Is China's Stock Market Crash Just Beginning?

Despair, in short, seeks its own environment as surely as water finds its own level.

A. Alvarez

Lately one naysayer after another, some of which actually like to call themselves experts are all marching to the same drumbeat. The Chinese economy is trouble and that the Chinese markets are going to continue crashing. Granted the Shanghai index experienced a breathtaking advance over a rather short period of time and so it should not have come as a surprise to anyone that the market was definitely going to pull back. The higher the run, the stronger the pullback. However, we feel that the Doctors of gloom and doom are over doing it and this is what we had to say on this subject recently.

Not much to add here, except that it followed the project path. The fear has not peaked yet, so that means more downside is to be expected. It traded below 3000, and as long as it does not close below 3200 on a monthly basis, the bottoming action will gain traction. As it has already traded below 3000 and fear levels have not hit the extreme ranges yet, a monthly close below 3200 will drive this below 2800. If the Chinese economy is dead, then there are no words to describe our economy. Our economy is based on smoke and mirrors. Alchemists are trying to create something from nothing, and so far the cocaine sniffing crowd is buying this. Market update Sept 1st, 2015

Stephen Roach the former manager of Morgan Stanley Asia made the following comments on CNBC towards the end of July. .

"Markets around the world are really rich. I think if the Chinese market corrects a little bit more from here then it would be my first choice," Roach, who is now a senior fellow at Yale University's Jackson Institute of Global Affairs, told CNBC on Friday.

Despite the strong correction, his overall view seems to be that China still makes for a good long-term investment, based on his September 3, 2015, statement.

Growth in China has slowed, “but it's not going in for a crash...and that will present, I think, an opportunity for shares to re-evaluate the China threat, big time."

When the crowd panics, it takes a bit of time for the dust to settle down. Their confidence has been shaken and they are letting their emotions do the talking. This means that the reaction (as always) will be much stronger than is warranted and stocks will be driven to levels that are not warranted. It goes without saying that there are and there will be some great bargains to be found in the near future. However, for those who are brave of heart and have a long term view, opening positions in top notch companies such as NTES, BABA, SOHU, HNP, CHA, etc., will most likely prove to be great investments

Our V indicator is indicating that we are going to witness volatility on a scale never seen before; indeed, the wild gyrations the Shanghai index has been experiencing is indicative of this new trend. Volatility tends to make the small player nervous and instead of just throwing the baby out with the bathwater, they could torch the entire house as reason takes flight and panic takes over.

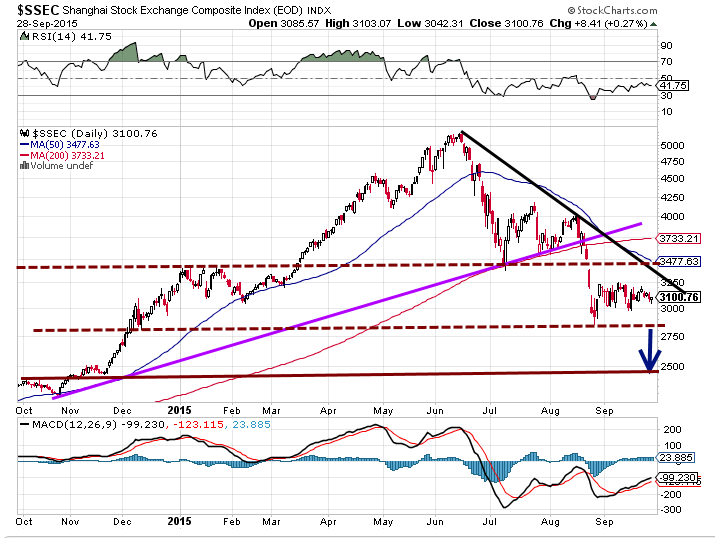

The Technical Outlook

In almost all the time frames (from 1 to 10 years) the upward trend line has been violated. There is a chance that this market could test the 3450-3500 ranges, with a possible overshoot to the 3700 ranges; a test of the old uptrend line, before testing 2750. As the trend is not positive in all time frames, this index is almost assured of testing its recent lows.

A weekly close below 2750 should trigger a fast move to the 2450-2500 ranges; from a long term perspective this would make a fabulous entry point. It would also be a good point to add larger amounts of the stocks we mentioned earlier.

Conclusion

If you dance to the rhythm of those singing the doom and gloom song, you will never awaken from this stage of stupor to recognize opportunity, even if it slaps you in the face. There is a wide chasm that separates fear from prudence. Prudence always has a place when it comes to investing, but fear is a parasite that only takes and gives nothing in return. Your best option is to eliminate this parasite as soon as possible. One should look for symbiotic relationships and not parasitic ones.

The masses are spooked and so it will take a bit longer for the waters to clear, but even at the current levels the Chinese markets look more promising than ours from a long term perspective. If you decide to open positions right now, don’t be over zealous; take nibbles instead of large bites. Finally, to answer the question posed in the title of this article. The answer is that we are closer to the end than the beginning. Naysayers would have you believe otherwise, but that is their game plan. Sing bloody murder after the correction is almost over and chant songs of joy when the markets are close to putting in a top.

Fortune always fights on the side of the prudent.

Critias

Disclosure: We are looking to open positions in the mentioned stock but have not entered our orders as of yet.

I agree wholeheartedly, the talking heads always make things look worse than they are, just to trigger the masses to stampeded. Great article!

Thank you for taking the time to comment

I agree with your picks NTES, SOHU, etc, what do you think of QIHO and YZC.

First of all, I have to add that we cannot give personal recommendations and that you should consult with your personal advisor before making any decision.

QIHO is a bit more speculative in nature. In general when one is looking at speculative stocks even though they offer great returns, one should wait for the broad market to bottom out. In other words there should be signs that a bottom is in place; the market trending sideways for several weeks to several months and putting higher lows would be one such indication that a bottom was in place.

The resource sector looks attractive from a long-term perspective and YZC falls under this category