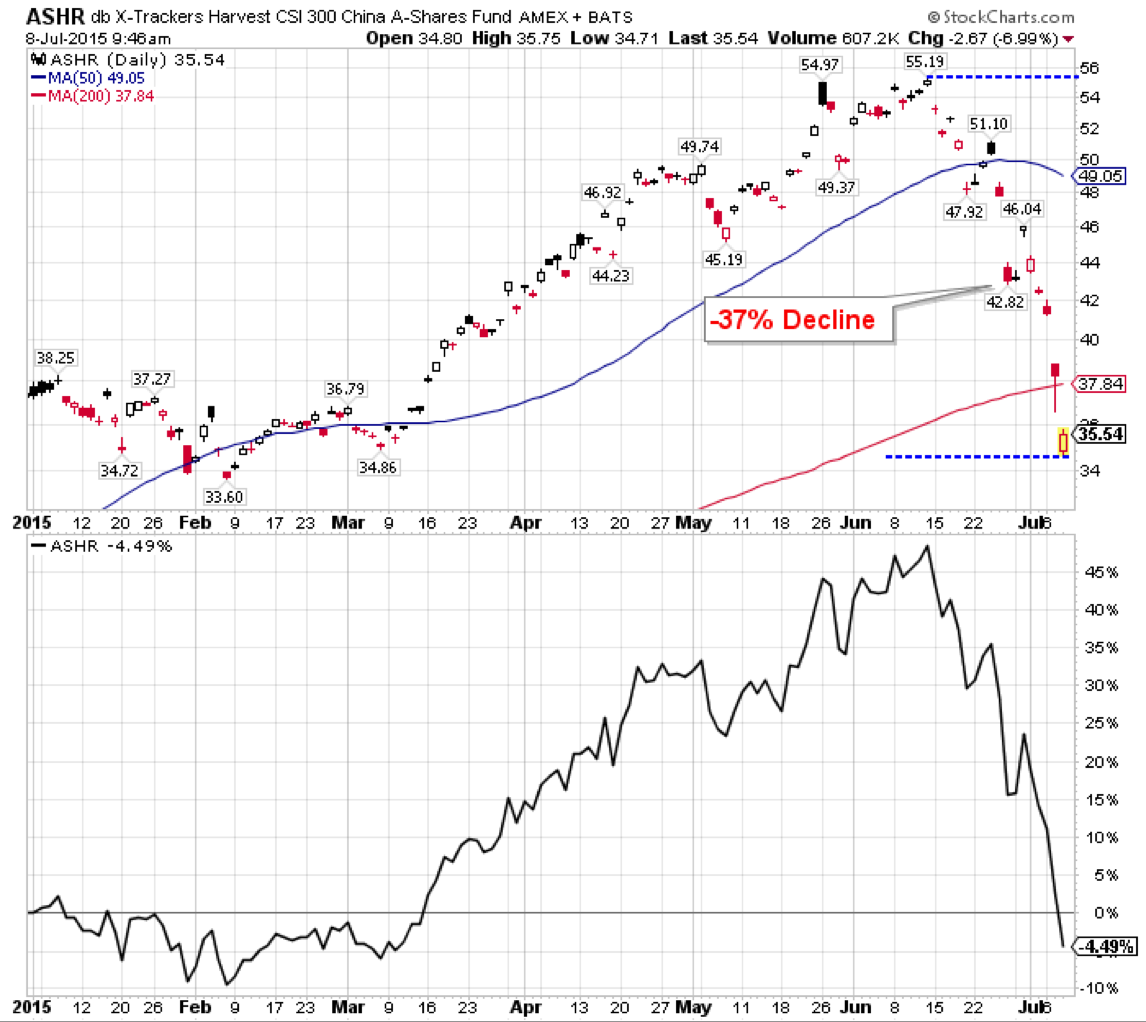

Incredibly, there's been a 37% decline in the China A-Shares ETF (ASHR) over the past 3 weeks. This is MORE than the US Market Crash of '87. To a value investor like me, big red Chinese firecrackers are going off on this occurence. China has been and always will be a very volatile market. They are at an inflection point and are suffering from a case of "too much too soon." The government has been impressive in controlling a lot of the trouble lately but there is still so much we don't know right now.

Click on picture to enlarge

So before I pull the trigger, I need to do a little more digging.

Here are my concerns. The Chinese stock market is an immature market at best and as any "adolescent," it is experiencing growing pains and questionable decisions as it finds is footing enroute to adulthood.

Fueled by leverage, indices have fallen as the government has cracked down on margin trading in order to create a more sustainable rally. However, the problem that it now faces is that it is having trouble arresting the decline. So much for Plan A. Onto Plan B?

The government is also trying to stem the tide through monetary easing, a lightening up of its crackdown on margin trading, and a ban on its still hot new IPO market. One wonders how seriously this selloff is when they can still raise billions on new IPO's coming to market.

The government also is seeking a commitment from the big brokers not to sell equities when the index is trading below 4,500 - a level that a month ago seemed unattainable.

All of this is somewhat moot. Applying the brakes to a market that got a "little ahead of itself" is always a bit of a risk. Too much and you cut off your other foot. Too little and you're faced with a runaway train driven by drunken lunatics.

Many who drank too much of the leveraged Kool-Aid are now hoping the government has the magic bullet so they can get their gains (or losses as is more likely the case) out. Just to give you an idea as to how much of an impact the leverage issue has, consider this: In 2007 there was ZERO leverage in the market. The economy was much stronger then. Ironically they could have weathered leverage then much more so than now. The Chinese economy will not see the boom times of 7% GDP in 2015 so all plunges the Shanghai experiences will be felt across the economy.

Many millions of newbies opened fresh brokerage accounts, took money from loan sharks and now may get hit big time if this market doesn't recover soon. The index simply can't stay this low and not do some significant systemic damage to the economy. The government clearly cannot allow that to happen especially at this time when it is already somewhat strained.

Right now 50% of all Chinese stocks are halted.

Hit a Chinese in his wallet and social unrest is not far behind. The government will do whatever it can to avoid a clash with a bunch of irate burned stock pickers.

As usual, the contrarians will buy the blood, even if it isn't ours. Red is red. The Rothschild trade makes no distinction.

Opportunities will surface somewhere between falling knives and Chinese jumping out of windows. P/E and P/S ratios don't need translations - they're way below those of the US listed counterparts. JD.com (JD), Qihoo 360 (QIHU) and Vipshop (VIPS) are large companies with stellar earnings that got routed along with the lesser lights. One could consider dip buying them as well.

For now, I am watching the A shares and the drama unfold. So far it reminds me of a wonderful 1942 Gene Tierney movie. In the film, she is rescued by a US Flying Tiger who steps in to save her and her father who run a missionary for poor Chinese farm children. (The Flying Tiger also wins her love!)

My fellow US compatriots and I can do no less for the poor Shanghai A shares and save them from certain death.

I have a small position right now. I plan on adding to that position opportunistically. I have my bids ready based on my time frame and comfort level which may be completely different from those anyone else reading this. (Therefore where my bid is, is only relevant for me.)

If I am unsure, I can always default and trade the UVXY or the VIX as they will certainly reflect all the "uncertainty" in the A Shares.

Cheers and good luck to us.

Disclaimer: This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an ...

more

It may bounce up to test the ma 50. it it fails it would be time to short..

Other than the volatility ETFs, which don't directly track China, how would you hedge vs ASHR?

hmm..not sure what I would hedge it with..thanks for reading!

thanks for reading this..feel free to post comments..I love to hear form you!

woops I meant to say from you..thanks