Is China Signaling Imminent Devaluation: PBOC Fixes Yuan Weaker Than Expected For Record 15th Consecutive Day

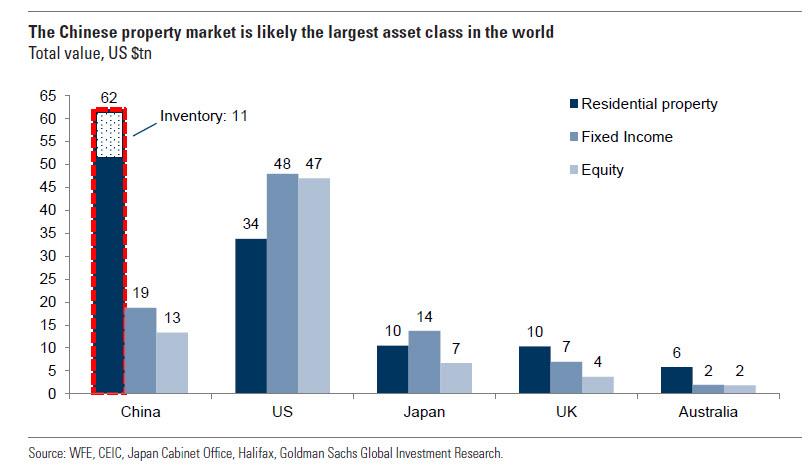

A little over two weeks ago, on Dec 10, just after Beijing had made it abundantly clear it was done with its latest experiment in financial tightening - an experiment which has led to the implosion of China's property developers led by Evergrande, a deep freeze in China's USD-denominated junk bond market, and an accelerating slowdown in China's $62 trillion housing sector which Goldman recently defined as the world's largest asset...

(Click on image to enlarge)

... Beijing issued its loudest hint yet that with China's economy rapidly slowing down and the country's monetary policy now fully reversed from the tightening observed across most DM central banks following a hike in China's FX reserve ratio (from 7% to 9%), and the first cut in China Required Reserve Ratio (by 50bps) in over a year, a currency devaluation may soon follow.

It did that by fixing the yuan at a whopping 179 pips weaker than consensus at 6.3702. This was the largest miss vs surveyed market participants' fixing expectations on record, and followed China’s fix on Thursday which was already the largest miss since Oct. 14. The news promptly sent the CNH sliding further, dropping as far as 6.3893 against the dollar, before sharply reversing amid continued foreign inflows into China's capital markets, making China's attempts to return to simple mercantilism more difficult in the process.

(Click on image to enlarge)

As Bloomberg's Simon Flint wrote then, "this is an extremely strong signal, and should prolong the impact of the policy change announced on Thursday"... only as shown in the chart above, it did just the opposite and the yuan actually strengthen shortly after the kneejerk reaction.

Fast forward to today, when Beijing's signaling is the loudest it has been since the August 2015 devaluation....

(Click on image to enlarge)

... as China’s central bank set a slightly weaker-than-expected reference rate for the yuan in its longest string of higher fixes on record.

On Friday, the PBOC set the daily reference rate at 6.3692 per dollar, weaker than the estimated 6.3688 with a surveyed range from 6.3676 to 6.3711. And, according to Bloomberg, at 15 days the stretch of higher-than-expected fixes is now at the record since Bloomberg released its median consensus forecast in June 2018.

(Click on image to enlarge)

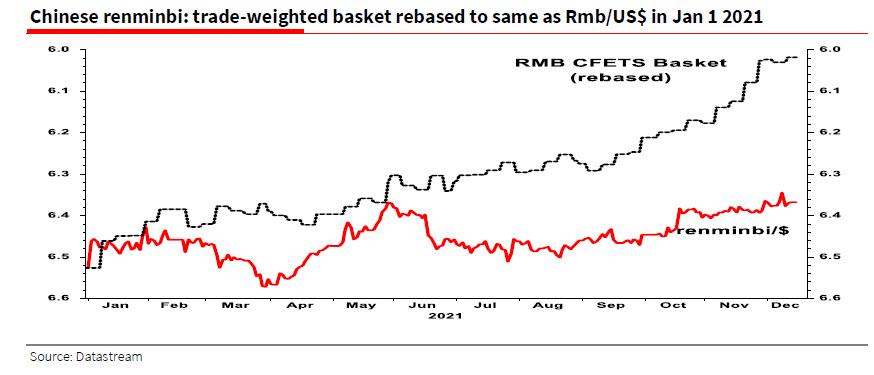

To some, Beijing could not be clear in its FX intentions - one among them is SocGen's Albert Edwards, who in his year ahead outlook show a "shocking chart" of the divergence in the yuan/USD vs trade-weighted yuan. This is what he said:

The second shocking chart I want to flag up is the one below. We all know that the renminbi has been pari-passu against a robust US dollar, but the officially targeted trade-weighted renminbi is through the roof this year and stands at an equivalent Rmb6.00/$. At a time when Chinese credit conditions are too tight, this is simply intolerable.

(Click on image to enlarge)

Edwards' conclusion: "Despite Chinese exports remaining robust, investors should be on the alert for a 2015-like surprise renminbi devaluation."

Maybe, but what is Beijing is unwilling to use this particular nuclear option especially since relations with the Joe "10 for the big guy" Biden admin are improving with every passing day, and the last thing Beijing needs is to be accused of stoking currency wars with the US. As we discussed two weeks ago, here China has four potential options to hit the currency:

- More verbal warnings against one-way bets

- Officially adding back the countercyclical factors to its yuan fixing, essentially setting the yuan weaker than otherwise

- Accumulate dollar reserves and/or ask state banks and experts to hold dollars

- Liberalizing FX outflows and tightening the channels for inflows.

Here, as Bloomberg's Ye Xie noted, "the most effective would be allowing more outbound investments to offset the inflows." But while authorities have already done some of that, including the launch of the Southbound bond connect that allows local residents to buy overseas bonds in Hong Kong, clearly it is not enough.

Which leads us to an ironic question: will China realize what has been clear to the Fed for so long, and use cryptocurrencies as an excess pressure "release valve", in this case letting cryptocurrencies absorb a measured amount of FX outflows to avoid further overheating in the yuan. Needless to say, Beijing realizing that it needs to buy crypto to ease pressure off the yuan - not long after China destroyed its domestic crypto industry by banning bitcoin mining- would truly be ironic.

And while that may be a bit hyperbolic (for now), a devaluation of sorts is clearly a topic that is being discussed among currency analysts, and last week when addressing the best way for China to ease financial conditions rapidly and lower market rates, Nomura's China strategist Ting Lu said that selling the yuan versus the dollar would be the most effective way to achieve this goal:

Needless to say, "buying FX", i.e., dollars in the open market, is certainly one way to devalue your currency. The only question is what is Xi's intervention "red line."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more