Inflation Proves Stubborn In Hungary Despite Deceleration In Yearly Reading

Although year-on-year inflation in July decelerated in Hungary, there was a troubling acceleration in the monthly figures. Therefore, we cannot be entirely happy with the price developments. Looking ahead, unpredictability will stay with us, just like high inflation.

Inflation decelerated, yet not enough to be cheerful

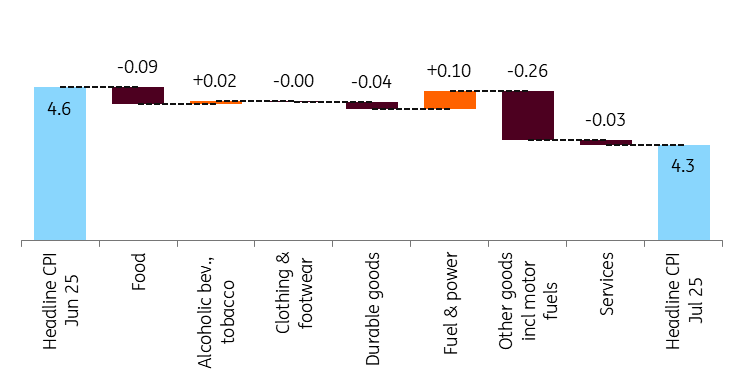

According to recent data released by the Hungarian Central Statistical Office (HCSO), the average price level increased by 0.4% on a monthly basis in July 2025, surpassing expectations. This marks the end of the period of slower monthly price adjustments. This suggests that the favourable inflation picture of the past four months was mainly due to the impact of government price measures and voluntary price restrictions implemented during this period.

Without any new measures, the one-month inflation-curbing effect of all measures had essentially worn off by July, allowing underlying trends to take over and causing the monthly price index to rise significantly. However, due to last year's high base, the year-on-year index decreased to 4.3%. This figure exceeds the upper limit of the NBH’s inflation tolerance range. Despite all efforts, structural inflation remains high in Hungary.

Main drivers of the change in headline CPI (%)

Source: HCSO, ING

The details

- Contrary to our expectations, inflation in services decelerated at a slower pace, mainly due to a significant increase in the price of transportation services. Travel to long-distance destinations, particularly by air, became more expensive.

- Another serious and unwanted surprise was the rise in household energy prices. Higher gas bills were the main factor in driving household energy inflation back into the double digits. Such a phenomenon was last recorded during the energy price shock in the summer of 2023.

- Just a minor additional impact, but the seasonal decline in clothing prices was smaller than usual. Conversely, prices of durable goods showed a monthly decline, probably due to the stronger forint.

- Last but not least, let's discuss food prices. Here, the year-on-year inflation fell just below 6%, in line with our expectations. However, supply-side shocks (e.g. frost, drought, and epidemics affecting livestock) caused significant price increases in some cases (e.g. meat, fruit, and vegetables), which does little to reduce perceived inflation.

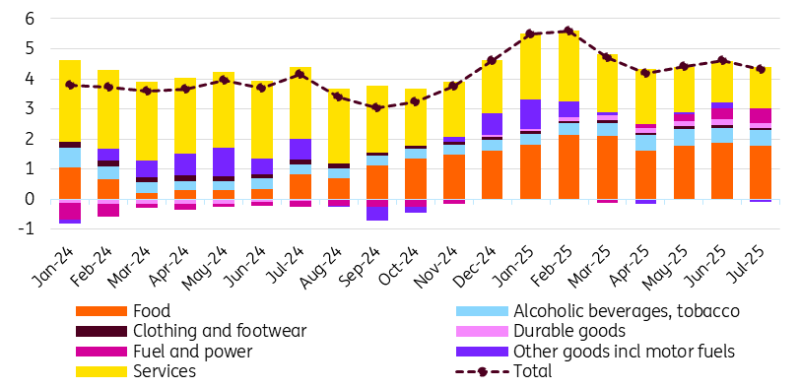

The composition of headline inflation (ppt)

Source: HCSO, ING

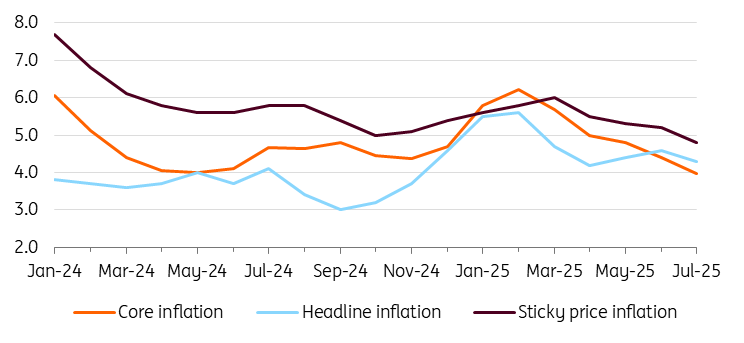

Core inflation fails to dip below 4%

Higher price increases across a wide range of areas resulted in an overall inflation rate that was higher than expected in July. As most of the price increases affected non-core items, core inflation slowed to 4.0% in July. However, the 0.4 percentage point slowdown was largely due to last year's high base. That said, there are some positive aspects to consider, too. Although headline monthly inflation is no longer consistent with the National Bank of Hungary's 3% price stability target, seasonally adjusted three-month annualised core inflation still meets this criterion.

Overall, official statistics paint a mixed picture. Although the annual inflation rate has moderated due to the high base, the monthly repricing rate has increased in the absence of new government measures to curb inflation. It will be interesting to see if the mild trend-like decline in inflation expectations among households continues after the four-month period of low repricing, or if it stalls or reverses due to soaring energy bills, higher food prices and more expensive holidays. If the latter were to happen, it would certainly be unfavourable for monetary policy, especially since price expectations are still too elevated.

Headline and underlying inflation measures (% YoY)

Source: HCSO, NBH, ING

Government decision about the measures will define future trends

However, if the government phases out the price shield measures at the end of this month, as set out in the relevant legislation, the inflation rate could rise above 5% YoY in October. For now, we are not revising our inflation forecast of 4.6% for this year's average. We are waiting for the government's upcoming decision on margin freezes before making any revisions.

According to our current view, inflation is likely to average around 4% over the next two years. If the deadline for price measures is extended, as we expect based on the disappointing July data, then this year's average inflation rate may be revised slightly downwards. However, the average for the next two years could clearly increase. In light of this, the hawkish monetary policy stance and unchanged base rate are likely to remain in place in the short term, and there is an increasing probability of rates remaining unchanged for an even longer period than previously anticipated.

More By This Author:

Think Ahead: Why Central Banks Can’t AgreeSoft Canadian July Jobs Boost The Case For More Rate Cuts

Asia Week Ahead: Australian Rate Decision And Key Data From China, South Korea, Japan

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more