Monday, July 3, 2023 11:29 AM EST

Sudirman Central Business District in Jakarta, Indonesia

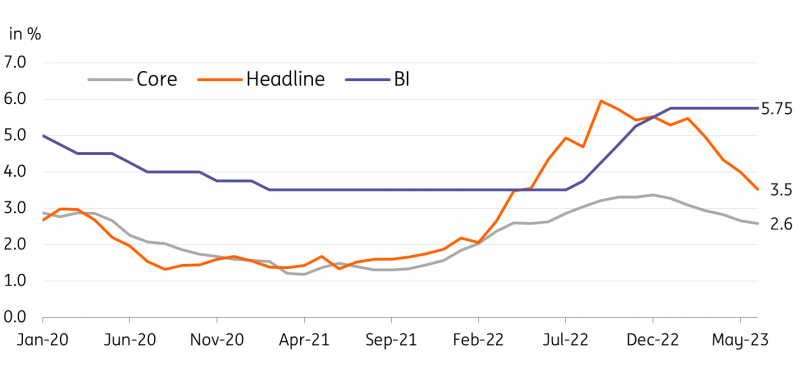

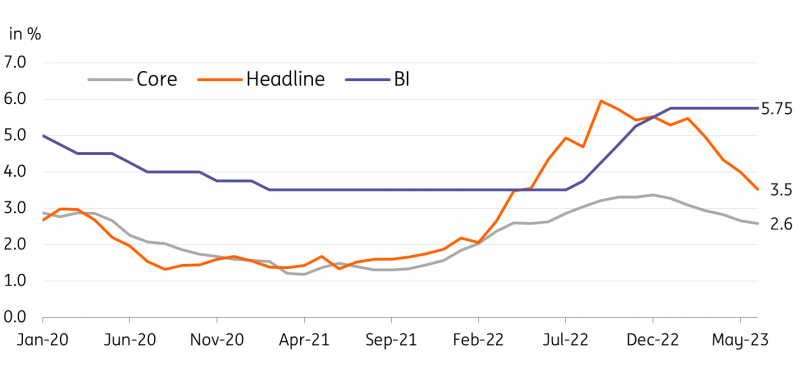

Headline inflation slipped to 3.5% year-on-year in June, down from 4.0%YoY in the previous month. The June reading was slightly below market consensus for a 3.6%YoY rise with prices up only 0.14% from May. Meanwhile, core inflation dipped to 2.6%, down from 2.7% in May.

A favourable base, in addition to moderating commodity prices, has helped steer prices back within target. We expect inflation to remain subdued in the near term, barring substantial supply-side shocks.

Inflation comfortably back within target

Badan Pusat Statistik and Bank Indonesia

Bank Indonesia likely to extend pause

Bank Indonesia (BI) hiked aggressively in late 2022 to help bring inflation back within target. However, despite price pressures abating, we do not expect the central bank to resort to rate cuts as it hopes to ensure continued support for the Indonesian rupiah. Foreign exchange stability will likely determine any BI rate adjustment, and we expect Governor Perry Warjiyo to extend his pause until IDR stabilises.

More By This Author:

FX Daily: Quiet Start To An Intense Week

The Commodities Feed: Specs Reduce Oil Net Long

Asia Morning Bites - Monday, July 2

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.